Bitcoin (BTC) price continues to consolidate just below $20,000. Meanwhile, the Shiba Inu (SHIB) is about to close the ninth weekly red candle. Let’s take a look at the technical comments from FXStreet analyst Philip L to reveal the critical levels for the week ahead.

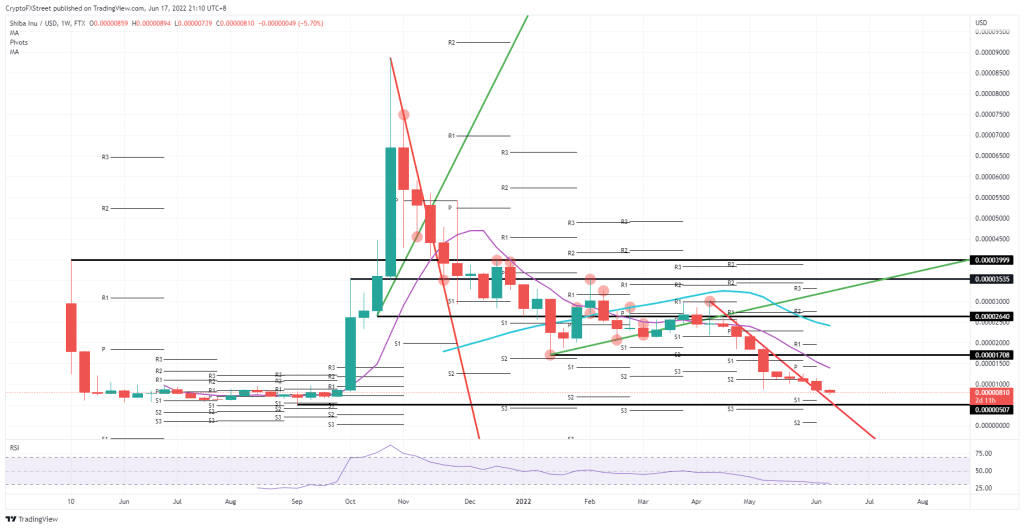

SHIB price approaching milestone

The Shiba Inu (SHIB) price is not yet close to its reversal point. The eighth consecutive weekly red candle is on its way, but the bulls are working hard to thwart it. However, inflation issues are a big nuisance for cryptocurrencies as the market’s total value drops below $1 trillion.

Meanwhile, SHIB price is consuming cash fuel to move towards $0.000002000 or even $0.00003000. However, there is a risk that SHIB price will still drop to $0.00000507. This level is an important zone for the bulls to initiate a reversal. The bulls will have the opportunity to stop the downtrend at this point. It could then create a bounce that could see a rebound towards $0.00001500 or even $0.000001708 depending on the momentum and other factors such as the strength of the dollar. Analyst Philip L., who holds this view, also reveals some bull traps.

With this ‘strategy’ where the bulls expect a 40% drop, there is a risk that the drop will be too much to bear. So the bulls will have to wait for this level to take the stage again. However, as hedge fund 3AC is on the verge of bankruptcy, there is a risk of breaching this level. In this case, a solid correction by price action threatens to push SHIB price down to almost zero. As a meme token, this bear market will be tougher for SHIB. Just as projects such as Solana and Avalanche reached the top 10, the risk of Shiba being shelved should not be ignored.

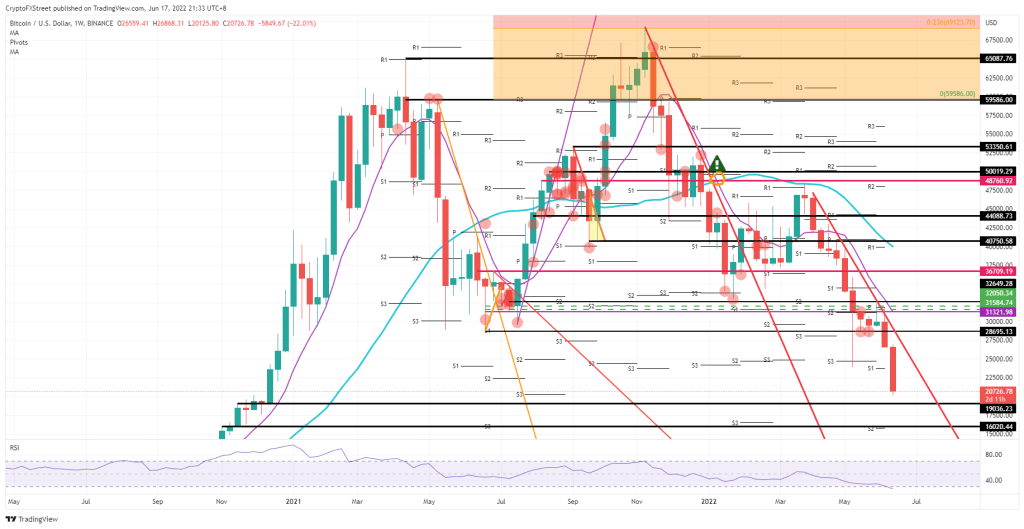

Why would it be good for Bitcoin to drop below $20,000?

The backbone of the market is Bitcoin. The leading cryptocurrency broke $20,000 during the week despite all efforts. It risks another double-digit loss this week. With traders and investors thinking that the BTC price could not drop any further and stocks rallied towards the end of the week, crypto investors thought it was time for a comeback. However, the 18 thousand-odd price proves that this is not the case. The risk is that early-term buyers are stuck on losing trades. So they can leave their positions despite the loss. This inevitably deepens the drop below $20,000.

Bitcoin price is now recording new lows for 2021 and 2022 below $19,000. $16,020 is an important technical level as a crash safe system. This region is seen as where Bitcoin finally reached the milestone. A V-shaped recovery is highly unlikely once a lower level is reached near $16,000. Instead, the analyst expects L or W structures. Because the catalyst currently suppressing cryptocurrencies is not likely to change overnight. More gradual ascent is required.

The headlines will be decisive this week. A few more headlines appeared this week saying that Russia is ready for peace talks as the aggression in Ukraine has faded into the background somewhat. Accordingly, it is seen that Russia has secured the provinces it wants to add for annexation. A groundbreaking headline would see investors quickly forget about the headwinds from inflation and focus solely on rallies in cryptocurrencies and stocks, as algorithms based on headline analysis alone will trigger massive buy orders anyway. BTC price will not seek ground but will see a break above $26,868. In just one or two trading days, it will be inches away from $30,000.