Tech company Meitu, operating in China, reported huge losses in the midst of sales in the cryptocurrency market.

Software firm Meitu lost up to $52.3 from these two cryptocurrencies

Chinese tech company Meitu reported a loss of $50 million after purchasing 940.89 BTC and 31,000 ETH in 2021. The software firm’s stock, Meitu (1357), listed on the HongKong stock exchange, has tumbled heavily in the past few months. This drop comes amid the downturn in the cryptocurrency market. Meanwhile, the company lost between $41.1 million and $52.3 million. Thus, only in the first half of 2022, a number of crypto companies went bankrupt.

The company’s loss almost doubled compared to the same period last year. Meitu reported a loss of 154.1%, up 99.6% on its filing with the Hong Kong Stock Exchange on July 1. Cayman Islands joint stock company Meitu is known for its synonymous AI-powered facial beautification app in China.

Meitu bought 940.89 BTC and 31,000 Ethereum (ETH) in 2021. However, it has not made any moves to sell or buy crypto since then, according to the file. An important reason for the company to bleed is due to the decline in the cryptocurrency market.

Why Bitcoin stagnated below $20,000

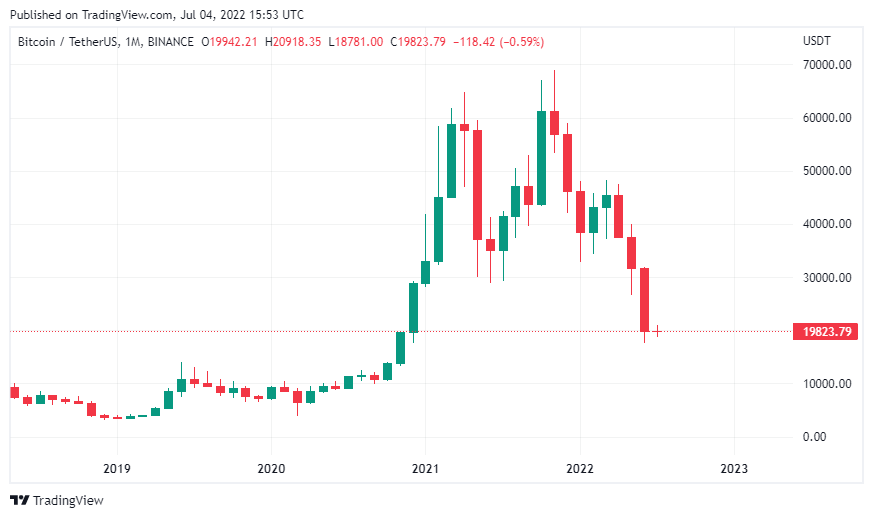

The price of major cryptocurrencies has dropped dramatically over the past month. Bitcoin (BTC) has lost almost 38% in June. Thus, it reached the second-largest monthly loss since its launch in 2009. In detail, Bitcoin has had a lot of support from the community over the years. Despite the challenging market conditions, its investors maintained a positive narrative without giving up. However, the price of BTC did not show much of the same enthusiasm.

cryptocoin.com As I have mentioned in the analysis, Bitcoin has followed an extremely volatile course. Meanwhile, it has lost 7% compared to last week. This marked the worst quarter for Bitcoin as BTC fell close to 50% in the second quarter of this year.

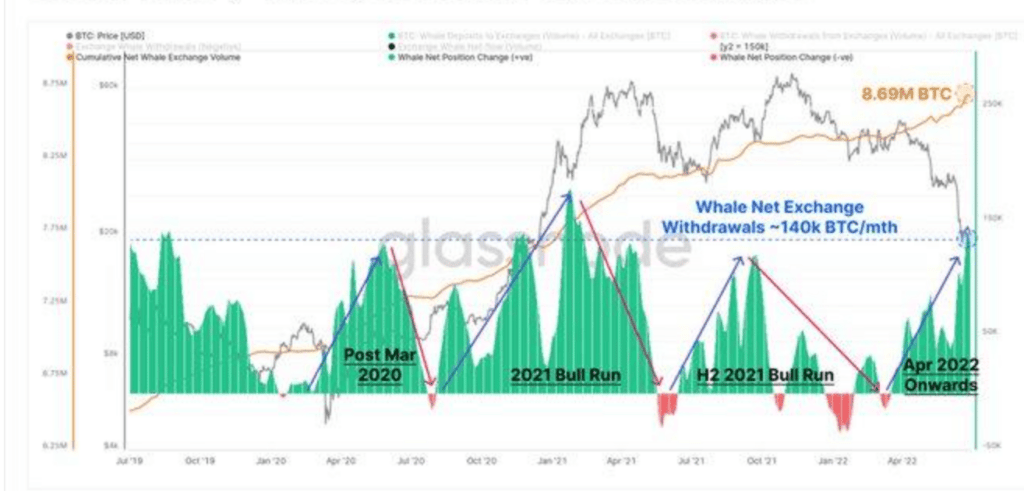

Whales, on the other hand, are accumulating BTC at a good pace. Currently, whales buy 140,000 BTC per month from cryptocurrency exchanges. At the same time, they hold 8.69 million BTC, which is about 45.6% of the circulating supply.

