Gold prices retreated to $1,830 ahead of Thursday’s European session. Yellow metal dampens Fed-induced recovery. Gold made its highest rally in a month the previous day after the Fed turned the markets upside down. However, according to market analyst Anil Panchal, he is assessing the bullion’s recent weakness. According to the analyst, it could be linked to DXY’s rebound moves during a sluggish trading session.

Rates keep golden bears hopeful

US 10-year Treasury yields rose to 3.32% from an intraday low of 3.288%. Despite this, benchmark bond coupons remained negative for the second day in a row, down at the latest 7.3 basis points (bps). Bond coupons fell after the Fed’s statements. It is worth noting that this is the largest drop since the beginning of March.

Gold prices cheered up Fed action but bulls remained cautious

Fed as you follow on cryptokoin.com On Wednesday, it rose 75 basis points. Therefore, the Fed announced the largest rate hike since 1994 to combat inflation fears. Meanwhile, the Fed lowered its inflation expectations. It also revised its inflation forecasts for this year and next year. Also, policymakers signaled a 50 or 75 basis point increase at the next meeting.

However, the Fed’s rejection of the possibility of a 100 basis point rate hike and President Jerome Powell’s restrained statements seem to have triggered a relief rally. However, major central banks remain on track for higher interest rates. This supports bond sellers and puts pressure on gold prices.

China-linked headlines testing buyers

Headlines from China seem to be putting downward pressure on late gold prices. Covid fears and Sino-American rivalry are challenging gold’s recovery. This includes pessimism over Taiwan surrounding one of the world’s largest gold consumers.

It is worth noting that offshore investors seem to have lost their confidence in China. This points to more troubles for the dragon nation. Reuters passed the following news:

Different monetary policy keeps Chinese interest rates stable below their US counterparts. That’s why offshore investors slashed Chinese bonds in May for the fourth month in a row, the fastest rate in nearly five and a half years.

Options market shows seller dominance

Options market continues to show bearish trend of traders despite corrective pullback in the previous day . However, risk reversal (RR) is poised for the biggest weekly drop in a month with data of -1,120 available. It is worth noting that RR is the difference between bullish and bearish bets in the market, known as call and put, respectively.

Investors will keep an eye on the Fed on Friday for gold prices

Fed Chairman Jerome Powell will deliver a speech in Washington DC on Friday. The US central banker recently praised the US economic transition. It also showed that it is ready to reach the 2.0% inflation target, alleviating the market’s fears of higher interest rates. The analyst makes the following assessment:

Powell is likely to repeat hawkish expectations for the US economy. In addition, as some markets expect, it is possible to turn down the rate hikes of 100 basis points. In this case, gold prices will be more downside.

Gold prices technical view

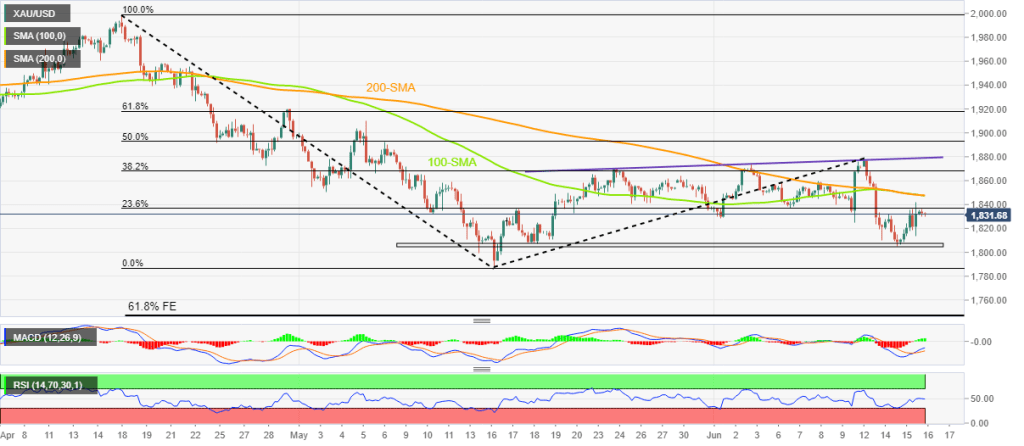

Market analyst Anil Panchal illustrates the technical outlook for gold as follows. Gold prices bounced back from the April-May downside 23.6% Fibonacci retracement. Hence, it dampens the Fed-inspired recovery from one month of horizontal resistance. However, pullback moves remain suspicious amid a rebound at the RSI (14) line and stronger MACD signals recently.

Even so, the upside statement of the $1,837 immediate resistance may not be enough to remind gold buyers that the 100-SMA and 200-SMA will be a strong resistance to watch for a convergence of around $1,848. If the price surpasses $1,848, an upward sloping trendline near $1,880 from May 24 will act as an extra filter to the north.

Alternatively, pullbacks are possible to retest the aforementioned monthly support around $1,805. Following this, the $1,800 threshold will act as a confirmation point for gold to continue further downside.

In this case, the previous month’s low near $1,786 and the 61.8% Fibonacci Expansion (FE) of April-May moves near $1,748 will attract the market’s attention.