Gold prices are down 0.3% at press time to trade just above $1,840. ANZ Bank economists predict that gold will correct sharply if safe-haven purchases decline. Market analyst Pablo Piovano, on the other hand, states that an upside move for gold seems more unlikely.

Rising real interest rates and a stronger dollar hinder gold prices

Gold prices are trying to hold above $1,840. Does this indicate the beginning of a bear trend? ANZ Bank economists say gold should see safe-haven flows amid geopolitical risks and rising stagflation. But, according to economists, the yellow metal risks falling sharply if these flows disappear. In this context, economists make the following assessment:

We accept that hawk central banks, rising real interest rates and a stronger US dollar have taken the glare of the gold market. The unprecedented withdrawal of financial and monetary support is also putting pressure on sentiment.

Economists predict gold will see a sharp correction

Also, geopolitical and economic safe-haven purchases are likely to bolster gold. he sees. From this point of view, economists predict that if these purchases disperse, gold will experience a sharp correction. As we have mentioned in the news ofKriptokoin.com , geopolitical and economic risks are increasing due to the ongoing Russia-Ukraine war. Economists say this reaffirms gold’s safe-haven status. In addition, economists make the following statement:

Inflation based on supply shocks can offset the effect of rising interest rates. In addition, it may limit the return to yielding assets. Fears are mounting that economic growth will decline if central banks maintain their tightening stance. In such an uncertain economic backdrop, investors may seek a safe store of value.

Pablo Piovano: Upward movement is very unlikely for gold prices

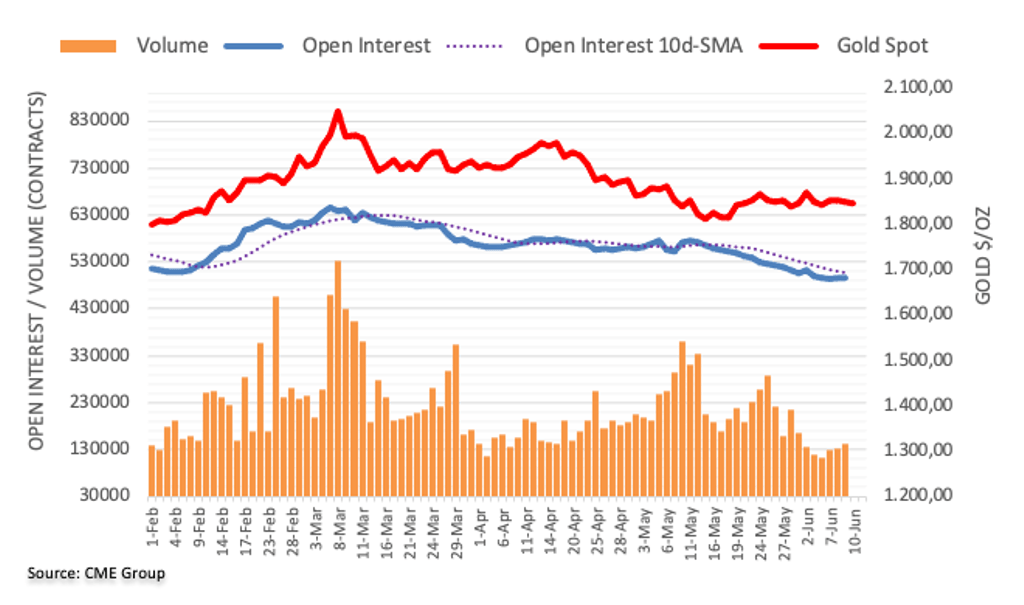

open interest continued its downward trend. In addition, open interest contracted by nearly 2.5k contracts on Thursday. Volume rose for the third session in a row, this time with nearly 10,000 contracts.

Gold prices dropped to the $1,840 region on Thursday before ending the session just above this level. The bounce in this region was amid declining open interest, according to market analyst Pablo Piovano. The analyst states that this situation largely leaves the ongoing consolidation in place for the time being, pointing to the idea that further upside movements are unlikely.