Bitcoin (BTC) is making its worst weekly close since December 2020. Crypto markets are under tight control, and as we reported on Cryptokoin.com, sales accelerated after a higher-than-expected inflation report from the United States on June 10. Can Bitcoin find support at lower levels and will this attract purchases in certain altcoin projects? Let’s examine the charts of the top 5 cryptocurrencies that are likely to rise if sentiment improves.

Here’s Bitcoin and 4 altcoins to watch this week

Bitcoin (BTC)

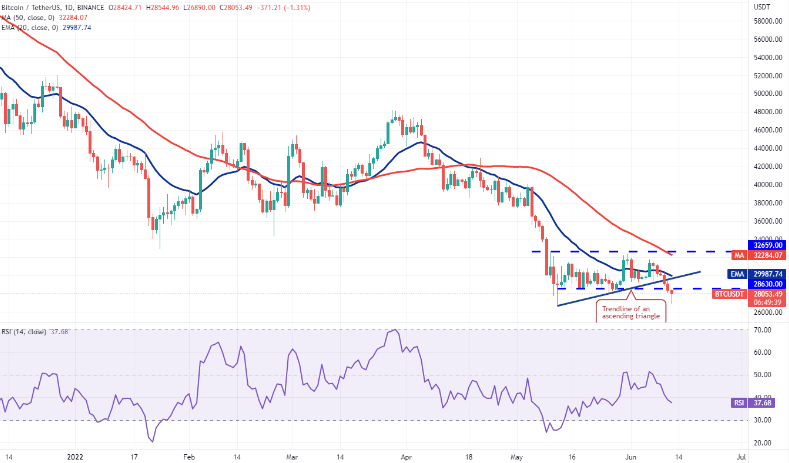

Bitcoin dropped below the trendline on June 10th, negating this ascending triangle pattern. Impressed. The bears continued the selling pressure and pushed the price below the strong support at $28,630 on June 11. The long tail on the June 12 candlestick shows that the bulls are trying to protect the support at $26,700. If buyers push the price back above the $28,630 breakout level, it will suggest that the BTC/USDT pair could remain range-bound between $32,659 and $26,700 for a while.

On the other hand, if the price drops from $28,630, it indicates that the bears have turned the level into resistance. This could increase the likelihood of a break below $26,700. If this happens, the sell-off could intensify and the pair could drop to $22,000 and later to $20,000.

First altcoin on the list: FTX Token (FTT)

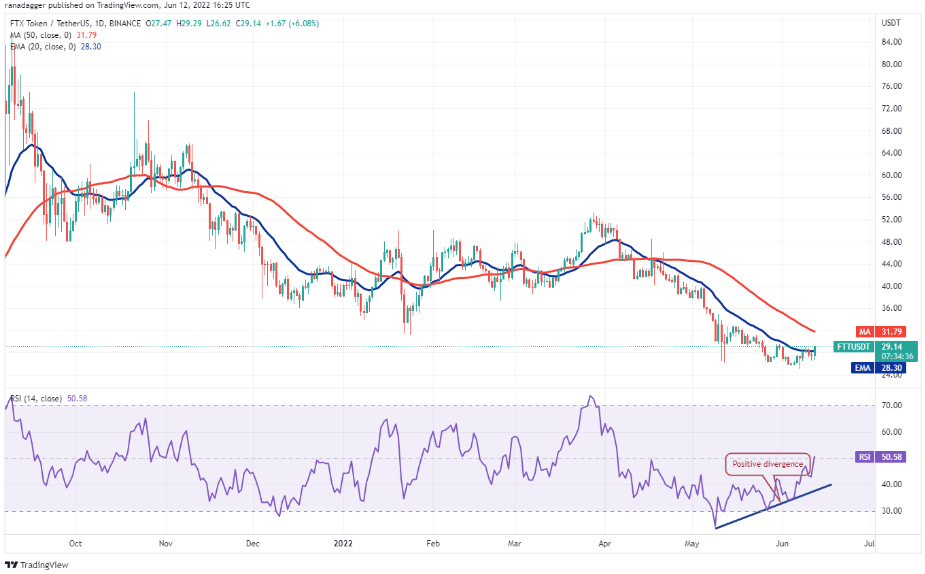

FTX Token (FTT) has been in a downtrend for the past few months but RSI has formed a positive divergence indicating that the bearish momentum may weaken. The bulls pushed the price above the 20-day EMA ($29) on June 9 but failed to sustain higher. The bears pushed the price below the 20-day EMA, but the bulls did not give up much ground. Continuous buying by the bulls pushed the price above the resistance on June 12. The FTT/USDT pair could rise to the 50-day SMA ($32) and if this level is breached, the upside could reach $35. This positive view could be invalidated if the price drops and drops below $25. Such a move would suggest the start of the next leg of the downtrend.

