Market Analysis: XRP vs. Dogecoin

The payments-focused cryptocurrency XRP is experiencing a downturn, yet it remains resilient, while the outlook for Dogecoin (DOGE) appears decidedly bleak, according to an analysis based on Fibonacci retracement levels.

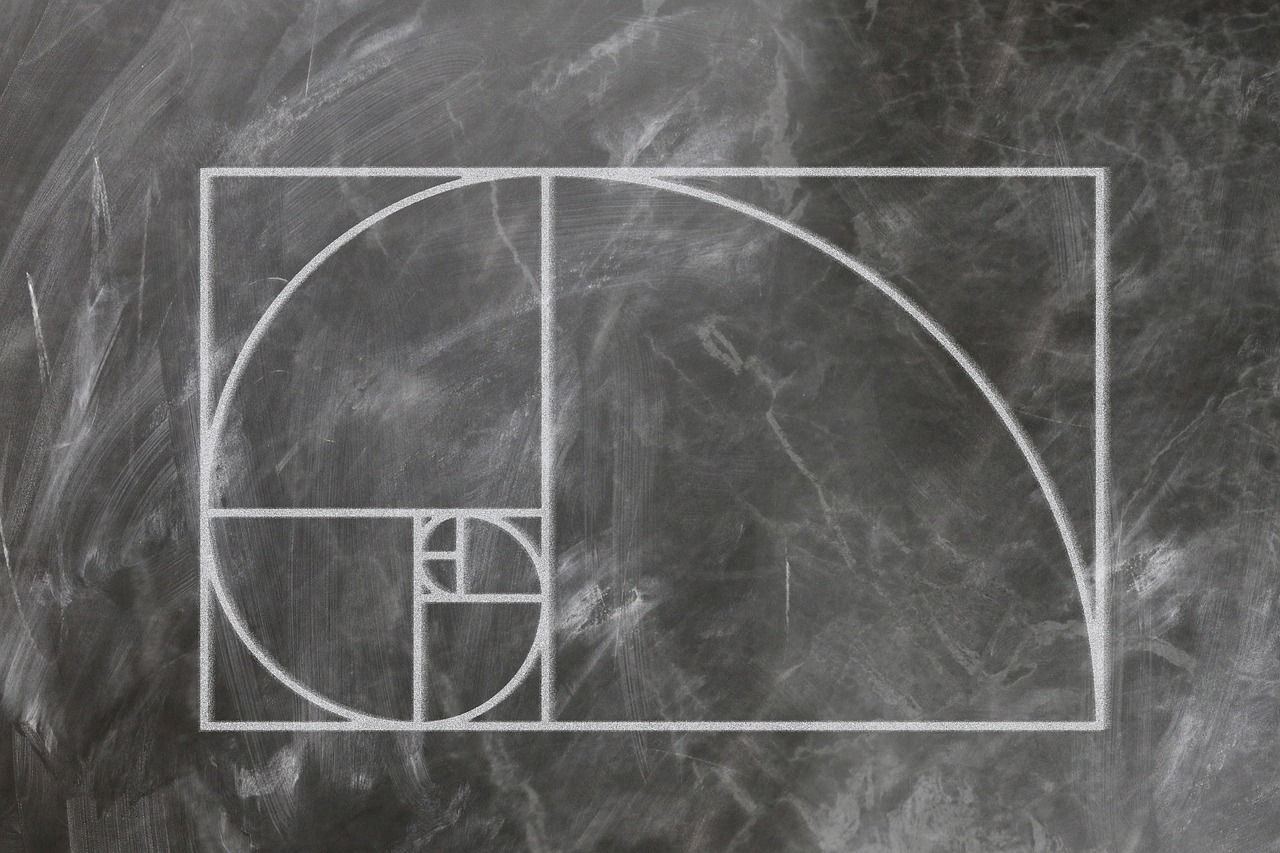

In mid-January, XRP soared to an impressive peak of $3.40, but it has since entered a downward trajectory, witnessing a substantial decline of 25% this month, bringing the price down to $2.28, as indicated by data from TradingView and CoinDesk. Although the sell-off has been significant, it corresponds to only a 38.2% Fibonacci retracement of the rally that commenced from the low of 49.5 cents on November 4 to the high of $3.40 reached on January 16. A retracement refers to a temporary decline from the principal trend.

This development is somewhat encouraging for XRP bulls, as the 38.2% level, in conjunction with the 50% and 61.8% Fibonacci ratios, signifies potential support zones where the price may resume its previous upward trend. According to the CME’s explanatory resources, trends often experience pullbacks to these critical levels before launching into larger rallies. Consequently, XRP enthusiasts have ample reason to remain optimistic about potential gains in the near future.

Moreover, recent positive developments surrounding XRP have emerged, further boosting investor sentiment. On Monday, ETF.com reported that Brazil’s securities regulator has registered the first spot XRP exchange-traded fund (ETF), as the Hashdex Nasdaq XRP Fund has entered a pre-operational phase with Brazil’s Comissão de Valores Mobiliários (CVM). Additionally, U.S. regulators are currently reviewing applications for XRP ETFs, and a potential approval could significantly enhance institutional demand for XRP, especially considering the successful uptake of Bitcoin (BTC) and Ethereum (ETH) ETFs.

