In a large part of February, the crypto market followed a horizontal course. However, this week, Donald Trump’s initiation of trade wars. Despite the withdrawal, crypto whales continue to accumulate some coins. Especially whales, Bitcoin and these 2 subcoin intake positioned themselves for potential gains in March. Crypto Analyst A Biodun Oladokun, These 3 Coins are looking closely.

Leading crypto Bitcoin It is located in the focus of whales!

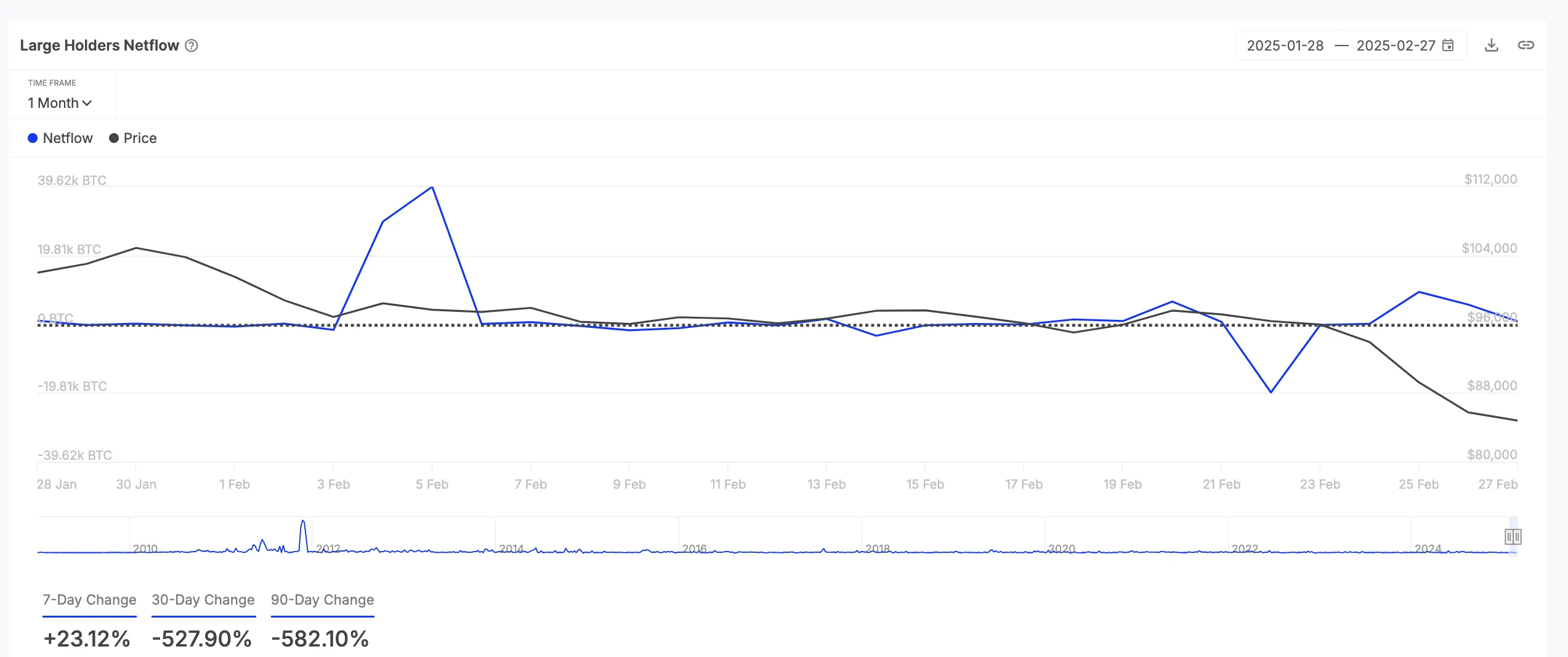

Bitcoin (BTC) has fallen below an important support line that has held its price in a range since the beginning of February. Thus, it fell to the lowest levels of the month. The BTC is traded for $ 79,610, the lowest price he recorded in November. Bitcoin whales reflecting the increase in the net flow of Coin’s large Holders, as well as benefited from discounted prices to strengthen their assets. According to Intothheblock, this metric has increased by 23 %in the last seven days.

