Gold prices continue to have a slight downward trend in the market. The yellow metal has visited below $1,800 this week. However, facing rising interest rates around the world, the precious metal continues to hold its ground. Market analysts do not expect a significant route under for now.

“The technical picture shows that the gold price may decline in the near term”

The latest Kitco News Weekly Gold Poll shows sentiment is relatively neutral among Wall Street analysts and Main Street investors. David Madden, Market Analyst at Capital, Equiti Capital, says rising interest rates are pushing the US dollar higher. He also states that it creates more volatility for the equity markets. Therefore, Madden states that $1,800 may represent the fair value of gold in the short term. In this context, the analyst makes the following statement:

I think the US dollar has a slight advantage over gold as a safe-haven asset. Gold seems comfortable trading around $1,800. However, the technical picture shows that the price may decline in the near term.

Daniel Pavilonis: The price of gold has dropped, but not broken!

The comments come as the gold market finished its third week in negative territory. August gold futures traded at $1,800.80, down more than 1.5% from last Friday. In addition to the gloomy technical outlook, the gold market closed June with its third loss in a row.

Despite a bleak start to the second half of 2022, gold continues to outperform equity markets. The S&P 500 closed the first half of the year with a 20% decline. This is the worst half-year performance since the 1970s. Daniel Pavilonis, Senior Commodity broker at RJO Futures, comments:

Gold is still doing what it’s supposed to do. With all the interest rate hike issues, it maintains its gold ground. The price is lower but not spoiled.

What do the gold survey results show?

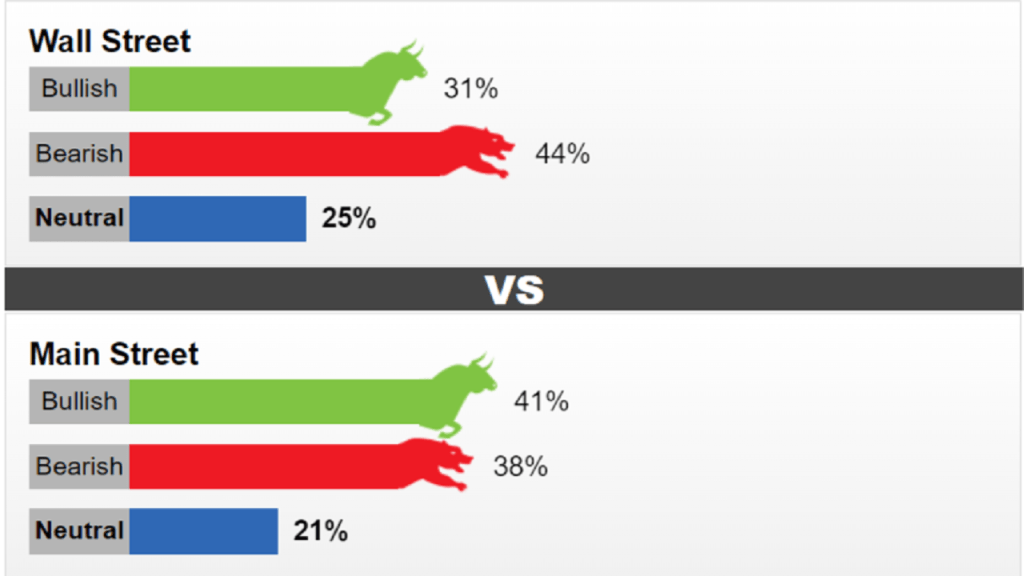

This week, 16 Wall Street analysts took part in Kitco News’ gold survey. Among respondents, five analysts, or 31%, were bullish under the near term. At the same time, seven analysts, or 44%, were bearish on gold. The other four analysts, or 25%, chose to remain neutral on the precious metal next week.

Meanwhile, 612 votes were cast in online Main Street polls. Of these, 253, or 41%, expect gold to rise next week. Another 233, or 38%, voters said they would decline further, while 126 voters, or 21%, remained neutral in the short term.

Sentiment among retail investors is at a multi-year low. That’s why the participation rate was the same. Analysts state that investors’ interest in gold has cooled recently as prices consolidate.

“Yellow metal will continue to struggle”

According to some analysts, gold will continue to struggle as the Federal Reserve leads the global pressure to raise interest rates. By the way cryptocoin.comAs you follow, the Fed is expected to raise interest rates by 75 basis points at the end of this month.

But the Federal Reserve isn’t the only central bank looking to tighten monetary policy. As inflation continues to rise, expectations are rising that the ECB will raise interest rates in July. On Friday, preliminary data showed that inflation in Europe rose to 8.6%, up from 8.1% year-on-year in June.

Adrian Day: This would be wildly positive for shiny metal

However, other analysts point out that central banks all face the same dilemma as they try to raise interest rates in the face of slowing growth. Adrian Day, Head of Wealth Management, says gold is oversold in the current environment and expects a jump. Day comments:

Central banks will be faced with the choice of either continuing to tighten to curb inflation or pushing economies into recession. The USA may already be in one. At this point most of them will slow down their tightening. Or it will reverse course if economic conditions get bad enough. If the Fed and other banks abandon their efforts to control inflation, that would be wildly positive for gold.

Marc Chandler takes a more cautious approach to gold

Marc Chandler, Managing Director of Bannockburn Global Forex, also says he’s looking for a jump in gold. However, he is not that optimistic about precious metal. Chandler shares these views:

After this week’s major crash below $1,800, I’m reluctant to go any lower. However, a jump in sales is possible as recession fears overshadow inflation as one of the main concerns.