Crypto-Equities Surge Following Trump’s Strategic Announcement

In a notable turn of events, crypto-equities have experienced a significant rebound following the announcement of Donald Trump’s crypto strategic reserve initiative. As the U.S. market prepares to open, bitcoin (BTC) maintains a strong position above $92,000, showcasing a recovery from its recent decline, which had seen prices dip to around $78,000.

This resurgence has positively impacted crypto-related stocks, which had recently faced considerable declines. Notably, MicroStrategy (MSTR) saw a remarkable 12% increase after suffering a staggering 50% drop from its November peak. Other major players in the market, including Coinbase (COIN) and Marathon Digital Holdings (MARA), recorded gains of 10%, while Iris Energy (IREN) rose by 11%.

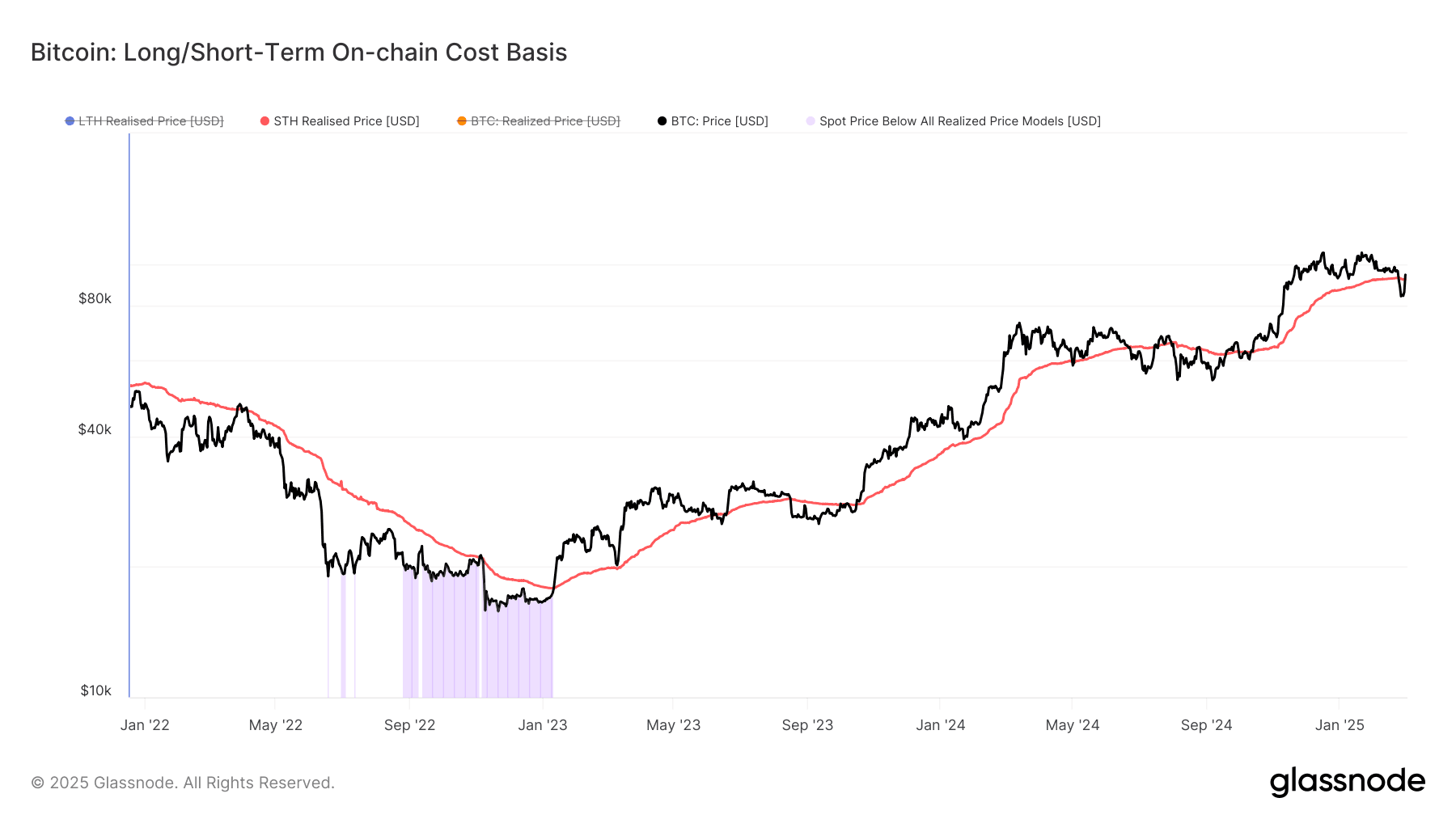

According to data from Glassnode, bitcoin has also surpassed the Short-Term Holder Realized Price (STH RP), currently set at $92,107. This metric is crucial as it tracks the average on-chain cost for investors over the last 155 days. Historically, maintaining a position above this threshold has indicated a bullish trend, although temporary dips have been observed, such as those in October 2023 and 2024, before further upward movements.

BTC: Long/Short Term On Chain Cost Basis (Glassnode)

Disclaimer: Portions of this article were generated with the assistance of AI tools and have been thoroughly reviewed by our editorial team to ensure accuracy and compliance with our standards. To learn more, please refer to CoinDesk’s complete AI Policy.