Net flow of BTC Great Holders. Source: Intothheblock

Net flow of BTC Great Holders. Source: IntothheblockGreat Holders are whale addresses that hold more than 0.1 %of the circulating supply of an asset. Net flows follow the difference between the inputs and exits of an asset held by these large investors. When it rises in this way, it shows that the great holders accumulate more than being. Therefore, this means increasing confidence and potential upward price pressure. This tendency can also lead BTC individual traders to increase procurement pressure. If this persists, the circulating supply of crypto money will decrease and in March, its value will probably rise to over $ 95,000.

There is a Metaverse Coin in the second place: Sandbox (Sand)

METAVERSE -based Token Sand received the renewed interest of whales this week because the market was waiting for a wider recovery in March. Token was traded for $ 0.29 during the article and recorded a 43 %decline last month. According to the data of Santimement, the whales that kept 100 million to 1 billion token last week accumulated 180 million sands with a value of over 52 million dollars with existing market prices. During the article, this group of investors has the highest number since June 2024, 1.93 billion SAND token.

Sand Supply Distribution. Source: centimeter

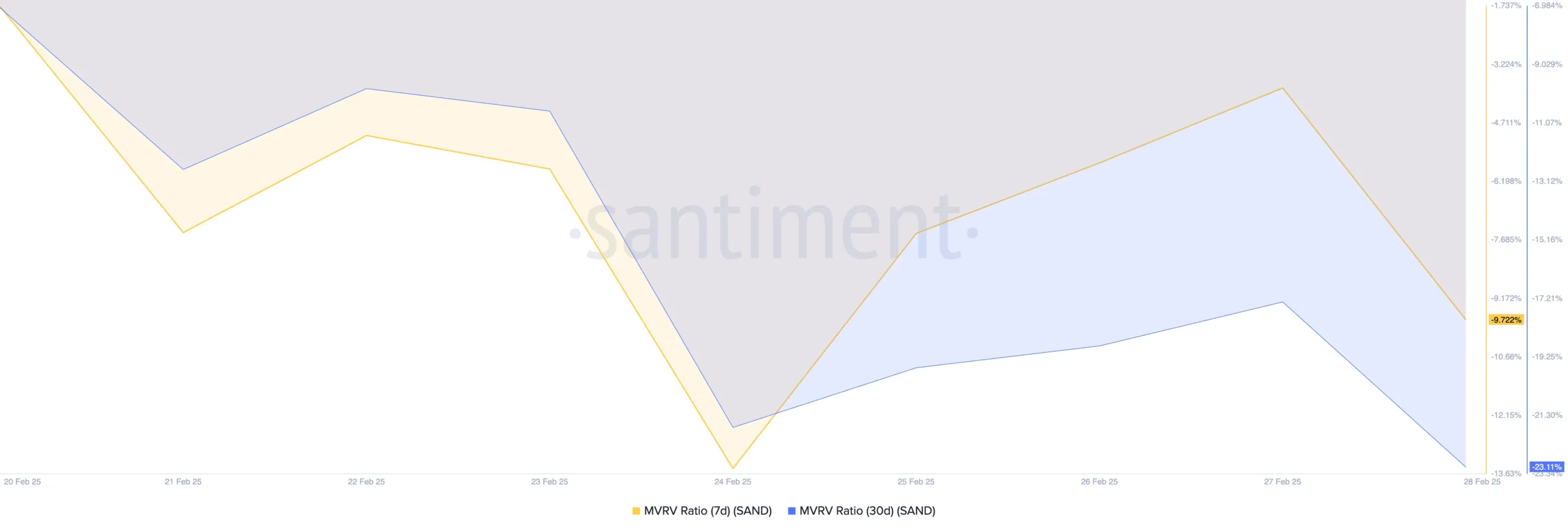

Sand Supply Distribution. Source: centimeterThe increase in Sand whale assets reflects the readings from the market value to the value (MVRV) ratio, as well as the current low -valuable state. As of this article, Altcoin’s 7 -day and 30 -day MVRV rates are -9,72 and -23,11, respectively.

Sand MVRV Rates. Source: centimeter

Sand MVRV Rates. Source: centimeterHistorically, negative MVRV rates are a purchase signal. It shows that the asset is traded below the historical purchase cost and offers a purchase opportunity for traders who want to buy the decline. Therefore, if this whale accumulation continues, Sand’s price may exceed the limit of $ 0.35 in March.

