Potential Impact of SEC’s Decision on Coinbase Lawsuit

The Securities and Exchange Commission (SEC) may be on the verge of dropping its lawsuit against Coinbase, a development that could significantly enhance market sentiment not only for the crypto tokens that were previously classified as securities under the last presidential administration but also for popular trading platform Robinhood (HOOD). While the SEC has yet to make an official announcement regarding the Coinbase case, such a decision would likely be welcomed by the crypto industry, which has faced heightened regulatory scrutiny during the Biden administration.

In June 2023, Robinhood was forced to delist several tokens that the SEC had alleged were securities. However, following the election of President Donald Trump last year, the platform gradually began reinstating some of those tokens, including Solana’s SOL, which had been implicated in the SEC’s allegations. With the potential dismissal of the Coinbase case, exchanges like Robinhood are likely to perceive less regulatory risk, empowering them to add more tokens to their offerings. This could subsequently lead to an increase in trading revenue.

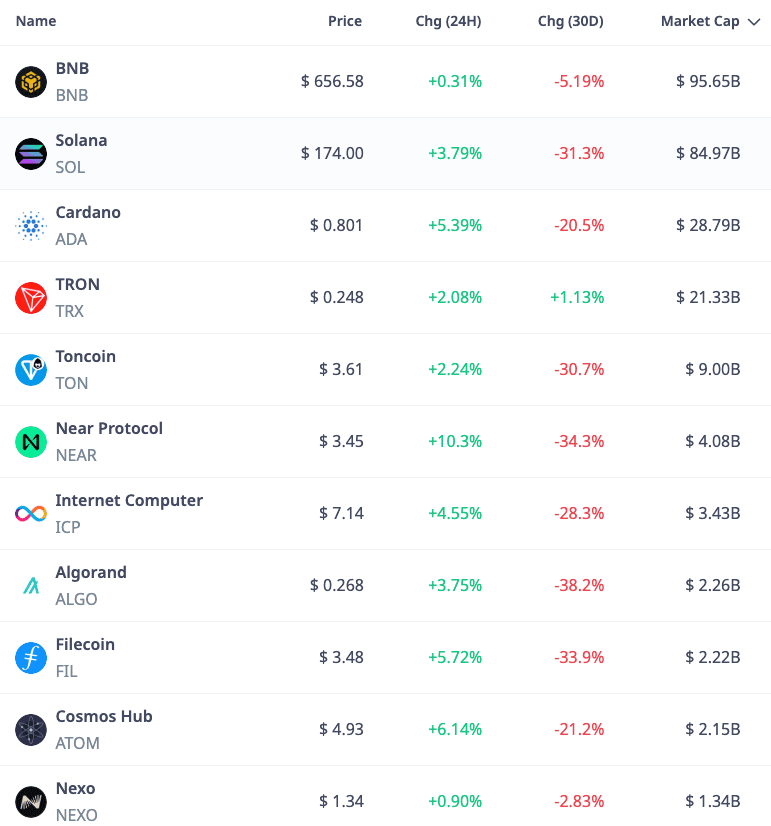

Recently, Robinhood announced that its fourth-quarter revenue surged by an impressive 115% compared to the previous year, surpassing Wall Street’s expectations. This growth was primarily driven by a notable rise in crypto trading activity. According to data from Cryptorank.io, the top five tokens identified as securities based on market capitalization include BNB, Solana (SOL), Cardano (ADA), Tron (TRX), and Toncoin (TON).

As of February 21, the tokens alleged to be securities by the SEC, with a market capitalization exceeding $1 billion, reflect a significant footprint in the crypto market. The potential resolution of the Coinbase lawsuit might not only revitalize trading platforms but also encourage more crypto companies to explore initial public offerings (IPOs) in U.S. markets. Several firms such as Blockchain.com, BitGo, Gemini, EToro, Bullish Global (CoinDesk’s parent company), Ripple, and Circle are already rumored to be contemplating IPOs in the U.S.