Crypto currency markets watch horizontally during the week, on Friday, February 14, the Bitcoin option worth $ 2 billion will expire. Investors are wondering how this major option maturity will have an effect on Bitcoin and the general market. Previously, a similar size option -maturity filling had not created a great mobility in prices.

Latest situation in Bitcoin options

The 21,300 Bitcoin option agreement, which will end this week, points to the $ 98,000 “Max Pain” level. In the option market, the Put/Call ratio is calculated as 0.67. This ratio shows that Long (Taurus) contracts are more than Short (bear) contracts. This shows that there is a simple procurement pressure.

https://x.com/greexlive/status/188986918481494853333

The largest open positions in the Bitcoin option market are 120,000 and $ 110,000. There is an open position of $ 1.8 billion at $ 120,000 and $ 1.2 billion at $ 110,000. This indicates that investors expect Bitcoin price to rise in the long term.

Ethereum Options and Effect on Crypto Market

Today, not only Bitcoin, but also the 176,000 Ethereum option agreement will fill the maturity. The total value of Ethereum options is 470 million dollars and the Max Pain level is calculated as $ 2,765. This shows that Ethereum can move close to this level in the short term.

https://x.com/greexlive/status/1890199504915468530

Greeks Live, the derivative analysis platform, says Impceded Volatility (IV) levels have declined to the lowest point of the last year. This indicates that the market expects low volatility in the short term. The effect of inflation data described in the US, especially on the market, is carefully monitored.

Current Situation in Crypto Markets

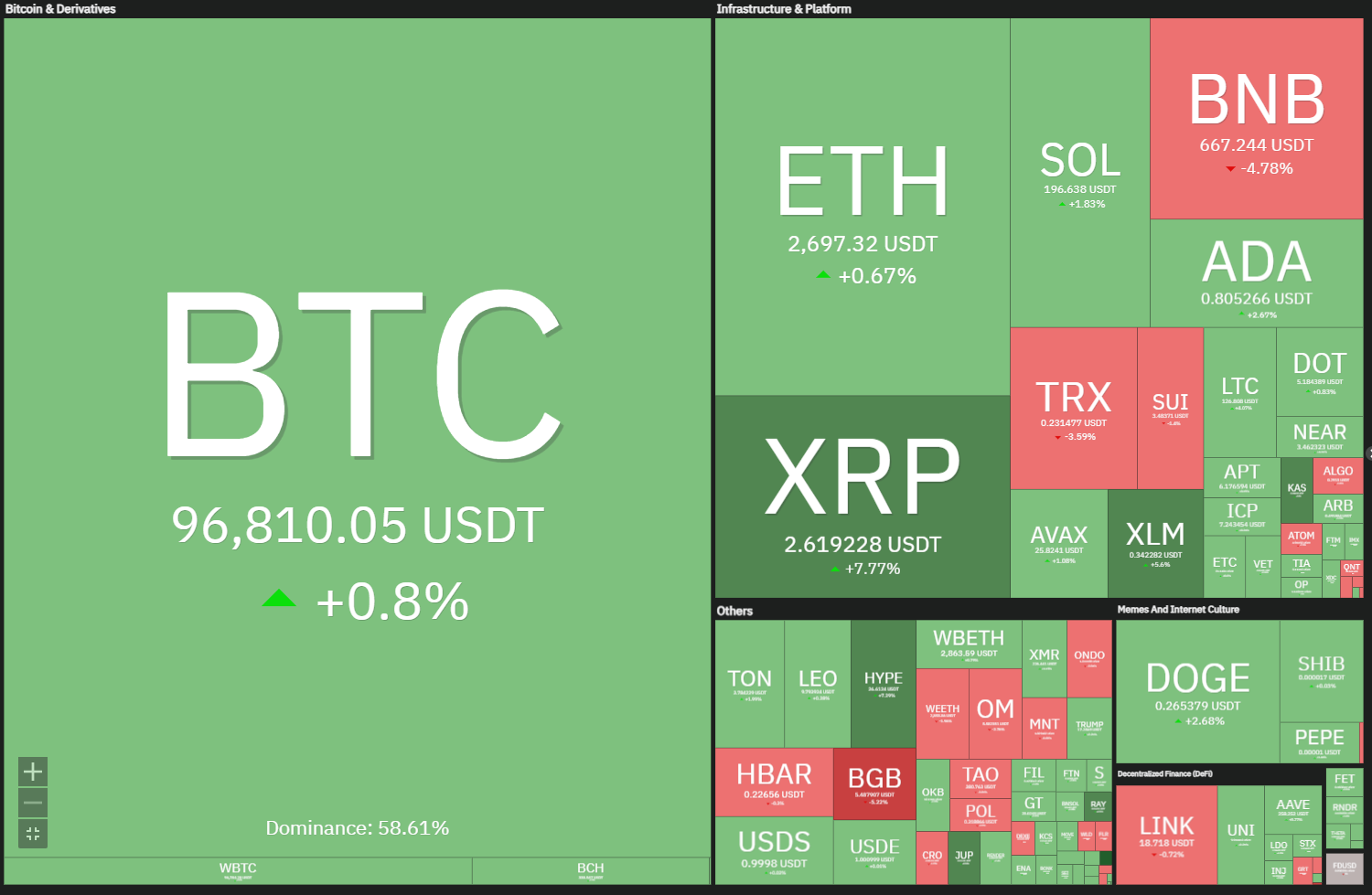

Bitcoin fell to $ 95,426 during Asian transactions, but rose to $ 96,700 again. The $ 98,000 level stands out as an important resistance point and the price movements are expected to remain limited unless this level is overcome.

Ethereum is traded between 2,600 and $ 2,700 in the last 24 hours. Bitcoin is expected to determine direction, while the Altcoin market is dominated by a mixed look. There is a significant increase in XRP and XLM, while BNB CoIN, TRX, LINK, HBAR and SUI are decreased.