Cryptocurrency markets have been going insane in recent weeks. Meanwhile, major institutional crypto investors such as Alameda and Three Arrows Capital used the blockchain protocol Curve to divest an altcoin project known as staked Ethereum (stETH).

Organizations divestment of sETH

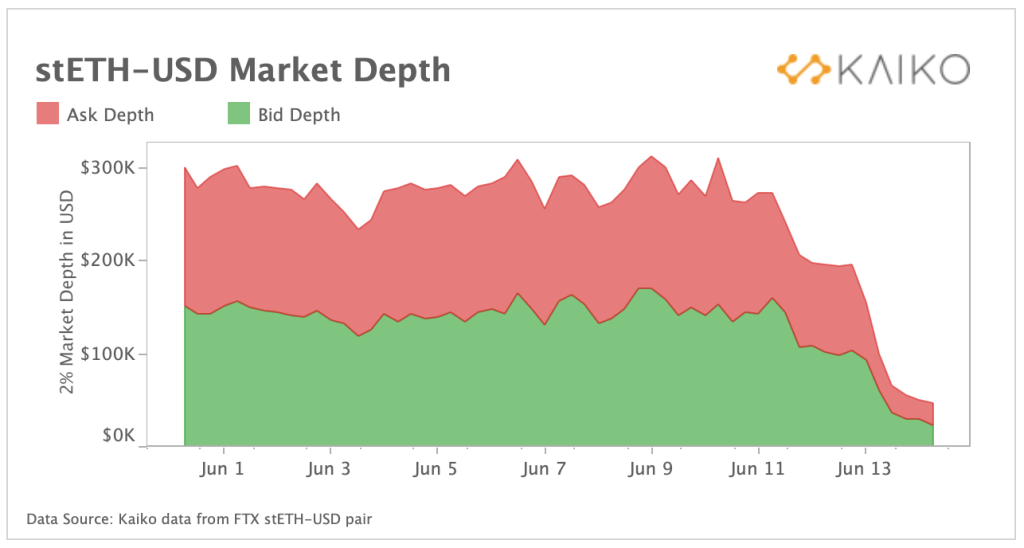

While disposing of sETH, a problem arose. The price of stETH tokens unexpectedly deviated from the default stable, the price of Ethereum. Now, however, the pool of liquidity that traders use to get rid of their stETH on Curve is quickly drying up. It is said that this situation may lead investors to “over-the-counter (OTC)” markets.

The aforementioned pool on Curve allows traders to exchange stETH for ETH. According to the data, since the beginning of May, the total locked value (TVL) in the protocol has dropped from $4.6 billion to $621 million. It is also stated to be quite unstable. This pool holds almost five times more stETH than ETH. This makes trading large volumes of tokens expensive or impossible. Vance Spencer, co-founder of venture capital investment firm Frameworks, said in an interview:

I feel bad for retail investors because the Curve pool was their only way out. Institutions can still get away with over-the-counter (OTC) deals, albeit at a much higher discount than the Curve pool.

Altcoin discount?

stETH’s discount has caught the attention of analysts as an explanatory sign of the recent liquidity crisis in the crypto markets. A stETH represents an ETH token locked in Ethereum’s new Blockchain called Beacon Chain. In times of high inflation and aggressive rate hikes, investors prefer to hold “liquid” assets that can be easily sold. The problem is that tokens locked on the Beacon Chain cannot be redeemed in the foreseeable future until six to 12 months after Ethereum successfully completes a much anticipated update. According to the latest estimate from Ethereum officials, this update is not expected until August.

Chase Devens, analyst at blockchain data platform Messari, stated in a note earlier this week that “stETH is in the early stages of natural price discovery.” He wrote that the discount will “probably expire once ETH staked on Ethereum’s Beacon Chain is unlocked.”

Big altcoin investors flee

Until the explosion of Terra Blockchain last month, stETH; It was traded at a one-to-one rate with ETH. But then a 2-3 percent difference between prices opened up. The gap widened further in early June following the financial troubles of Celsius and hedge fund Three Arrows Capital, both of which are the main owners of stETH. It reached 5-6 percent.

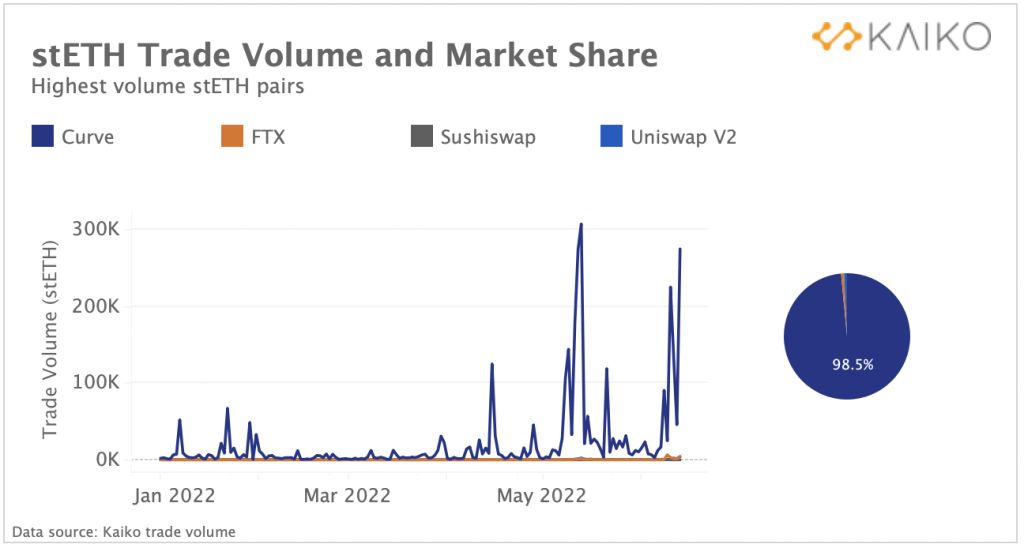

As a result, some large investors dumped their stETH to buy ETH, mostly using the Curve pool. Kaiko’s data showed that the stETH-ETH Curve pool was responsible for 98.5 percent of all decentralized exchange trading volumes on stETH in the last few months, trading on centralized exchanges was negligible.

According to Kaiko report, Amber, a crypto investment platform, attracted $160 million in a few days at the beginning of June. Digital asset trading company Alameda Research has sold $88 million on stETH. Hedge fund Three Arrows Capital, which is facing potential bankruptcy, redeemed around 400,000 ETH and stETH tokens from the protocol in May.

“The reason liquidity providers are leaving is because once the stable is broken, they have a terrible deal because they sell ETH so cheap,” said Bob Baxley, chief technology officer of auto market maker Maverick Protocol. As a result, the Curve pool has lost 85 percent of its value and has roughly 111,000 ETH and 492,000 stETH.

Investors trapped

Crypto lending protocol Celsius is currently under tight scrutiny as it has stopped withdrawals due to “extreme market conditions”. So it may be trapped with stETH entities. Celsius still holds at least 409,000 stETH, worth about $413 million at current prices, according to data provided by Ape Board, a portfolio tracker from blockchain analytics firm Nansen. The stETH-ETH Curve pool only has around 110,000 ETH. This means that there are not enough tokens to trade stETH.