The 4-hour chart shows the formation of a break above the neckline and an inverted shoulder head-shoulder pattern that will complete at close. If this happens, the pair could start a fresh upward move towards the $34 pattern target. On the contrary, if the price fails to continue above the neckline, it will show that the bears are not willing to give up their advantage. Sellers will then try to push the price below $26. If they are successful, the pair could drop to $25.

Tezos (XTZ)

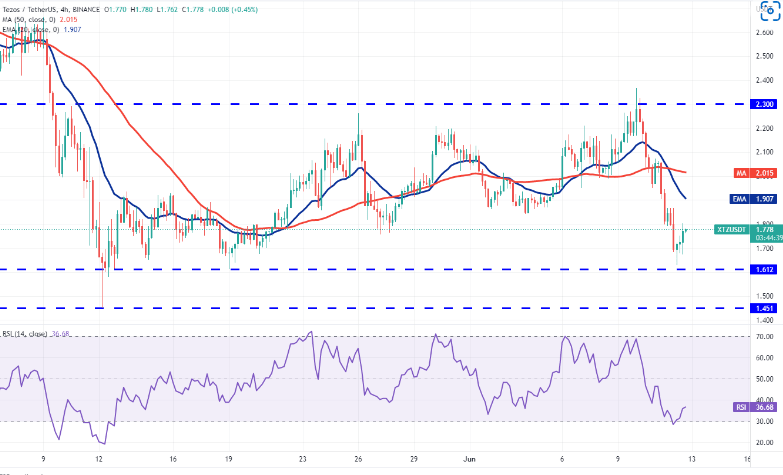

Tezos (XTZ) rallied above the 50-day SMA ($2.14) on June 9 but the bulls could not develop this power. This indicates that the bears are active at higher levels. The strong selling of the bears pushed the price below the moving averages and the XTZ/USDT pair fell into the critical support zone between $1.61 and $1.45. If the price bounces back from this zone, the bulls will again attempt to push the pair above the 50-day SMA and challenge the overhead resistance at $2.36. This positive view could be invalidated if the price continues to decline and falls below the support zone. If this happens, the pair could continue its downtrend and drop to the psychological $1 level.

The 4-hour chart shows the price holding between $2.30 and $1.61. Usually, when the price consolidates in a range, investors buy near the support and sell near the resistance. This is what happened as seen from the recovery at $1.61. The bears may try to sell on rallies to the 20-EMA, but if the bulls break this hurdle, the probability of a rise to $2.30 increases. To invalidate this view, the bears will need to try and sustain the price below $1.61. If this happens, the pair could drop to $1.45.

KuCoin Token (KCS)

