Market Rebound: Altcoin Performance Amidst Turbulence

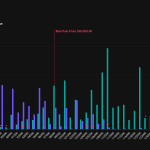

Crypto traders are likely still grappling with the aftermath of Tuesday’s significant market downturn, but there’s a silver lining as bullish positions on two particular altcoins are yielding impressive returns. The innovative intellectual property platform, Story, has seen its token surge by nearly 40%, significantly outperforming the broader market, which recorded only a 5.20% increase in major tokens tracked by the CoinDesk 20 index. In a similar vein, the on-chain exchange Hyperliquid has witnessed its token, HYPE, rise by 15%.

Monitoring tokens that are outperforming during a market rally or rebound is a crucial strategy for traders, as it indicates heightened demand. This presents an opportunity for traders to consider these assets for future purchases, especially if market dips occur, making them potentially profitable investments.

Recent data from IP-tracked futures revealed a remarkable 52% increase in open interest, reaching $162 million on Wednesday. This surge signals a growing enthusiasm among traders. Story Protocol specializes in tokenizing creative assets, such as art, music, and AI-generated content, transforming them into programmable and tradable entities that grant holders rights to the underlying assets.

In a noteworthy development, Aria Protocol, a project within the Story ecosystem, announced on Wednesday that it had obtained partial rights to the hit song “The Truth Untold” by the renowned Korean band BTS, which boasts over 670 million streams. Read more here.

Meanwhile, the strong fundamentals behind HYPE may be driving its increasing demand. The primary exchange has reported staggering trading volumes of over $190 billion in January and $167 billion in February, with all revenue generated being allocated for token buybacks in the open market.

Data indicates that Hyperliquid generated a remarkable $3.5 million in revenue just on Tuesday, accumulating nearly $40 million throughout the month. This consistent revenue generation creates a steady buying pressure for HYPE, regardless of the overall market’s fluctuations.