Movement of Bitcoin from Mt. Gox Sparks Speculation on Creditor Payouts

In a notable development, Bitcoin (BTC) associated with Mt. Gox, the now-defunct cryptocurrency exchange that collapsed in 2014, has been on the move again. This activity follows last week’s significant maneuvering, which may indicate the potential resumption of creditor payouts after the exchange distributed crypto assets worth billions last year.

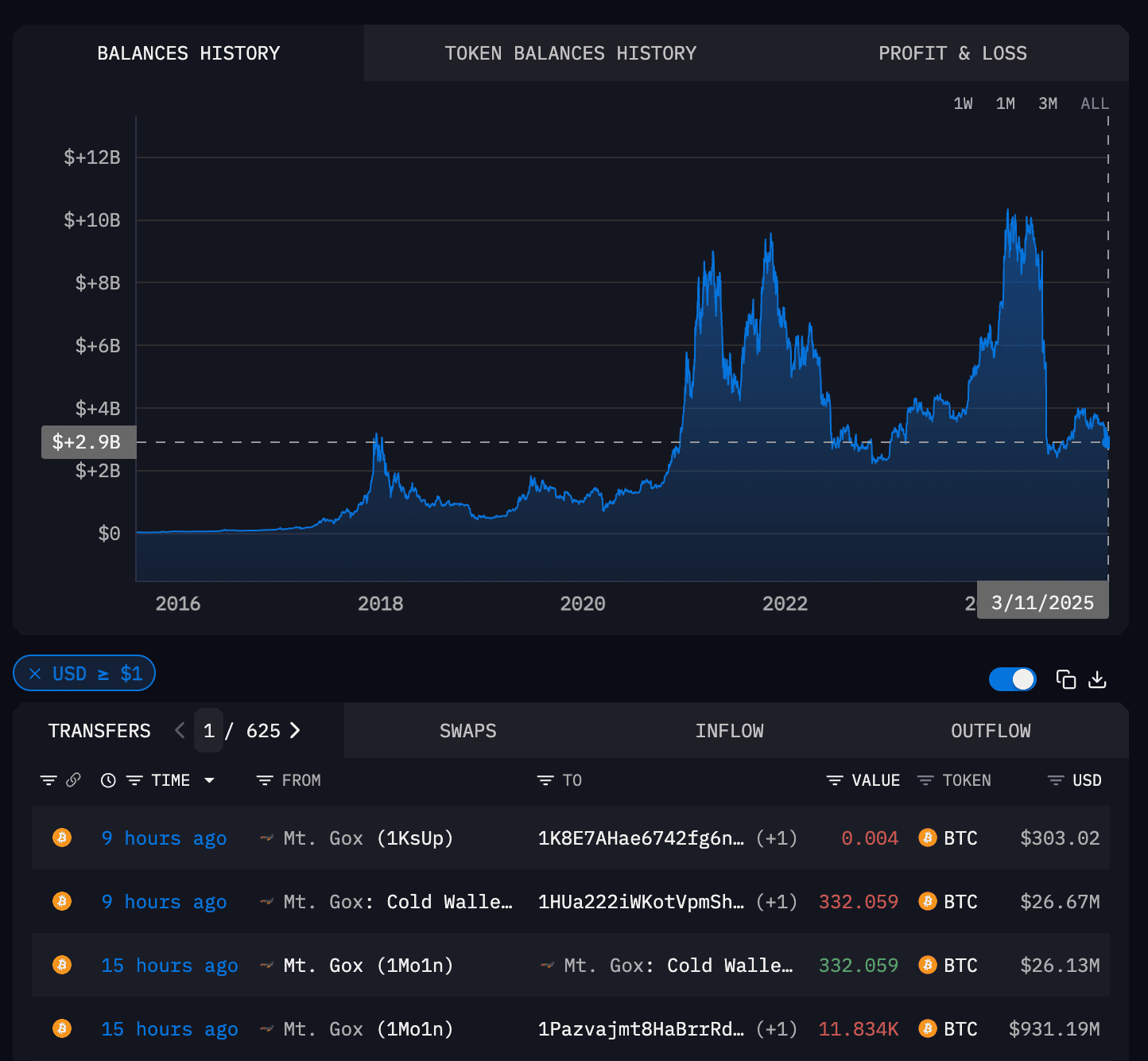

According to data from Arkham Intelligence, a Bitcoin address linked to Mt. Gox transferred 11,834 BTC, valued at approximately $930 million, to new wallets on Tuesday. Among these transactions, around $26 million worth of BTC was allocated to an “operations wallet.” This could signal preparations for upcoming distributions to creditors, while the remainder of the transferred assets was sent to a “change wallet,” as noted by analysts from Arkham in a post on X.

The recent wallet movements came after a substantial $1 billion internal reshuffling of assets last week, which included a $15 million transfer to the cryptocurrency custodian BitGo. BitGo serves as one of the distribution platforms where creditors can claim their assets, further complicating the landscape for traders and investors.

It is important to note that transfers from Mt. Gox wallets have historically impacted BTC prices, with expectations of increased selling pressure projected through mid-2024. Traders are on high alert as the exchange prepares to pay out billions of dollars in assets to creditors after a prolonged wait of ten years. In a related announcement last October, the trustee managing the exchange’s assets postponed the deadline for repaying creditors to October 31, 2025, which temporarily alleviated concerns about immediate market pressure.

However, these latest movements could signal that the estate is gearing up to repay the remaining assets to users, reigniting fears of potential selling pressure at a time when the cryptocurrency markets are already undergoing a correction. Bitcoin has seen a decline of nearly 30% from its record highs in January, adding to the uncertainty in the market.

As of now, Mt. Gox-linked wallets reportedly held around $2.9 billion worth of BTC, according to Arkham data, highlighting the significant amount of assets still at play in the market and the implications for future trading dynamics.