Leading cryptocurrency analysts are predicting a bear run for Bitcoin despite the recent price surge. Also, hodl investors give a negative opinion about BTC. So, what sparked this negative sentiment and what has been said about the future of Bitcoin?

deVere Group CEO predicts a big jump for Bitcoin

Nigel Green, CEO of financial consulting firm deVere Group, in a new company blog post He said it is on track to see a significant leap forward by the last quarter of 2022. Nigel explains why Bitcoin price may recover soon:

A good indicator that the bottom is near is when monitoring services reveal that ‘insiders’ are on a buying spree. They leverage reasonable valuations to increase their stake in quality companies to create and grow wealth over the long term. The stock market rally will benefit Bitcoin as investors return to riskier assets.

Nigel also said that Bitcoin could rise again as investors see Bitcoin as a viable store of value and a hedge against inflation. Additionally, he stated that Bitcoin will fly by the end of the year and the rally will be supported by investments from large institutional investors.

Benjamin Cowen says that Bitcoin (BTC) can recover from current levels

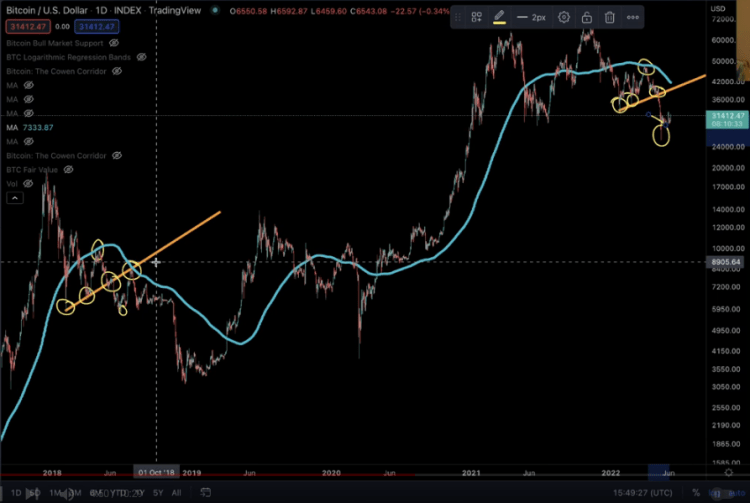

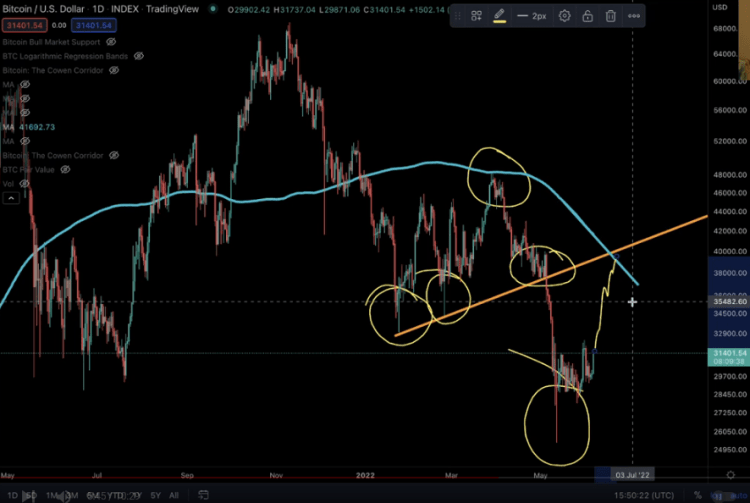

Benjamin Cowen, whose analysis we shared as Cryptokoin.com , in a new Youtube broadcast He says that the 200-day SMA is an accurate indicator of future Bitcoin prices. The crypto expert cites 2018 chart data as historical data.

Cowen then shares two levels in the SMA that he believes are crucial for BTC to hold. The analyst highlights two potential price points, $41,700 and $40,000. He adds that it may take several attempts for Bitcoin to break above the 200-day SMA price point. According to Cowen, as BTC is currently in a bear market, it is difficult to determine exactly how and when for now.

