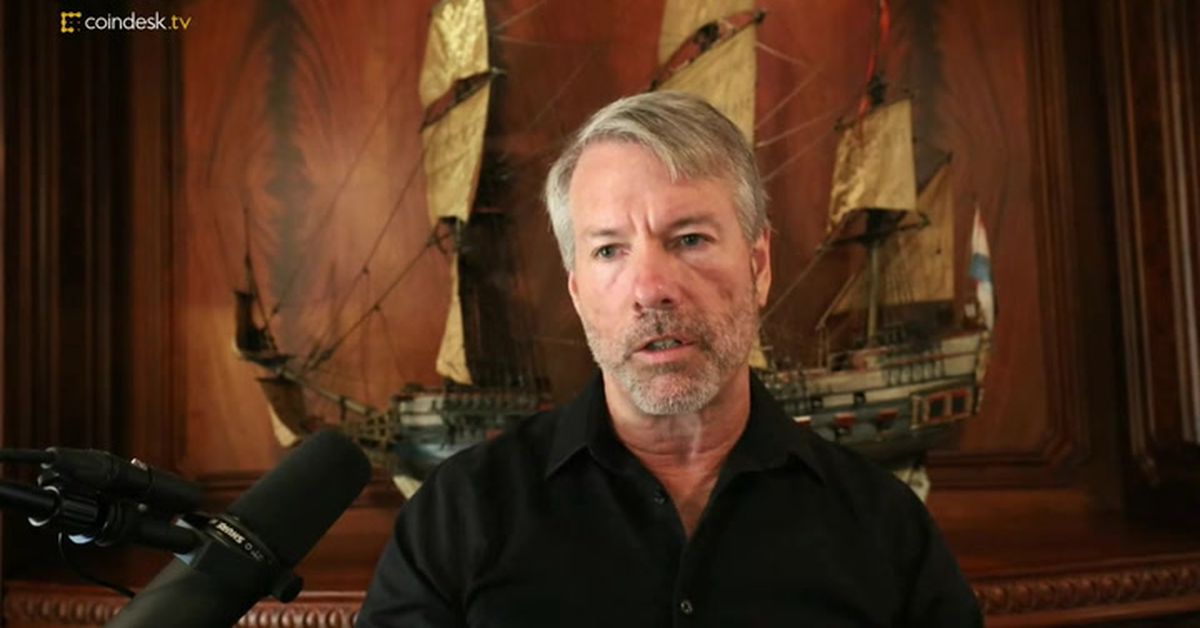

MicroStrategy (MSTR) CEO Michael Saylor reiterated his bullish stance on owning bitcoin as part of the company’s strategy, and said he remains unconcerned about a margin call on the company’s bitcoin-backed loan from Silvergate.

-

“The margin call thing is much ado about nothing,” Saylor said on CNBC’s “Squawk on the Street” Wednesday morning. “It’s just made me Twitter famous, so I appreciate that,” he added.

-

“On a multibillion-dollar balance sheet, we’ve only got a $200 million loan that we have to collateralize and we’re 10x over collateralized on that right now,” Saylor added.

-

Saylor also said MicroStrategy continues to generate cash flow, and that “from time to time as we have excess cash, we’re going to buy more [bitcoin],” he told CNBC. “Our strategy is buy it and hold it and sweep our free cash flows into bitcoin.”

-

When asked whether it would make sense for the company to buy some of its own bonds, which are trading at a discount, Saylor said “the securities market is very volatile,” and that the company’s investors are very aware of its bitcoin-focused strategy.

Read more: MicroStrategy Defended at BTIG; Saylor Not Expecting Imminent Margin Call

Read more about

MicroStrategyMichael SaylorMargin CallsStocks

The Festival for the Decentralized World

Thursday – Sunday, June 9-12, 2022

Austin, Texas

Save a Seat Now

BTC$21,214.14

BTC$21,214.14

5.73%

ETH$1,101.94

ETH$1,101.94

10.45%

BNB$211.39

BNB$211.39

6.01%

XRP$0.309472

XRP$0.309472

2.78%

BUSD$1.00

BUSD$1.00

0.03%

View All Prices

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why.