The Evolving Landscape of Crypto Regulation

The U.S. Securities and Exchange Commission (SEC) has been making headlines recently, signaling a potentially brighter future for cryptocurrency companies. This shift comes amidst a backdrop of significant political changes, particularly with Donald Trump’s second term as President of the United States.

You’re reading State of Crypto, a CoinDesk newsletter exploring the intersection of cryptocurrency and government. Click here to sign up for future editions.

A New Chapter for Crypto

The Narrative

In the early weeks of Trump’s presidency, the crypto industry has celebrated a series of victories. The SEC announced its decision to withdraw or close several ongoing investigations and cases, which has sent ripples of optimism through the crypto community. Additionally, the SEC has sought to pause two other cases, indicating a strategic shift in its approach.

Why It Matters

The crypto sector has emerged as a significant player in the political arena during the 2024 election cycle, and the implications of these changes are just beginning to unfold. The ongoing debate around the appropriate regulatory framework for the industry is now more pertinent than ever.

Breaking It Down

In the past week, the SEC has taken notable steps by filing to withdraw its case against the cryptocurrency exchange Coinbase, pausing its actions against Binance and Tron, and informing platforms such as ConsenSys, OpenSea, Robinhood, Uniswap, and Gemini that their cases or investigations would be closed. These announcements coincided with SEC Commissioner Hester Peirce’s announcement of a new crypto task force aimed at addressing regulatory questions regarding how securities laws apply to various cryptocurrencies.

The SEC has also retracted Staff Accounting Bulletin 121, an accounting standard that many in the industry criticized. Although some investigations remain open, it is evident that the SEC’s direction under Acting Chair Mark Uyeda marks a stark departure from the more aggressive stance taken by former Chair Gary Gensler.

Commissioner Peirce emphasized that the SEC is working towards establishing clearer policies to guide the Division of Enforcement in its future actions, rather than allowing enforcement actions to dictate regulatory policy. “We are striving to utilize our enforcement division for its intended purpose, while allowing our regulatory divisions to do the essential work of crafting rules, guidance, and interpretations,” she explained in an interview with CoinDesk. “This has been an area where we have approached things in reverse, and we are working to correct that.” The industry has responded positively, interpreting these withdrawals and dropped cases as a sign of progress.

Amanda Tuminelli, the Chief Legal Officer at DeFi Education Fund, expressed that while there is optimism, true victory will only be realized once clear and lasting regulatory rules are established to foster innovation and the sustainability of the industry.

Contrasting Perspectives

On the flip side, some experts warn that the SEC’s relaxed approach could invite chaos into the financial system. Corey Frayer, Director of Investor Protection for the Consumer Federation of America and a former SEC senior adviser, cautioned that the SEC is not just stepping back from enforcement but is actively fostering an unregulated market for crypto assets, which could pose systemic risks.

Frayer referenced the collapses of FTX and Silicon Valley Bank, stating, “As we’ve learned from prior financial crises, increased leverage risks that any single bad bet or significant asset value fluctuation could jeopardize the entire crypto sector.” Congress’s efforts to regulate this space may take time, as evidenced by the recent formation of the Senate Banking Committee’s new digital assets subcommittee, which held its first hearing focused on future legislation.

Lewis Cohen, a seasoned attorney in the crypto realm and a witness at the hearing, highlighted the urgency for regulatory frameworks, stating, “This uncertain regulatory environment has left consumers and users of digital assets at risk. A clear, practical, and flexible federal statutory regime is urgently needed to address activities involving digital assets in both primary and secondary markets.” Former Commodity Futures Trading Commission Chair Timothy Massad suggested lawmakers prioritize stablecoins while postponing any market structure legislation until the SEC and his former agency can provide more comprehensive rulemaking and guidance.

Tuminelli voiced concerns that some in the crypto sector might misinterpret recent developments as a green light for unchecked activities, although she anticipates that law enforcement will continue to address outright criminal behavior. Recent hacking incidents, such as Bybit’s $1.5 billion loss, underscore the ongoing challenges facing the industry.

Stories You May Have Missed

- Bybit Sees Over $4 Billion ‘Bank Run’ After Crypto’s Biggest Hack: Following a $1.5 billion hack, Bybit experienced an additional $4 billion in customer withdrawals.

- Bybit Closes ‘ETH Gap’ as Exchange Replenishes $1.4B Hole After Hack: Bybit claims to have addressed its $1.5 billion deficit through loans and ether (ETH) acquisitions.

- North Korean Hackers Were Behind Crypto’s Largest ‘Theft of All Time’: The notorious Lazarus Group was identified as the perpetrator of the Bybit hack, as confirmed by Arkham Intelligence and crypto investigator ZachXBT.

- Bybit Declares ‘War on Lazarus’ as It Crowdsources Effort to Freeze Stolen Funds: Bybit is offering a 5% bounty to individuals who assist in freezing or recovering its stolen funds.

