The Federal Reserve responded to historic highs in US inflation with a historic interest rate hike. Although the Fed’s hawkish stance caused a jolt in the markets, it seems to have had a relatively less impact on the gold price. Despite these developments, economists at Deutsche Bank expect gold to maintain its safe-haven appeal. Market analyst Pablo Piovano says the precious metal remains capped at $1,880.

“Gold’s hedging properties are also likely to come to the fore”

cryptocoin.com As you can follow in the news, the Fed increased by 75 basis points last Wednesday. An increase in this rate is the highest in the last 30 years. Therefore, it was interpreted as the Fed will not hesitate to be aggressive to rein in inflation.

Spot gold price was moving sideways at $1,940 at the time of writing. Gold futures were last traded at $1,841.7. According to analysts, the yellow metal seems to have entered a consolidation phase around $1,850.

In this environment, economists at Deutsche Bank expect the yellow metal to maintain its safe-haven appeal. He also predicts that in June 2023, precious metal prices will be around $2,100. Economists evaluate the latest developments and their impact on gold as follows:

Rising real interest rates are a headwind for gold. However, in terms of the rate outlook, we think the market is already pricing the highest falconry. Gold’s hedging properties are also likely to come to the fore.

In the one-year outlook, gold prices will be $2,100.”

Market volatility is likely to continue to be driven by concerns about inflation, recession, and/or geopolitics. According to economists, therefore, gold needs to be well supported by investor demand. Accordingly, economists make the following prediction for the yellow metal price:

We estimate gold prices to be $2,100 in June 2023.

Pablo Piovano: Gold remains limited to $1,880

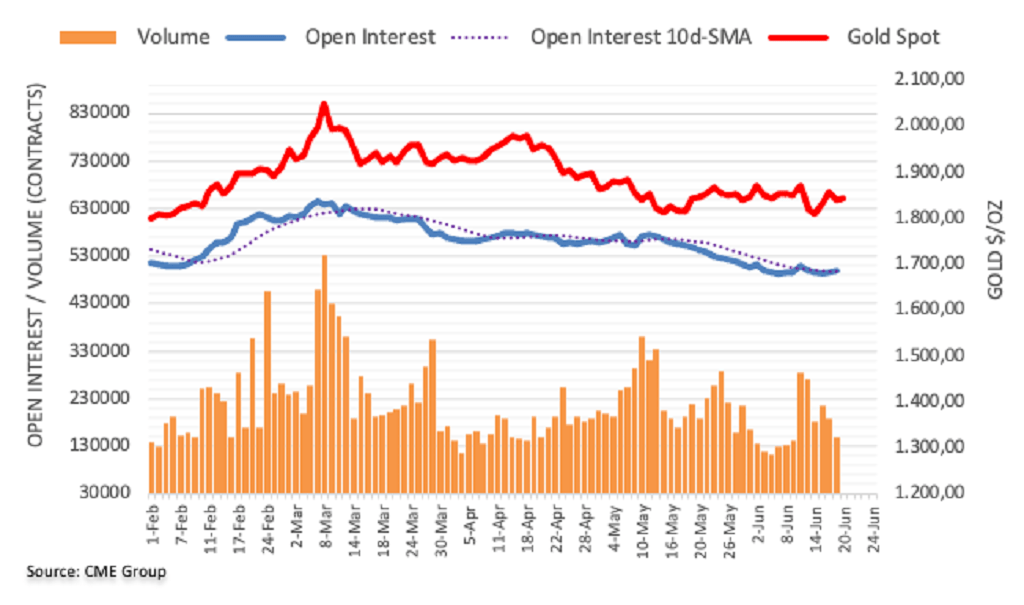

Open interest on gold futures markets rose for the second consecutive session on Friday, this time with around 5.3k contracts, according to advanced data from CME Group. Instead, volume contracted for the second consecutive day. Volume now stands at around 41.2k contracts.

Gold prices reversed two consecutive days of gains on Friday. Market analyst Pablo Piovano notes that the yellow metal continues to hover around the key 200-day SMA near $1,840. According to the analyst, the decline was paralleled by rising open interest rates. The analyst says this supports more weakness in the very near term. On the upside, precious metal prices seem limited around the June high of $1,880.