Last row token: Optimism (OP)

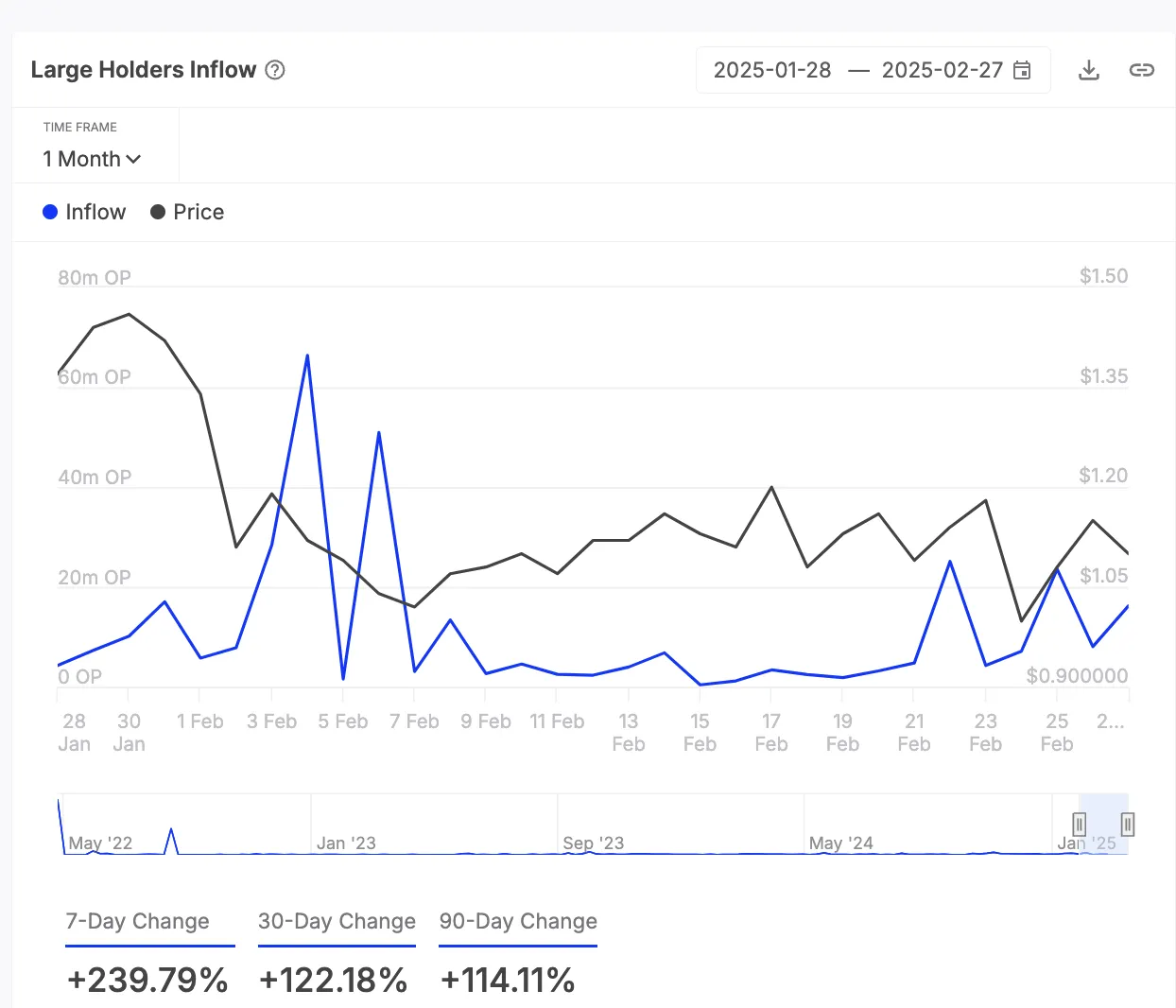

OP is another token that whales purchased strategically to earn in March. Intothheblock’s data revealed that there was an increase of 240 %in the entrance of the Great Holders in the last seven days.

Op Büyük Holder entrance. Source: Intothheblock

Op Büyük Holder entrance. Source: IntothheblockOP’s value fell by 8 %during this time. This shows that whales increase their entrances despite the price decrease. When the Great Holders increase their entrances, they transfer the significant amounts of an asset to their wallets. This is often seen as a signal of ascension because it indicates that the presence of the future price movement and the upward acceleration potential. If this continues in March, the OP’s price may rise to $ 1.52.

The opinions and estimates in the article belong to the analyst and are not definitely investment advice. Kriptokoin.comWe recommend that you do your own research before investing.