The Ethereum price has been booming for quite some time, thanks to the consolidation of Bitcoin. BTC’s intraday price action gives the impression of a pump and dump. Altcoins, on the other hand, feel like they’ve managed to thrive. ETH, for example, is responding positively to upward moves. However, it remains partially unresponsive to minor downtrends. Alongside the short-term volatility in the leading altcoin, the Ethereum Merge upgrade is also among the most talked about.

What is Ethereum Merge?

Simply put, Merge refers to an upgrade to the Ethereum blockchain. The upgrade will switch the Ether network from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The main reason behind the update is that the ETH team wanted to increase scalability while maintaining the security of the network. As it is known, Blockchain is frequently on the agenda due to high gas fees. In fact, the Merge upgrade has been planned and delayed several times before. But now, the developers predict that the upgrade will happen in August.

According to an Ethereum developer, Ethereum’s testnet Ropsten will receive the upgrade on June 8. Thus, Ropsten will switch to the Proof-of-Stake mechanism. Merge will then take place in Sepolia and Goerli, with a two-week buffer period between each upgrade. Later, the developers will test whether these testnets work smoothly. Eventually the mainnet will also get the Merge upgrade. Ethereum developers and team hope this happens in early August.

What would be the Ether price if the merge happened today?

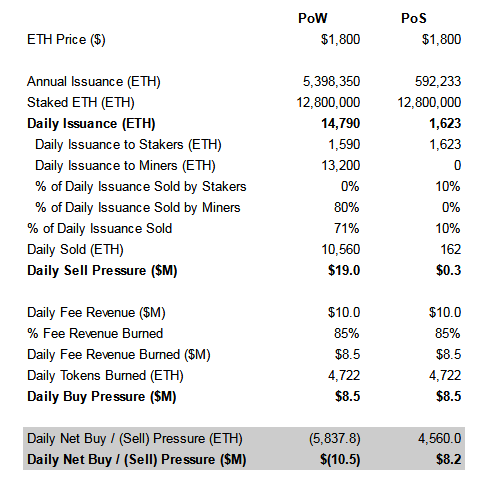

Ethereum Merge upgrade is getting everyone excited because of its key factors. However, some people have started a discussion about the effects on the ETH price. Korpi87, a Twitter user, explained what would happen if the upgrade happened today. According to his thesis, we should pay attention to some facts such as ETH issuance in PoW and PoS. Daily wage income and the percentage of wage income burned due to EIP-1559 will change. It is also necessary to include the estimation of the number of ETH sold by miners and stakers into the equation. When the above is done correctly, it is possible for the data to be as shown below. Twitter user

Twitter user Merge estimates that if it happens today, total daily sales pressure of currently $10 million will be replaced by $8 million buy pressure. From a fundamental perspective, the shift in the narrative from oversold pressure to overbought pressure will positively impact Ethereum price. Currently, technical indicators are in a tight spot due to BTC price. Merge will benefit greatly from the imbalance of buying and selling pressure. Thus, it will trigger a rally in Ethereum price.

ETH price to rise?

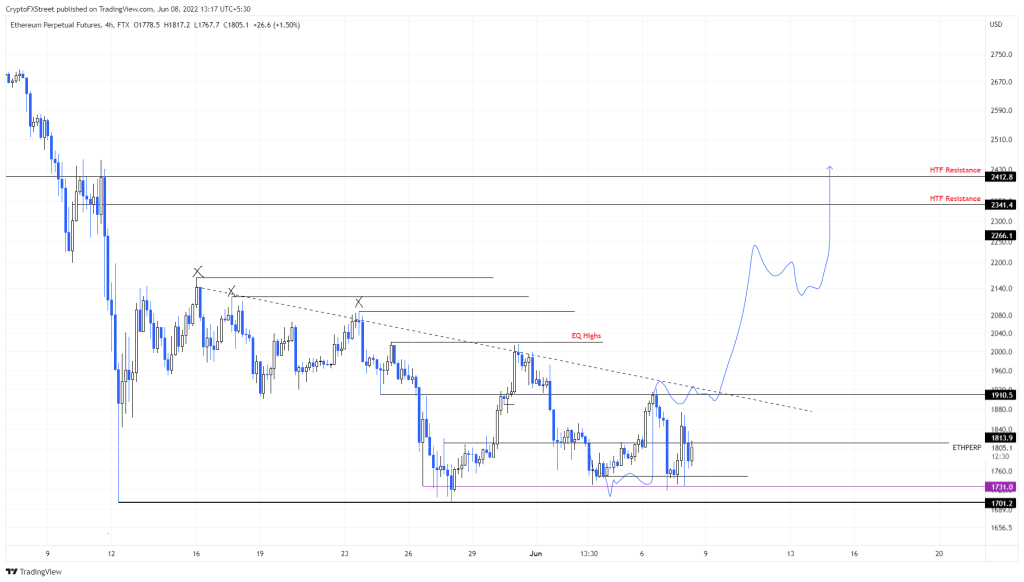

Ether price has produced a series of lower lows since May 16. As reported by Kriptokoin.com , Leading altcoin is forming lows around the $1,700 support level. This consolidation, coupled with Merge’s bullish prospects, could prompt a rally for ETH.

When we separate the fundamentals from the technical indicators, we see that there is an equal high at $2,020 and Ethereum price could rise at least 12% to sweep the equal high at $2,020. If the buying pressure continues to build, ETH will begin to rally the remaining liquidity above the lower high swing points formed until May 16. Assuming Ethereum price crosses the May 16 high of $2,164, a 20% rise is possible. Even if this possibility is realized, it will be a short-term uptrend. Also, the 20% rise will likely be where ETH stops on the upside.

If Bitcoin price rises above $35,000, investors can expect ETH to follow suit. They can also expect Ether to label the resistance barriers at $2,341 and $2,412, respectively, in the broader time.

Optimism around the merge upgrade dominates the market for now. However, if the market does not react to the rise, it is possible that the bullish thesis will not materialize. If Ethereum price produces a four-hour candlestick below $1,701, it will form a lower low. Thus, the price will invalidate the bullish thesis. After that, we could see the altcoin revisit the $1,543 support level.