Justin Drake, one of the leading Ethereum researchers, argues that a limit should be set to the amount of stinging. According to Drake, this change can help Ethereum fulfill the promise of being a deflationist.

What kind of stinging policy is it in the current situation?

Ethereum’s local token ETH has remained at a fixed supply level since the Merge update in 2022. However, this does not satisfy investors. Ethereum did not expect “Ultrasound Money” (superior sound money), and ETH price was stuck around $ 3,000.

Crypto assets such as Bitcoin, Solana and Dogecoin experienced major value increases in the last year, while Ethereum rose only 22 %. As a result, intense discussions have begun about how to make the token economy more efficient in the Ethereum community.

Is it a solution to bring the stake limit?

One of the most important changes in Ethereum was the transition to the post-MERGE Proof-of-Stake (POS) mechanism. In this system, users secure the network by staging ETHs and get annual return in return.

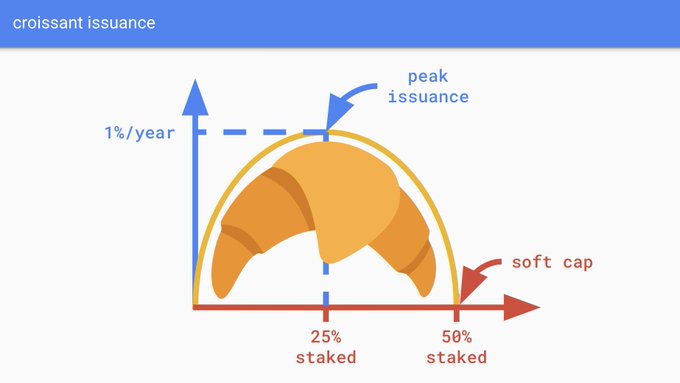

However, Drake thinks that the stinging process has expanded ETH supply and that this prevents the token from reaching a deflationist structure. As a solution, Ethereum suggests that 50 %of the total supply is stopped when it is stake.

According to Drake, Ethereum’s current export curve is incorrectly designed and like Bitcoin, like Bitcoin, must adopt a tighter monetary policy.

How should the new Ethereum supply policy be?

Drake advocates the necessity of withdrawing Ethereum’s annual supply increase from 0.5 %to zero. In the system proposed for this:

- When 25 %of ETH supply is stake, the new ETH production will peak at a level of 1 %.

- When the stake ratio reaches 50 %, ETH production will stop completely.

He also states that Ethereum should continue to reduce transaction fees. Low trading fees may also balance the “burning mechanism için to reduce circulating ETH supply while attracting more users to Ethereum.

Drake supports his suggestion with the following words:

10 million transactions/seconds capacity and a fee of $ 0.001 per transaction is much more advantageous than 100 transactions/seconds and 100 dollars trading fee.