Bitcoin (BTC) is starting a new week and is still struggling for $20,000 support while the market has had a week full of serious losses. Bitcoin dropped as low as $17,600 over the weekend. Tensions rise ahead of the June 20 Wall Street opening. Here are the events that will affect BTC and altcoins in the coming days…

BTC recovers $20,000 on weekly chart

Bitcoin’s last weekly close could have been lower at $20,580. However, BTC has managed to maintain a significant level of support, at least on the weekly timeframes. However, the bottom wick extended $2,400. A repeat performance can increase the pain for those who bet $20,000. It can create a significant price level. BTC/USD hit $20,629 overnight on Bitstamp. Just under $20,000 it’s back to consolidating. This indicates that the situation remains unstable in tighter timeframes.

While some call for a sudden recovery, the general mood among commentators remains more cautious optimism. Arguing that the recovery will come when the mandatory sales are over, but more sales pressure may be seen, Arthur Hayes, the former CEO of BitMEX, used the following statements in a Twitter thread:

Over the weekend, with the fiat markets closed, BTC tumbled to $17,600 with good volume, down almost 20 percent from Friday. Is it not over yet… I don’t know. However, this may be additional opportunities for skilled traders to purchase coins.

The role of crypto hedge funds and related investment vehicles in exacerbating BTC price weakness has been a hot topic of discussion since the Terra boom in May. With Celsius, Three Arrows Capital and others participating in forced liquidations into the chaos resulting from several-year lows. “The job of liquidating the big players in Bitcoin is not over,” Investor Mike Alfred said on June 18. On the other hand, il Capo of Crypto cited $16,000 as its main target. He also described $16,000 as a “strong magnet.”

Stocks and bonds “have nowhere to hide”

Meanwhile, the loose outlook for equities ahead of the Wall Street opening provides little in terms of upside prospects for BTC on June 20. As noted by analyst and commentator Josh Rager, the correlation between Bitcoin and stocks exists. Globally, stocks recorded “the worst quarter ever,” according to current data, as of June 18. As such, one of the market players that can change the course seems to be the FED.

Some argue that monetary tightening will not last long as its negative impact will force the Fed to expand the US dollar supply once again. This, in turn, will allow cash flow to return to risky assets. This is a view shared even by the Fed itself should the US face a recession.

Miners are not in the mood for capitulation

Who is selling BTC at the lowest levels since November 2020? On-chain data tracks groups of investors, some mandatory, some voluntarily contributing to selling pressure. Miners moved from buyers to sellers, stopping a perennial trend of accumulation. “Miners spent about 9k BTC from their treasury this week and are still holding about 50,000 BTC,” on-chain analytics firm Glassnode said on June 19.

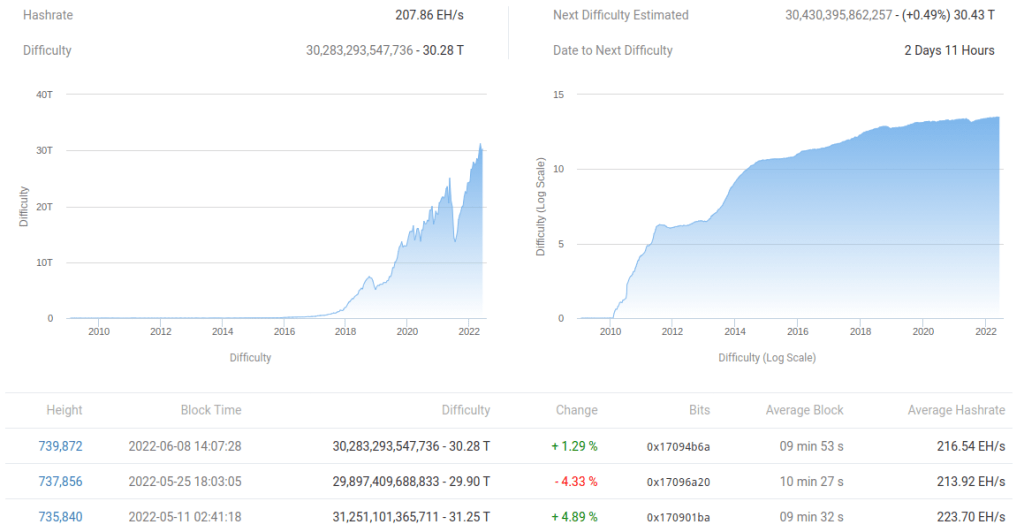

However, it is difficult to calculate the miner production cost exactly, and different installations face drastically different mining conditions and costs. Therefore, many of them can be profitable even at current prices. Meanwhile, data from BTC.com provides surprising news. Bitcoin’s network difficulty does not reflect a miner capitulation. It will not be dropped. Instead, it will adjust upwards this week.

The difficulty allows the Bitcoin network to adapt to changing economic conditions. It is the backbone of the PoW algorithm. If miners quit because of a lack of profitability, the difficulty automatically decreases, reducing costs and making mining more attractive. Similarly, the hash rate is hitting record highs. It stays above an estimated 200 exahash per second (EH/s).

