According to analysts, the Altcoin market should be prepared to open a total of $ 17 billion token locks by the end of April. This will lead to the depreciation of many toks and the suppression of the market due to excessive supply.

Token lock expansions and market saturation pose a threat to new projects

According to the latest developments, US President Donald Trump has approximately $ 10 billion in the crypto market due to tariffs. This further weakened the market liquidity.

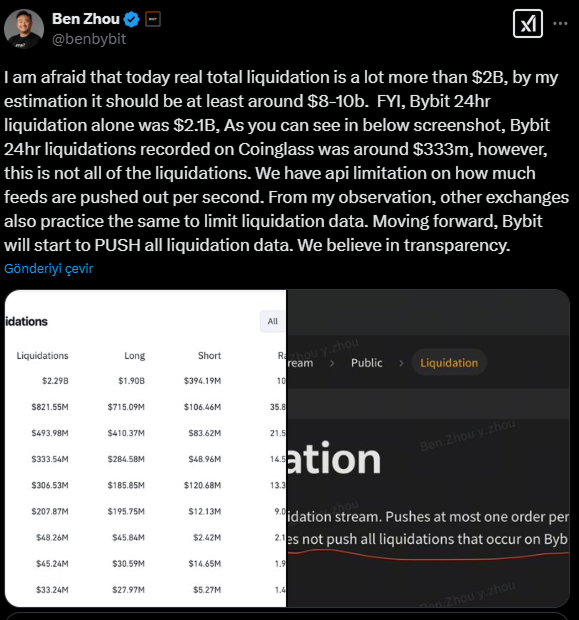

Bybit CEO Ben Zhou said that the crypto liquids after US tariffs could be between $ 8-10 billion.

At present, analysts emphasize that the market is no longer willing to support new projects that are no longer offering unique value. This view is parallel with reports that the interest of investors shifted to Altcoins with real world value from breast coins.

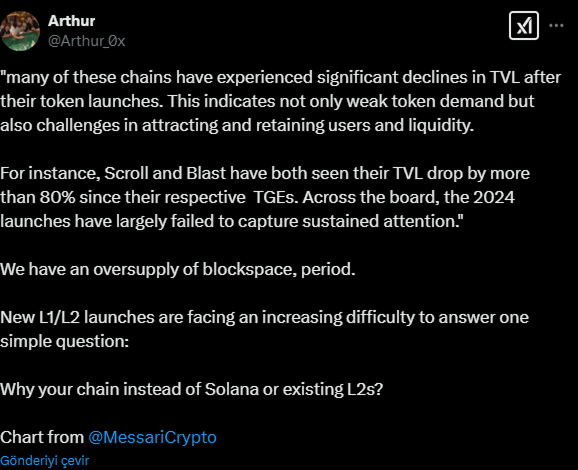

A new analysis based on data from Messari shows that projects such as Starknet, Mode, Blast, ZKSYNC, Scroll and Dymension experience serious value after the token launch.

However, Hyperliquid’s Hype token was one of the rare projects that opposed this general tendency by experiencing an extraordinary rise of 1100 %.

Large -scale Altcoin lock expansions often lead to price decrease

According to a study by Keyrock Research, 90 %of the projects opened token lock has a price decreases.

The reason for this is that the token supply put on the market is usually more than demand. The tokens, which are opened with the lock, are generally sold by early investors and people in the project, which increases sales pressure. Arthur, the founder and CIO of Defian Capital, supported this tendency and said:

Following the Token launch, most of the chains (total locked value) have decreased significantly. This shows not only the demand for weak token, but also the challenges of pulling user and liquidity.

Why are new Blockchain projects forced?

According to fashion show data, the TVLs of projects such as Scroll and Blast experienced a decrease of over 80 %after the Token launch. The general market tendency shows that the blockspace supply is high and that new chains have difficulty in differentiating themselves.

According to the Defiance Capital manager, the competition between the new Layer 1 (L1) and Layer 2 (L2) projects is increasing, while the sitting nets like Solana continue to stand strong.

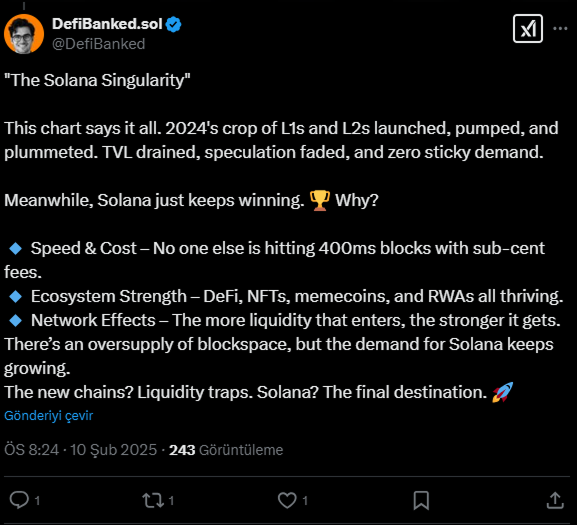

Solana left most of the L1 and L2 projects launched in 2024. These projects initially experienced rise, then fell. TVLs decreased, speculation is over, demand disappeared. However, he continues to win.

According to analysts, solana stands out with 400MS block times and ultra low trading fees. It also has a wide ecosystem, including defi, NFTs, breast coins and real world assets (RWA).

This shows that new Blockchain projects have difficulty in differentiating themselves and that projects that cannot offer a unique use are rapidly forgotten. As a result, developers and investors should focus on innovation. Otherwise, new projects will face the risk of extinction in this market, where competition is intense.