ENA gives recovery signals, but the critical resistance levels will determine whether this rise will continue.

ENA Purchase Signal and Market Status

According to recent analyzes, Ethena (ENA) gave a purchase signal on the 12 -hour graph through the TD Sequential indicator. This signal points to a potential recovery movement after the previous decline process.

During the spelling, ENA was traded for $ 0.4838 with an increase of 4.49 %in the last 24 hours. However, there are some levels of resistance that can limit the rise. Investors carefully monitor whether the bull trend will continue if these levels are exceeded.

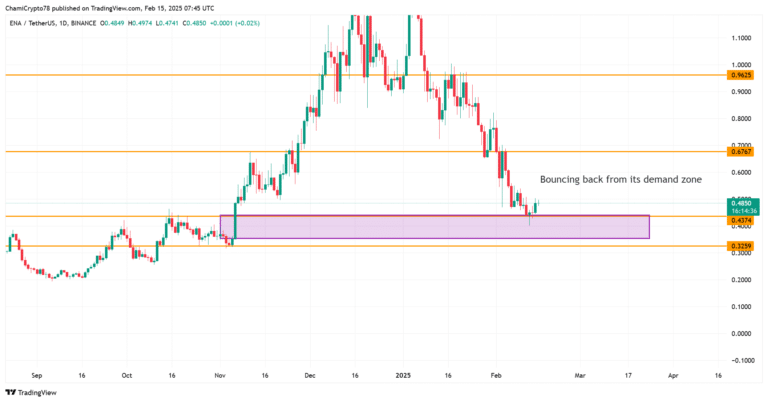

ENA is currently trying to recover from the demand zone of $ 0.4374. However, the first major resistance point in front of the dollar, if this level is not exceeded, the rise movement may weaken.

If ENA manages to break this resistance, the next important resistance is $ 0.6770. The overcoming of these resistance points will determine whether ENA will enter a longer -term rise trend.

ENA’s Network Event and User Participation

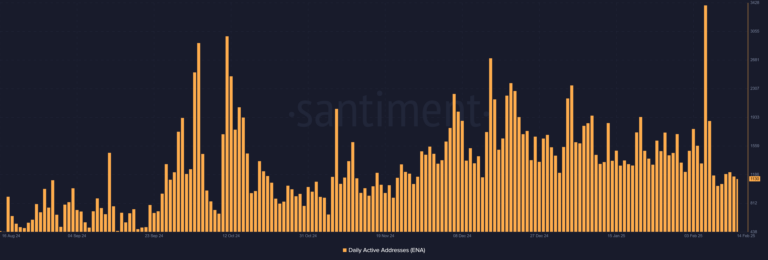

ENA’s daily active address reached 1130 and showed a moderate growth. This shows that the interest in ENA has increased steadily. If the continuity of the activities on the network is ensured, this may contribute to the tendency to rise.

However, not only the increase in the number of active addresses does not guarantee that the price will continue to increase. Other factors, such as the increase in the transaction volume, also need to be supportive.

ENA’s transaction volume reached a moderate level by reaching 1120. Although this is not a sudden explosion, it shows that the demand continues. If the price of ENA continues to move upward, the increase in the process volume can help break the resistance levels.

However, if the transaction volume decreases again, it may be difficult to maintain the current levels of the price. Therefore, the mobility in the transaction volume will be an important factor that determines ENA’s price trend in the short term.

The current situation for ENA investors

The current price, $ 0.4838, has approximately 70 %of investors profit. This may be a positive sign for the continuation of the bull market because investors tend to protect their positions as long as they are in profit.

On the other hand, the proportion of investors in loss seems low. This shows that sellers are cautious for now and can wait for prices to rise further.

- ENA gives recovery signals, but it has strong levels of resistance.

- Network activity and transaction volume can support this rise, but not enough.

- Since most of the investors are in profit, the bull momentum can continue.