BTC users see “big” losses

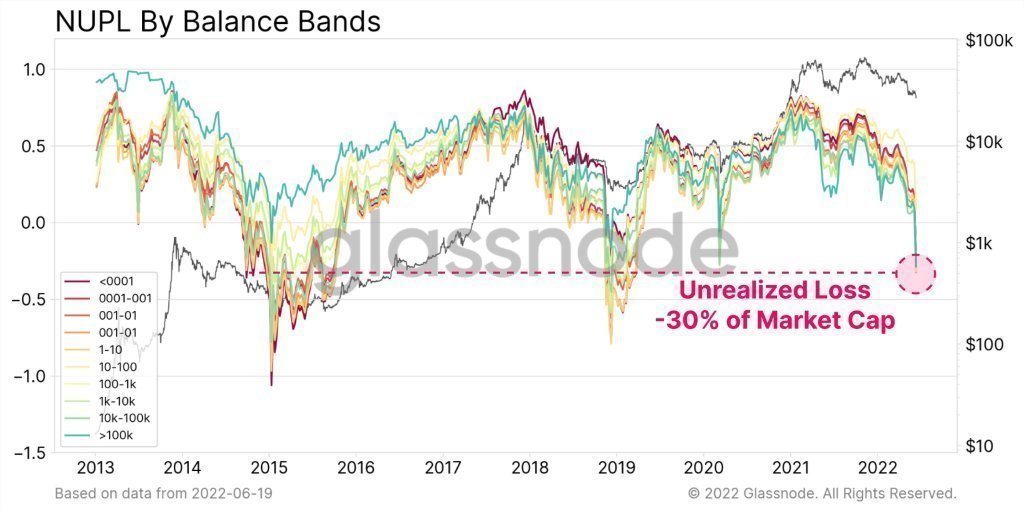

Glassnode says that hodlers, both large and small, who haven’t weathered the storm are seeing “huge” losses when they sell. “If we assess the damage, we can see that almost all wallets, from ‘shrimp to whales’, have worse, larger unrealized losses than March 2020,” the researchers wrote, along with a chart showing how much BTC holdings have dropped on a cost basis. The least profitable group of wallets hold 1-100 BTC.

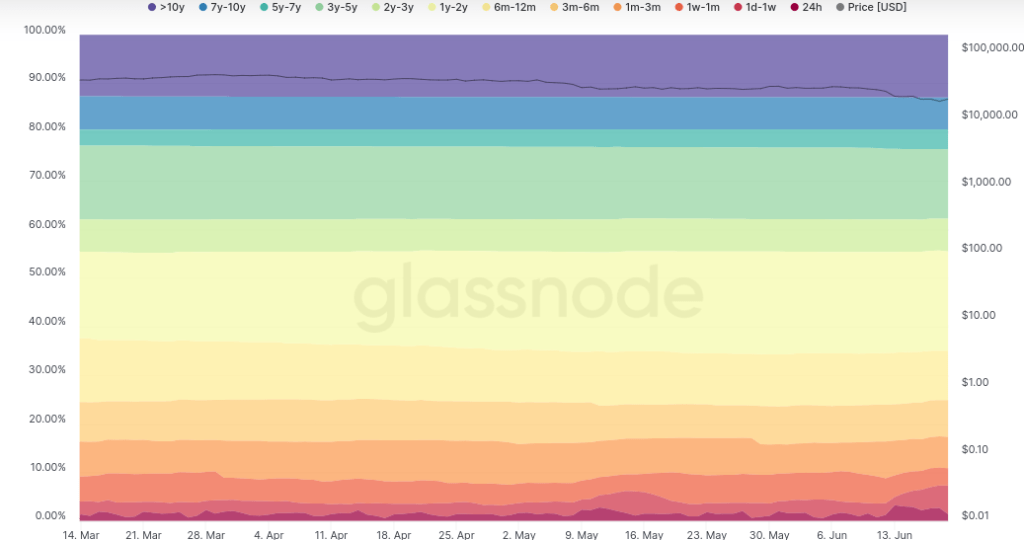

The numbers point to a state of panic, even among seasoned investors, given Bitcoin’s history of volatility. A look at the HODL Waves indicator, which groups coins by how long ago they last moved, meanwhile recording bottom sellers and buyers. Between June 13 and June 19, the percentage of the total BTC supply that moved in the last day to a week increased from 1.65% to about 6 percent.

Sentiment nearly hits historic lows

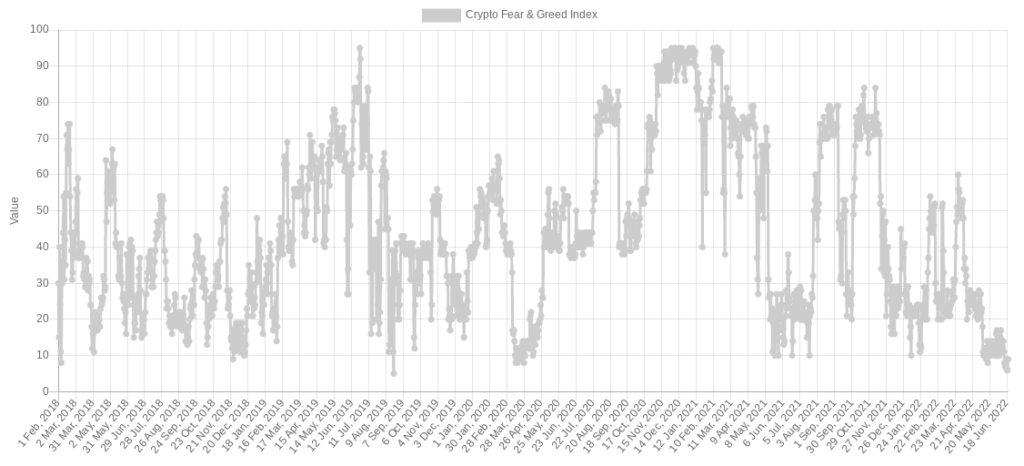

According to the Crypto Fear and Greed Index, the average investor is now more fearful than almost any other time in industry history. On June 19, the Index, which uses a number of factors to calculate overall sentiment, fell close to record lows of just 6/100, deep in the “extreme fear” category.

The weekly close only marginally improved the situation. The index has added three points to continue staying at levels that have marked historical bear market lows for Bitcoin. Only in August 2019 was the index at a lower score.