The crypto money market has been full of great fluctuations since the first day, but the last collapse has once again revealed how unpredictable crypto beings were. Under current conditions, 619 million dollars from the market in the last 24 hours were reported to be liquid. However, the question of whether the crypto market was better before Donald Trump came to the agenda. Despite the latest developments, the market is still going through a difficult process.

Tremor in Trump portfolio

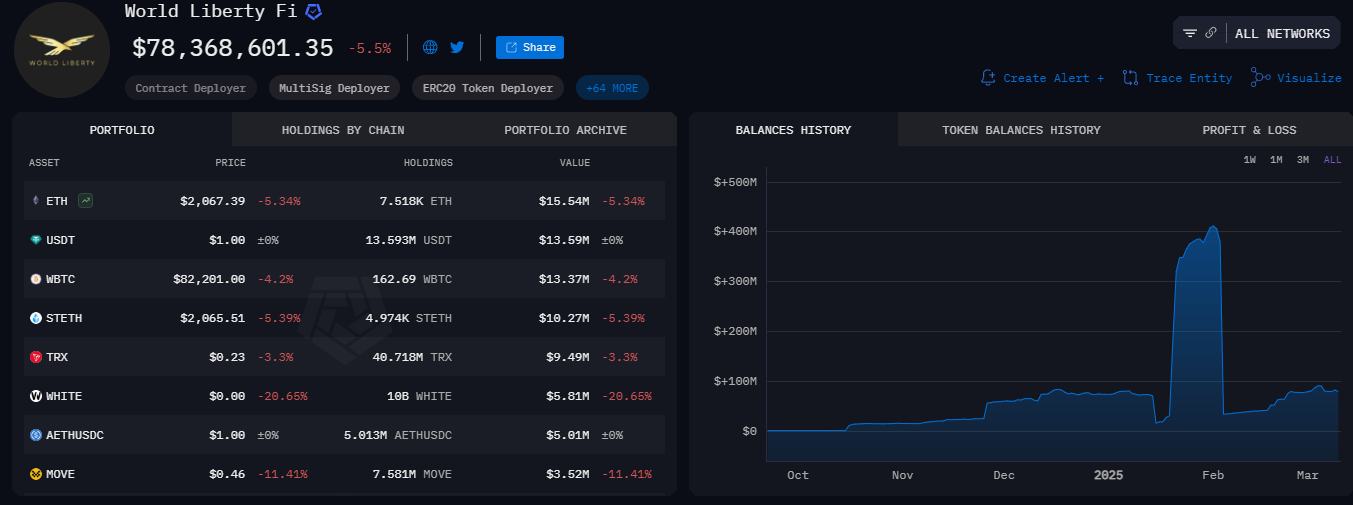

According to Arkham Intelligence data, the portfolio of World Liberty Financial, Trump’s crypto project, received a major blow due to the collapse in the crypto market. The portfolio suffered a loss of $ 110 million in this process. In addition, Donald Trump’s personal crypto portfolio also showed a significant decrease and depreciated by 13 %. Interestingly, the biggest decline was caused by fluctuations in the Ethereum price and 65 %of the loss depend on it. In addition, other subcoins have also lost value to a great extent, which has revealed the bad situation on the market.

In the last 24 hours, the liquid of $ 619 million from the market has caused the global crypto market value to decline to $ 2.7 trillion. This level was finally found before Trump won the presidential elections. Donald Trump’s stance in the crypto world contributed to the development of the market. Although the crypto market has experienced great gains with the rising confidence, there were landing. Developments such as Trump’s announcement of the US Strategic Crypto Reserve, the regulation of the Crypto Summit strengthened the positive atmosphere in the sector. However, the later uncertainties caused the crypto market to collapse again.

Crypto reserve is a risky move?

Among the high expectations of the US Strategic Crypto Reserve, some analysts say that a government -supported reserve can bring a few risks. It was emphasized that such a reserve contradicts the principle of decentralization in a controversial statements of the Solana founder. Other experts suggest that this can lead to market manipulation. In addition, it is also possible that the government’s policy in favor of the government, the fact that assets become “favorite ve and the passing of the regulators are among the possibilities.

Crypto critic Peter Schiff, Trump’s Bitcoin Reserve in a cynical criticism, said he plans to start a reserve. Such developments show that investors’ feelings for Trump’s crypto policies have changed and therefore the collapse in the market increased. With the political rise of Donald Trump, both rise and destructive decreases in the crypto market took place. Trump’s crypto policies aims to make the USA center for crypto currencies, while these policies also increase market volatility. Ethical concerns are growing and many people question Trump’s crypto effect.