- Payments Card Issuer Infini Offers Reward for Return of Funds After $49 Million Exploit: Infini lost nearly $50 million to a hack and is offering a deal for the hacker to retain 20% of the stolen funds if the rest is returned.

- Germany’s Centre Right Alliance Secures Most Seats in EU Nation’s Election: In recent elections, Germany’s Centre Right Alliance emerged with the most parliamentary seats, with the far-right Alternative for Germany (AfD) securing second place.

- U.S. Appeals Court (Mostly) Affirms 2023 Ruling Tossing Out Uniswap Class Action Suit: The Second Circuit Court of Appeals largely upheld a decision dismissing a class action lawsuit against Uniswap regarding third-party tokens.

- OKX Settles U.S. DOJ Charges, Pays Over $500M Penalty and Forfeiture: The exchange settled charges with the U.S. Department of Justice, paying over $500 million to resolve allegations of operating without a money transmitter license.

- How to Prepare for a Major Compliance Failure Settlement: The OKX Approach: CoinDesk’s Ian Allison reports on how OKX meticulously prepared for its compliance failure announcement.

- UK Introduces Crime Bill That Extends Powers for Courts When Retrieving Crypto: New legislation in the U.K. provides local law enforcement agencies with enhanced authority to seize cryptocurrencies linked to suspected crimes.

- One of 2 Remaining Democrats at U.S. CFTC Will Exit When New Chair Arrives: CFTC Commissioner Christy Goldsmith Romero, whose term has ended, will leave the agency following the Senate’s confirmation of former commissioner Brian Quintenz as chair.

- Crypto-Friendly Former Congressman Patrick McHenry Joins A16z as a Senior Advisor: Former House Speaker Pro Tempore Patrick McHenry has joined venture capital firm Andreessen Horowitz as a senior advisor.

- Hackers Are Using Fake GitHub Code to Steal Your Bitcoin: Kaspersky: Kaspersky has warned that some seemingly legitimate GitHub projects contain malicious files designed to steal cryptocurrency.

- Michael Novogratz’s Galaxy Hires Zac Prince, Former CEO and Co-Founder of BlockFi: Zac Prince, the former BlockFi CEO, is joining Galaxy Digital as a managing director.

- Crypto Asset Manager Bitwise Bolsters Balance Sheet With $70M Equity Raise: Bitwise raised $70 million in an equity deal, enhancing its position as a pioneer in crypto exchange-traded products.

- U.S. Law Enforcement Seizes $31M in Crypto Tied to Uranium Finance Hack: Authorities recovered $31 million in cryptocurrency linked to a hack of automated market maker Uranium Finance.

- U.S. Appeals Court (Mostly) Affirms 2023 Ruling Tossing Out Uniswap Class Action Suit: The appeals court upheld the dismissal of a class action lawsuit against Uniswap regarding third-party tokens.

- Crypto Trading Platform BitMEX Is Looking for a Buyer: Sources: Reports indicate that BitMEX is currently seeking potential buyers.

- Utah One Vote Away, But Some States Fail to Break Through on Crypto Stakes: Jesse Hamilton examines state efforts to establish crypto reserves, noting that some initiatives have faltered.

- U.S. Treasury’s New Crypto Point Person Says Stablecoin Law a Good First Goal: Tyler Williams, a former attorney at Galaxy Digital, now advising the U.S. Treasury, discussed the need for stablecoin regulations.

- FTT Briefly Spikes After Sam Bankman-Fried Tweets for First Time in 2 Years: Bankman-Fried’s X account tweeted about checking email and layoffs, raising questions about who is managing the account while he remains in detention.

ETF Bonanza

Beyond enforcement actions, the crypto industry is keenly awaiting the SEC’s approval of a wave of new exchange-traded products (ETPs) that track or are backed by digital assets previously overlooked. In recent weeks, companies such as Canary, Grayscale, and WisdomTree have filed initial paperwork for ETPs focused on cardano (ADA), solana (SOL), XRP (XRP), litecoin (LTC), hedera (HBAR), and polkadot (DOT). Unlike in prior years, there is rising confidence that retail and institutional investors will soon have access to these digital assets through regulated investment vehicles.

