The Middle East, especially the Gulf countries, may have been in front of the US in adopting Bitcoin.

Bitcoin move from Abu Dhabi

According to analysts, Abu Dhabi may have more Bitcoin than expected. Some experts argue that the US should include Bitcoin in the national asset fund.

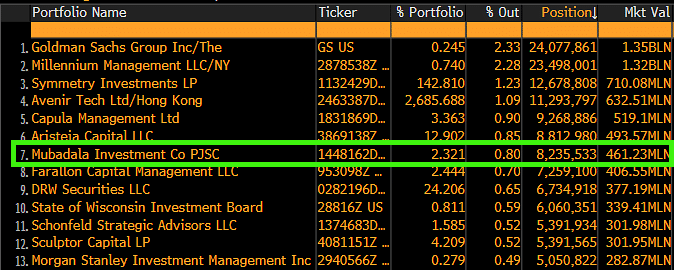

Mubadala Investments, the sovereign asset fund of Abu Dhabi, has invested 461 million dollars in the last quarter of 2024 and became the seventh largest investor in the Bitcoin ETF of Blackrock in IBIT.

Speculation that the total BTC assets of Abu Dhabi, one of the emirates of the United Arab Emirates (UAE), could rise up to $ 40 billion in BTC assets, became more strengthened by this development.

Is Abu Dhabi’s Bitcoin accumulation bigger?

Bloomberg ETF analyst James Seyffart used the following statement when evaluating this development:

“The rumors are not just rumors!”

However, the UAE government has not officially announced BTC assets. Binance’s founder Changpeng Zhao (CZ) suggested that Abu Dabi’s BTC amount may be much more. CZ commented on the subject:

“This report is based only on Mubadala, one of the sovereign asset funds (SWF) in Abu Dhabi. However, there are several more different sovereign assets funds in Abu Dhabi. ”

Can the United States follow the UAE’s path?

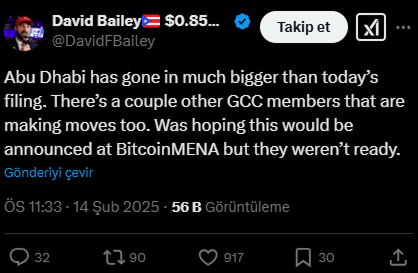

David Bailey, CEO of Bitcoin Magazine, said that Abu Dhabi has much more explained and other members of the Gulf Cooperation Council (GCC) took similar steps:

“Abu Dhabi has made a much larger investment than it was announced. Other GCC countries also participate on this train. I was expecting this development to be announced at the Bitcoinmena event, but they weren’t ready yet. ”

These developments have increased calls for the US to create a national Bitcoin reserve. The idea of the inclusion of Bitcoin in the new sovereign asset fund (SWF) announced by former US President Donald Trump is coming to the agenda.

Bailey also argued that Trump’s Trade Minister candidate Howard Lutnick could look hot to add Bitcoin to the US sovereign asset fund.

Can USA set up a Bitcoin reserve?

Bitcoin Policy Institute crypto currency defender group also made a similar proposal. The report prepared by the group included the following statements:

“The US government may form a national Bitcoin reserve using approximately 200,000 BTC confiscated by legal processes. This step can be the fundamental capital of the sovereign asset fund without creating a new tax burden. ”

However, this suggestion is not priced sufficiently by the market for the time being. According to Polymarket data, the probability of the US to set up a national BTC fund until the summer months is priced as only 14 %.

Latest situation in BTC price

While BTC investments gained momentum on a state basis, the impact of these developments in the crypto currency market was limited. Bitcoin has been trading under $ 100,000 for the last 10 days and is now at $ 97,000. This price is below 12 %of Bitcoin’s highest level (ATH).