As illustrated in XRP’s daily chart with Fibonacci retracements (source: CoinDesk/TradingView), the Fibonacci series operates by adding the two preceding numbers to generate the next number in the sequence. This sequence, which has captivated mathematicians and scientists for centuries, unfolds as follows: 1, 3, 5, 8, 13, 21, 34, 55, and so forth. The ratio of any number to the next higher number approximates 0.618, while dividing any number in the sequence by the one two spaces to the right yields 38.2.

Traders frequently utilize these ratios and the 50% level to forecast the potential retracement of an asset from its primary trend, which, in the case of XRP, is the ongoing bull run.

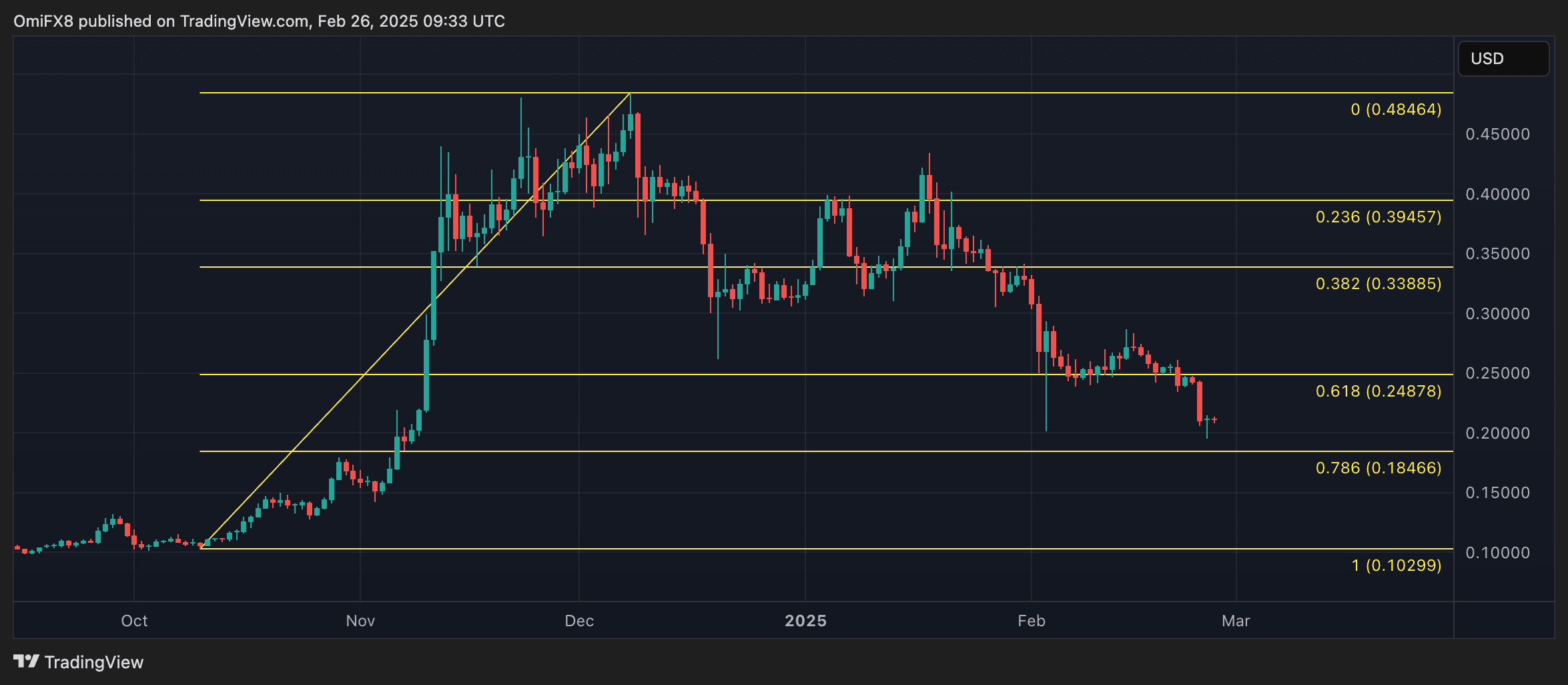

Conversely, the situation for Dogecoin presents a stark contrast. A primary trend is typically considered to be at an end when a retracement surpasses the 61.8% Fibonacci level. Unfortunately, the world’s largest meme cryptocurrency by market capitalization has plummeted below 21 cents, retracing more than 70% of the rally that began from the lows of October near 10 cents and peaked at 48.4 cents in December. The decline of DOGE below the 61.8% Fibonacci level indicates that its uptrend has officially concluded.

As the market evolves, both XRP and Dogecoin reflect different narratives, with XRP showing signs of potential recovery while Dogecoin faces significant challenges ahead.