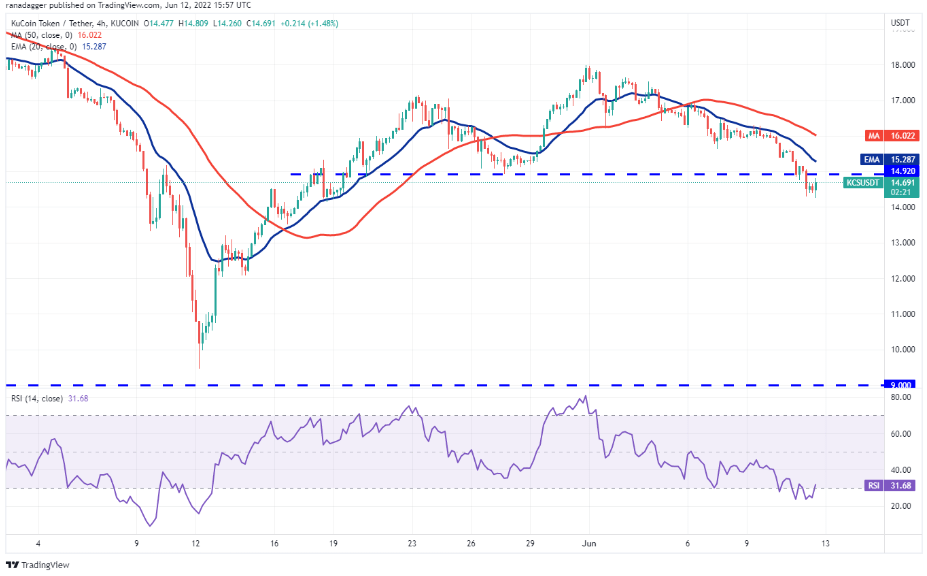

KuCoin Token (KCS) buyers are trying to defend the zone between the 50 percent Fibonacci retracement level of $13.75 and the 61.8% retracement level of $12.75. they will work. If the price bounces back from this zone, the bulls will try to push the KCS/USDT pair above the moving averages. If they succeed, it will suggest that the fix may be finished. The pair could then retest the critical resistance at $18. Alternatively, if the price continues to decline and dips below $12.75, this will indicate that traders may be in a rush to exit. This could increase the 100% probability of a pullback to $9.50.

The bulls tried to stop the decline around $15 but the bears continued their selling and dragged the price below the support. Although the price is trading below $15, one small positive is that the bulls have not allowed the bears to extend the decline. Buyers will try to push the price above $15 and the 20-EMA. If successful, it will show that lower levels continue to attract strong buys. This could push the price towards $16.30 and near $17. Conversely, if the price drops from $15, it indicates that the bears have turned the level into resistance. This could open the doors for more declines to the $14 to $13.50 zone.

The last altcoin on the list: Helium (HNT)

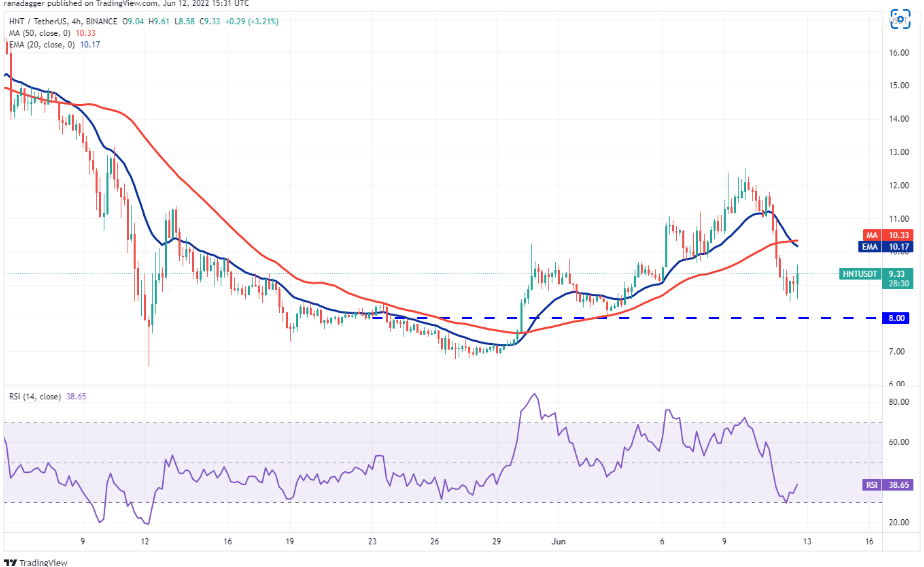

Helium (HNT) bears aggressively sold at $12.50 on June 10, trapping the aggressive bulls. This led to the long liquidation that drove the price below the 20-day EMA ($9.69) on June 11. The bulls will attempt to stop the decline at the strong support at $8 and create a higher bottom. If they do, the HNT/USDT pair will attempt to climb above the moving averages again and challenge the resistance at $12.50. This positive view could be invalidated in the short term if the price drops below $8. If that happens, the pair could slide to the May 12 intraday low of $6.54. A break below this level will suggest a resumption of the downtrend. Looking at the

4 Hourly chart, a break and close below $11 intensified the selling and resulted in a decline. The moving averages have completed the downtrend and the RSI is in the negative territory, showing the bears an advantage. An attempt to start a recovery is facing strong resistance near $9.50. If this level is crossed, the next hurdle could be the 20-EMA. A break above this resistance will be the first sign that selling pressure may drop. Alternatively, the pair could drop to the strong support at $8 if the altcoin price declines from overhead resistance and drops below $8.50.