The crash of algorithmic stablecoin Terra USD (UST) has been a lesson to other projects. Recently, Tron’s stablecoin USDD has also lost its $1 anchor. The altcoin project Tron DAO, which does not want to suffer the same fate, decided to intervene early. In this context, TRON DAO Reserve announced its plans to withdraw significant amounts of TRX from its trading platforms.

TRON DAO will withdraw another 3 billion TRX to protect USDD peg

Tron DAO Reserve, Terra USD (UST) is acting early to avoid a similar collapse. The altcoin project is preparing to withdraw another 3 billion TRX tokens from a centralized exchange and a decentralized finance (DeFi) loan protocol as part of its efforts.

Tron did not specify the CeFi and DeFi platforms where DAO withdrawals will take place. The foundation plans to withdraw a total of 5.5 billion TRX with the latest announcement. Scheduled withdrawals are part of efforts to reduce liquidity and prevent a crash for short-term traders, as is the case with Terra’s UST stablecoin. As previously reported as

Kritptokoin.com , Traon DAO has announced its plans to withdraw 2.5 billion TRX tokens from Binance for it. Altcoin stated that it did this in the name of “protecting the blockchain industry and crypto market.” The goal of TRON DAO Reserve is to withdraw 2.5 billion TRX, making it harder for short sellers to reveal the asset.

Following the collapse of Terra, Justin Sun’s algorithmic stablecoin USDD has become the new target of short sellers. On Tuesday, TRX, one of the dominant crypto assets backing USDD as collateral, has slumped over 30% in the past seven days as market selling deepens. That’s why its sister stablecoin lost its dollar anchor.

What is the purpose of the altcoin project in attracting tokens?

As it is known, there is a link between USDD, such as TRX’s relationship with UST and LUNA. With this move, Tron DAO will stop short sellers from filling the TRX price. If they can cause TRX to drop sharply, the token won’t be valuable enough to honor USDD redemptions.

The idea behind such a strategy is to reduce the supply of TRX circulating in the stock market. Therefore, short sellers have to pay a higher fee to short the asset. The price of the asset should theoretically rise again as sellers run out of bullets and selling pressure eases.

In this context, TRON DAO Reserve transferred 100 million USDC to Binance to acquire TRX. In addition to this, it distributed an additional $120 million to purchase the token. Earlier in June, founder Justin Sun said that TRON DAO will tackle shorts on Binance. In this context, he noted that he will inject 2 billion dollars in order to maintain the USDD constant.

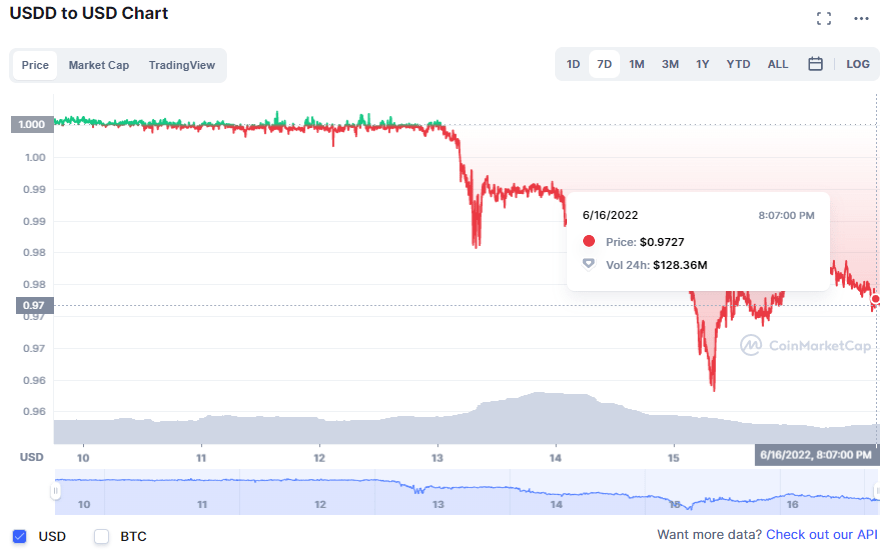

However, according to CoinMarketCap, the algorithmic stablecoin is currently trading at $0.9727. This is why stablecoin USDD has yet to earn the US dollar peg of $1. At press time, TRX is priced at $0.06068.

USDD one-week chart

USDD one-week chart