Dogecoin (DEGE) continues to be traded around 0.24 dollars after falling more than 7 percent the previous week. According to analysts, the technical appearance shows that more corrections will be made due to the fact that Doge’s momentum indicators reflect the decline tendencies. In the meantime, the centimeter data reveals that Dogge whale processes have fallen and show signs of weakness.

Doge whale activity fell from the cliff

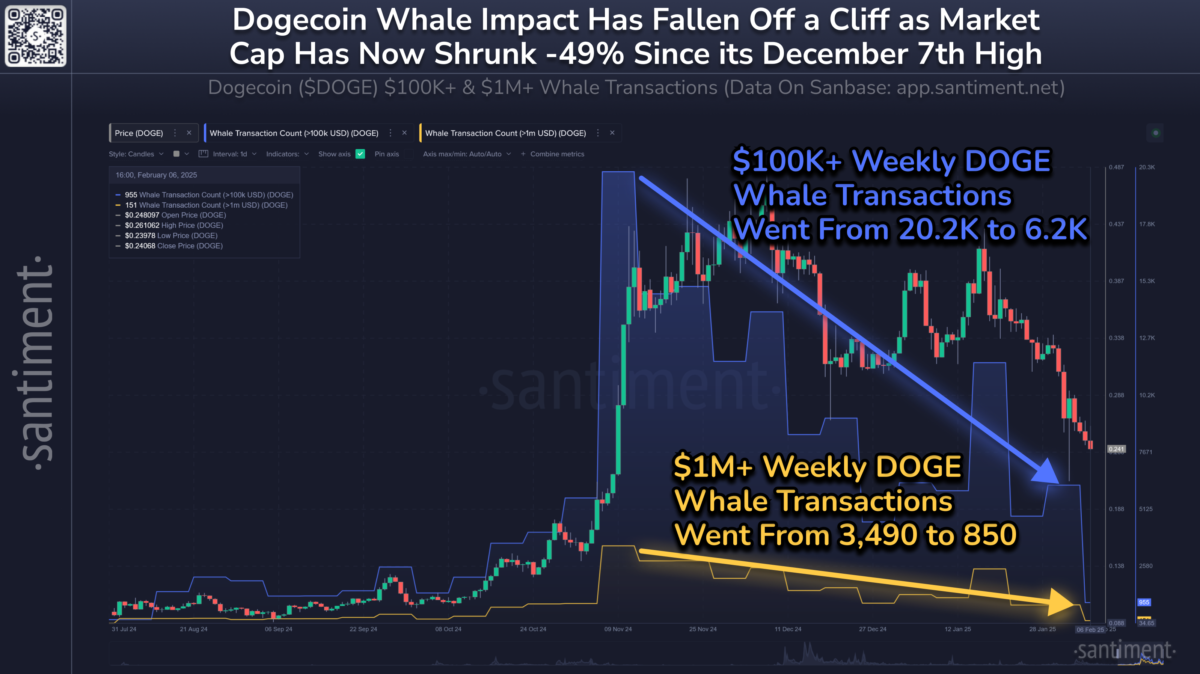

The price of Dogecoin has fallen more than 30 %since mid -January and continues to fall. According to the analytical platform centimeter data, Doge whale operations decreased with the price. The following graph shows that Dge’s 100 thousand dollars+ weekly whale processes have dropped from 20,200 to 6,200 since the beginning of November. In addition, weekly transactions over $ 1 million decreased from 3.490 to 850 in the same period and indicate the weakness of whale accumulation.

Dogge weekly whale operations graph. Source: centimeter

Dogge weekly whale operations graph. Source: centimeterOn the other hand, approaching developments in the Dogecoin ecosystem also increase expectations within the Dogge community. Timothy Stebbing, a manager at the Dogecoin Foundation, implied recently expected major announcements. Any important development may affect investor sensitivity and potentially affect Dogecoin’s price orbit. Traders closely monitor these updates because the market expects more clarity about the direction of Breast Coin.

Dogecoin Technical View: There are $ 0.18 on cards for breast coins!

Crypto analyst Manish Chhetri evaluates the technical look of Dogge. Dogecoin’s weekly graph decreased by 7.15 %last week, under the 50 %price correction level (the highest $ 0.48 at the highest level of $ 0.05 on August 14), $ 0.27. Dge is around $ 0.24 at the beginning of this week on Monday. If Dge continues to fall, it may extend the correction to re -test its weekly support for $ 0.18.

The Relative Power Index (RSI) indicator in the weekly chart reads an increase in the decline momentum by reading the value of 48 below the neutral level. In addition, the moving average convergence deviation (MACD) indicators also tend to decline in the weekly graph, which shows that the decline tendency continues.

Doge/USDT weekly graphics

Doge/USDT weekly graphicsThe opinions and estimates in the article belong to the analyst and are not definitely investment advice. Kriptokoin.comWe recommend that you do your own research before investing.