Market Reactions to Tariff Delays and Economic Developments

This week, a flurry of headlines has sent shockwaves across financial markets, notably as Donald Trump announced a one-month delay on tariffs concerning auto parts imported from Canada and Mexico. This decision, made public on Wednesday, helped to alleviate investor concerns, particularly in the cryptocurrency sector, with Bitcoin (BTC) leading the charge upward.

Following the tariff news, BTC witnessed a surge, climbing just above $90,000, representing a robust increase of 3.7% over the preceding 24 hours. The majority of assets within the broad-market CoinDesk 20 Index also saw positive movement, with notable performers including Bitcoin Cash (BCH), Chainlink’s LINK, and Aptos (APT), all recording impressive double-digit gains.

In parallel, traditional markets reflected a similar upward trend; the tech-heavy Nasdaq rose by 1.2%, while the more comprehensive S&P 500 climbed 1.5% during the afternoon trading session. Additionally, cryptocurrency-related stocks showed resilience, with Coinbase (COIN) increasing by 3.5% and the largest corporate holder of Bitcoin, known as Strategy, gaining nearly 10%.

However, the backdrop of trade tensions and geopolitical uncertainties has recently dominated headlines, leading to a decline in investor sentiment and pressuring risk assets, including both U.S. stocks and digital currencies. Typically, such risk-off scenarios prompt investors to flock to the safety of the U.S. dollar, exerting downward pressure on cryptocurrency prices. As noted by Joel Kruger, a market strategist at LMAX Group, this time, the U.S. dollar index (DXY) fell to its lowest level since early November, marking a decline of more than 5% from its peak in mid-January.

“With Federal Reserve rate expectations now leaning towards the anticipation of more rate cuts in 2025, in conjunction with Bitcoin’s potential as a store of value, we find numerous reasons to believe that Bitcoin will remain supported during any pullbacks,” Kruger remarked.

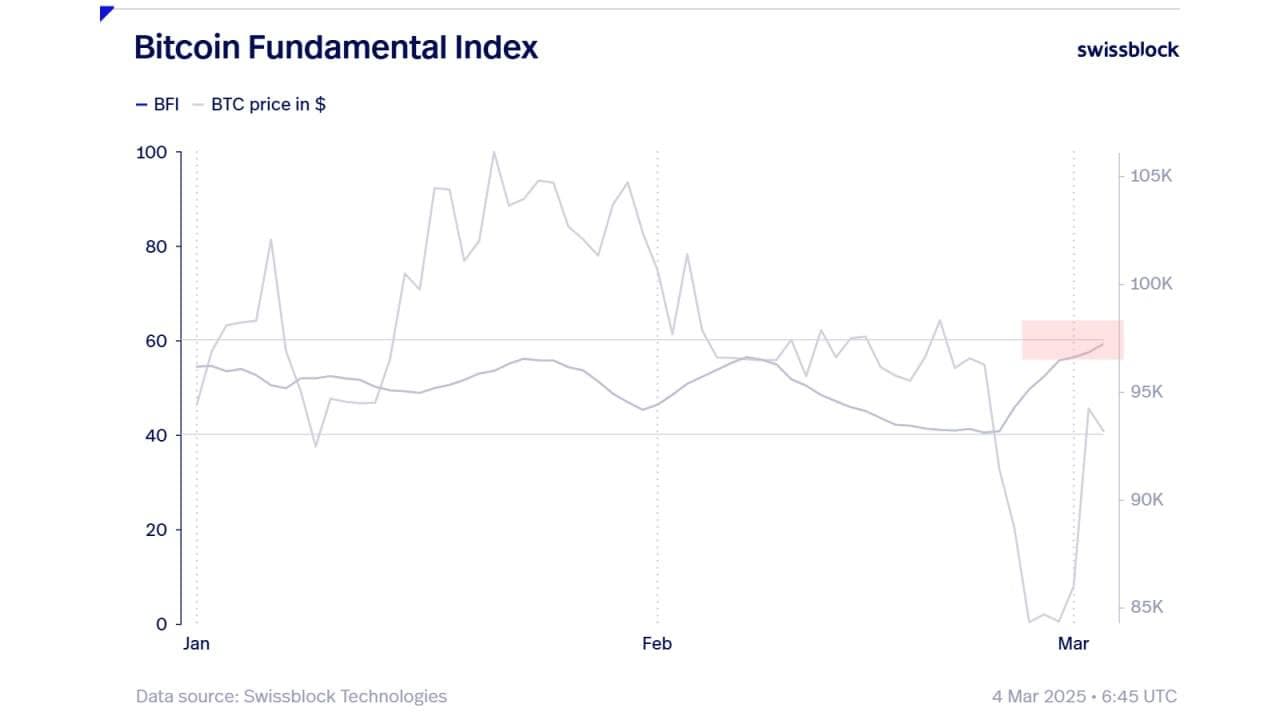

Moreover, Swissblock, a prominent crypto analytics firm, pointed out that despite the recent volatility in prices, its Bitcoin Fundamental Index—which assesses the overall health of the Bitcoin network—has remained relatively stable. In a recent broadcast via Telegram, Swissblock analysts stated, “The fundamentals of Bitcoin are on the cusp of transitioning into a bullish phase, driven by continuous improvements in liquidity and network growth. This resilience indicates that BTC is unlikely to be pushed into a bear market.”