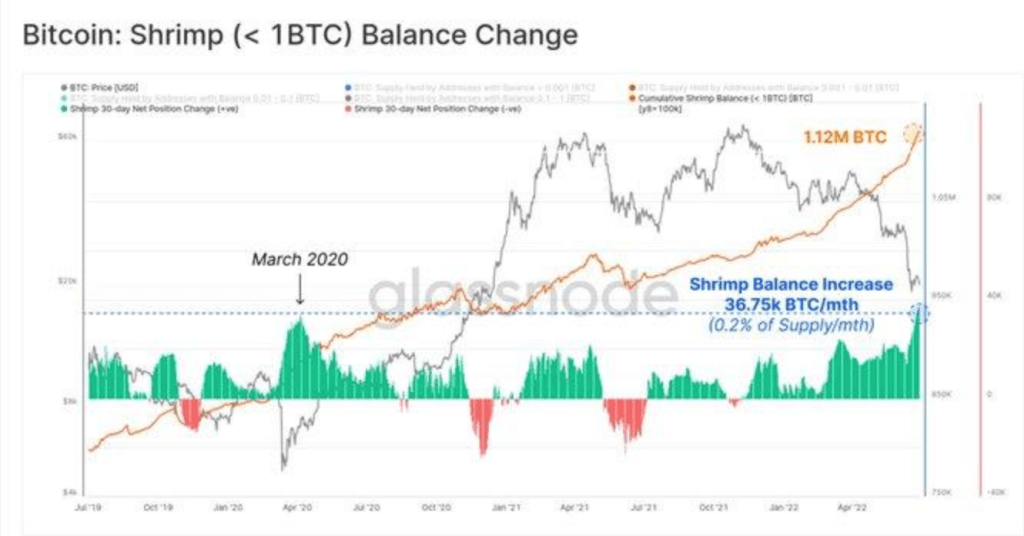

However, accumulation happens very slowly. This is one of the reasons why the price is not so appreciated. Also, smaller investors (wallets with one BTC or less) benefited from the drop. In the last two quarters, shrimp added about 36.75k BTC per month, about 0.2% of the total circulating supply. They currently hold a total of 1.12 million BTC.

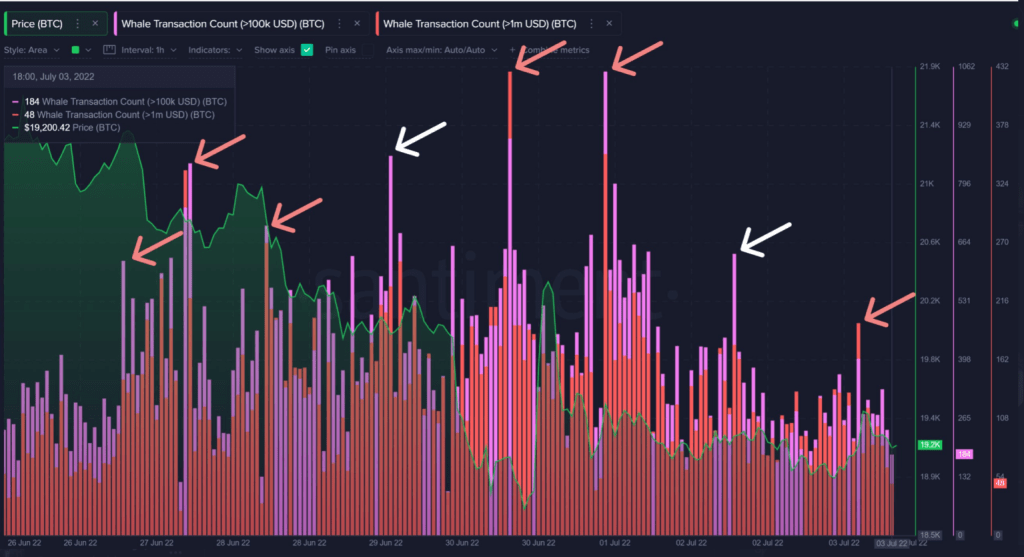

Although wallets with one or less BTC received more BTC than the whale, it did not affect the price of BTC much. The on-chain data source Santiment sheds more light on this situation. The chart below shows that BTC’s biggest whale transaction spikes occurred in minor rallies.

The vast majority of the biggest spikes in BTC’s whale transactions occurred after minor BTC price spikes of $100 to $200. However, prices fell after each of these temporary increases in 100,000+ or $1,000,000+ transactions.