Binance CEO Changpeng Zhao said at the CNBC Squawk Box Asia participation that Binance’s leverage system is unique. He explained the advantages of the world’s largest stock exchange. Apart from that, CZ says the four-year market cycle may not repeat itself.

Regulators do not want leveraged markets

Changpeng Zhao discussed the accuracy of his exchange offering leveraged Bitcoin products. The cryptocurrency market, which is still in its infancy, has millions of inexperienced investors. With these investors in mind, CZ had this to say about leveraged transactions:

We only offer leveraged products where permitted; If there is no permission, we do not offer them.

Traders must pass a “mini-test” to trade leverage on the Binance exchange. One of the questions is: “Do you think your chances of making money are more than 50%?”. If users answer “yes” to this question, Binance does not allow leveraged trading. The purpose of this is to protect unconscious investors from loss of funds.

CZ says that when it comes to leveraged transactions, these products stabilize the market. As Kriptokoin.com , in a recent interview, finance expert Jim Rogers expressed a similar view. CZ, on the other hand, emphasizes stability and says he has angered regulators:

The ‘correct’ answers to all questions can be found on Reddit. Wouldn’t it make more sense to say that people will lose money on leveraged products? Doesn’t it lead to more stability and at the same time draw the ire of regulators?

Binance CEO: The current crypto decline could take 4 years

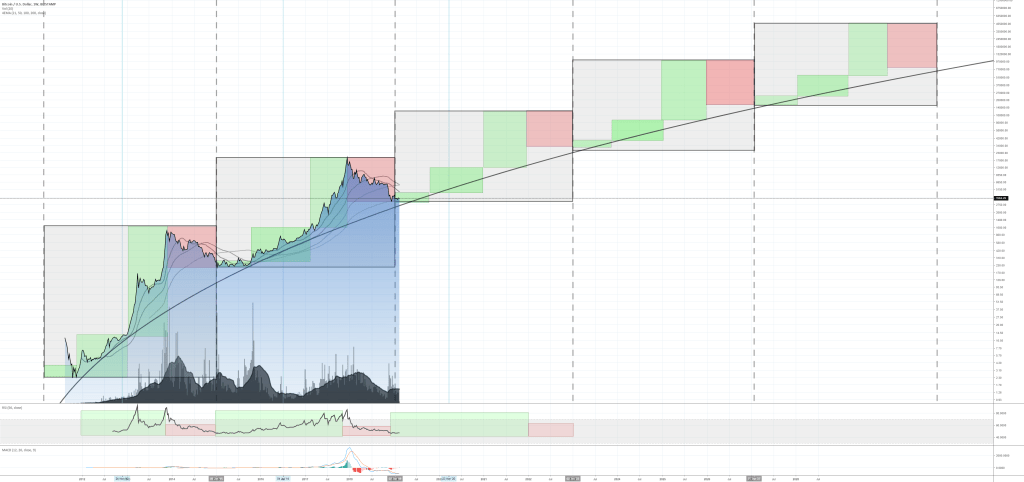

One of the questions CZ was asked was how long the bear market could last. CZ said that no one knows the answer to this, but that the bear market has historically lasted 4 years. 2013, 2017 and 2021 were the 4-year cycle periods when the bulls were in the field. But CZ says that history doesn’t always repeat itself:

Just because history is like that doesn’t mean the future will be like that.