Rekt Capital updated its Bitcoin forecasts

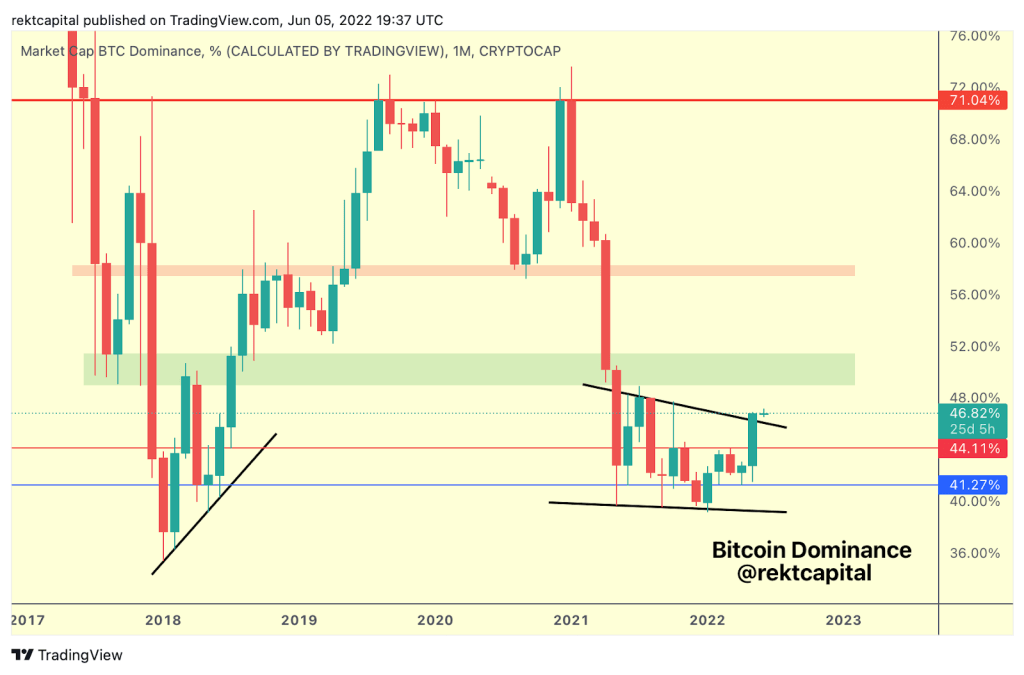

Popular crypto analyst Rekt Capital examines the Bitcoin dominance (BTC.D) chart. In terms of dominance, he claims Bitcoin is poised to climb into a wedge formation stretching back to early 2021. “BTC.D is now on the verge of breaking a one-year wedge pattern (black),” the analyst said in a tweet. Hence, he believes that breaching this trend will almost certainly result in additional losses for cryptocurrencies.

The analyst then looks deeper into the chart to indicate that BTC.D may continue to rise. According to the analyst, the boom will most likely occur in the 49% to 51% region. BTC.D last saw this level above $60,000 in April and May 2021.

Indeed, #BTC Dominance broke the red level once again

There's a strong possibility that $BTC Dominance can continue to the top of the black wedging structure over time#Crypto #Bitcoin pic.twitter.com/AVKq7i30Yu

— Rekt Capital (@rektcapital) May 17, 2022

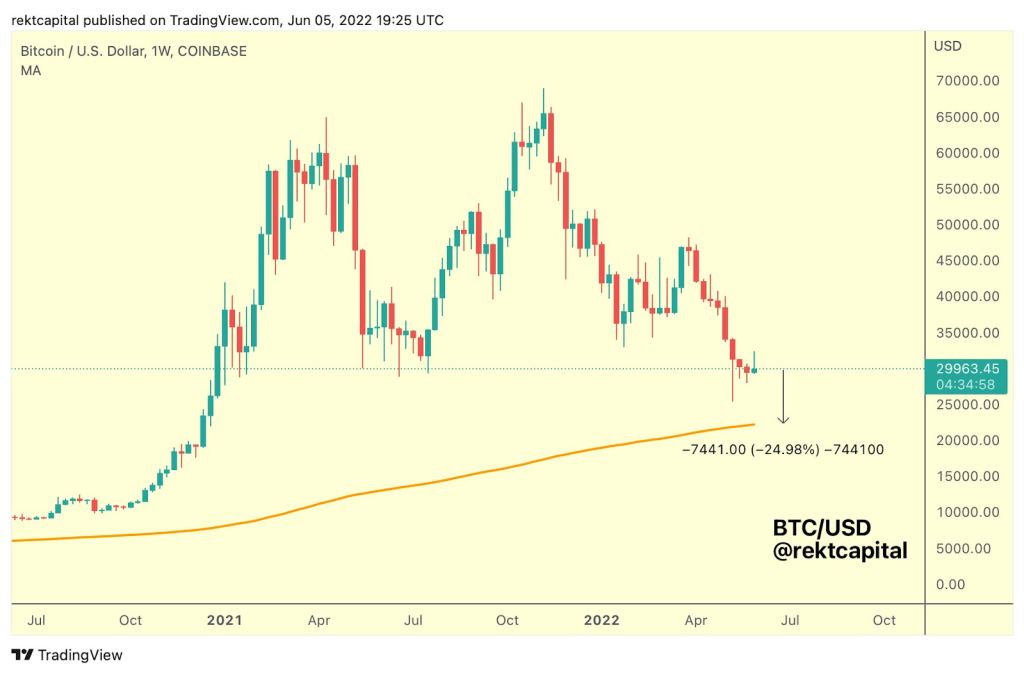

Rekt Capital noted the 200-day moving average of Bitcoin and analyzed their analysis. ends. He says that the 200 MA is a possible signal of what could describe Bitcoin bearish in the current bearish trend. According to the strategist, Bitcoin usually hovers around the 200-week MA (orange). Additionally, it trades just under a few points. Also, the analyst says that Bitcoin needs to drop another 25% from its current price to find a bottom at the 200 MA.

“BTC still facing $19,937”

Financial analyst Crispus Nyaga is among analysts expecting a drop. Due to the double top formation on the Bitcoin chart, the analyst thinks that the sales are still intact.

If this view is correct, the next reference level will be $19,937, the ATH level of 2017, according to the analyst.