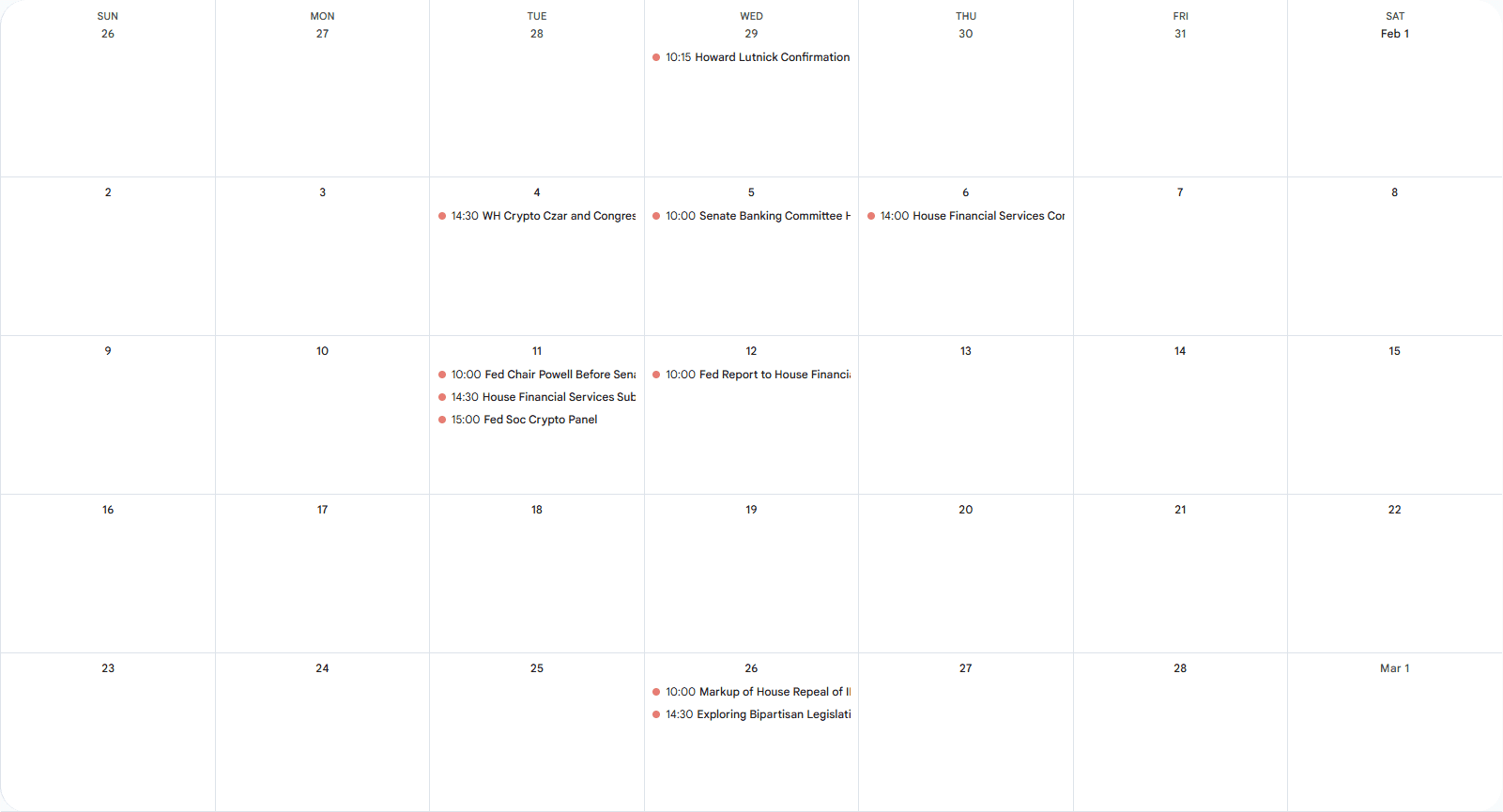

This Week

Wednesday

- 15:00 UTC (10:00 a.m. ET) – The House Ways and Means Committee advanced a Congressional Review Act effort to reverse an IRS rule imposing tax reporting requirements on DeFi entities. This resolution will now be presented to the full House of Representatives.

- 19:30 UTC (2:30 p.m. ET) – The Senate Banking Committee’s digital assets subcommittee convened to discuss legislation related to stablecoins and market structure.

Elsewhere:

- (The Wall Street Journal) – A lawyer with X (formerly Twitter) reportedly warned an advertising conglomerate’s lawyer to encourage clients to spend on the platform “or else.”

- (The Ringer) – The Ringer has published a detailed report on NBA Top Shots.

- (The New York Times) – The Times has released an extensive feature on Elon Musk’s current role in the White House.

- (The Washington Post) – The Post examined the government loans that have supported Musk’s various business ventures over the years.

- (NPR) – The Social Security Administration plans to reduce its workforce by 7,000 employees.

- (Science) – Several universities are canceling plans to host students due to cuts from the National Science Foundation.

In a surprising move, Microsoft has announced it will officially retire Skype in May 2025. Skype GUI in 2003

If you have thoughts or questions on what topics I should cover next week, or any other feedback, please feel free to email me at [email protected] or connect with me on Bluesky @nikhileshde.bsky.social. You can also join the conversation on Telegram.

Looking forward to seeing you next week!