The altcoin market is giving its next LUNA-UST exam with ETH-stETH. Celsius, which holds a large fund in this pair, came under pressure with the loss of price stability. The CEL, which investors earn as returns, had been declining for a while until yesterday. Then, on June 14, it suddenly rose over 600%. However, analysts say this is most likely due to a trading error or liquidation of short-term traders.

Why did Celsius (CEL) rise? As

Kriptokoin.com , Celsius filled the media headlines on June 14th. The news on June 14 includes the platform’s CEL token making huge gains after an event that looked like an exchange glitch or short-term nuisance. CEL price rose from $0.18 to $1.55 in a spike. It then fell back to $0.60 within the same one-hour candle.

Currently, analysts are worried about the cause of the explosive price breakout. Some cite Celsius’ repayment of some of its debts as the reason. Others see a possible bug in the FTX exchange as the cause of a short squeeze.

Does debt repayment give altcoin investors confidence?

Celsius continues its efforts to pay off some debts. It is possible that some investors may see this as a sign that the platform can survive the current turmoil.

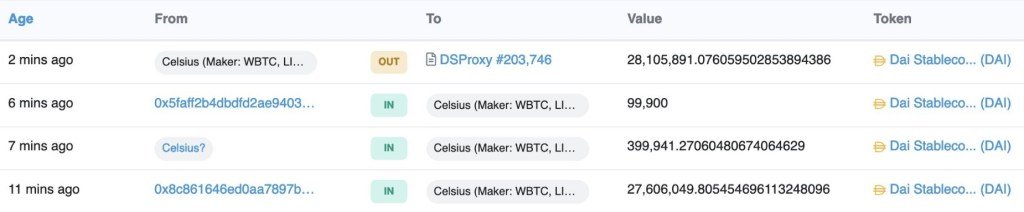

DAI arriving.

Celsius finally going to start paying back the debt after buying enough time by reupping collateral to lower liq? pic.twitter.com/z6y165fzlL

— Hsaka (@HsakaTrades) June 14, 2022

Twitter analyst Hsaka said on-chain data was recently released by Celsius. He said it showed that $28 million of Dai (DAI) deposited in a controlled wallet has since been sent to a separate address he identified as a debt repayment address.

Analysts believe Celsius’s strategy is to lower the liquidation price in the MakerDAO vaults it holds and ultimately avoid bankruptcy.

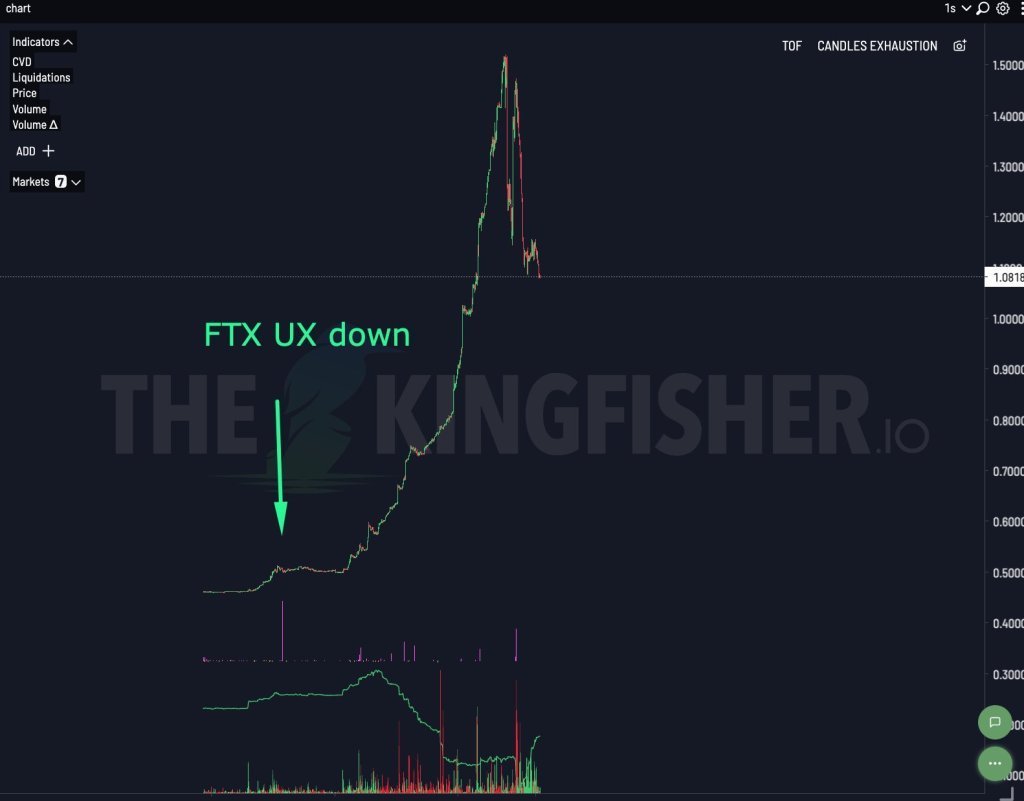

User interface issues in FTX

Debt repayment initiation helped give Celsius more confidence. However, several crypto investors reported that they are having problems trying to buy and sell tokens on the FTX exchange.

Several replies to the above tweet have confirmed user difficulties when trying to sell CELs on FTX. Additionally, Twitter user Karl Larsen said they could “fill our shorts at just 0.87-0.95.”

The possibility that UI challenges in FTX could play a role in the rapid rise of CEL was also noted by analytics provider TheKingFisher, who published the graph below highlighting when the UI declines relative to when the CEL price rises.

According to TheKingfisher, when interface problems arose, “most traders were unable to hedge, close [or] reduce their positions”. The firm reported in a note:

The spot market rallied above $2 to break the index and deliberately trigger liquidations. This is a point manipulation to liquidate investors. The index is calculated on FTX itself. This is not out of bounds against scams to keep the market in order.

It’s just another short squeeze

Some altcoin analysts are saying that the price breakout is nothing more than an old-fashioned short squeeze, as Saleem Lala points out.

Seems like a big fund who had massive $CEL holdings fake pumped the market once the news of #celsius repaying their loans on their Maker Vaults spread.

They didn't just get exit liquidity for their holdings, they seem to have made profit as well on their fake pump

— Saleem Lala (@saleemlala) June 14, 2022

As the price of CEL progresses, it will soon become clear. According to analysts, the most likely culprit appears to be a gradual liquidation. Because such events are common during strong market fluctuations. For example, Chain (XCN) had a similar event on June 14 due to its price. It fell 95% due to consecutive liquidations.