While the altcoin market is still recovering, a popular analyst shared that he expects a 50% drop. In this article, let’s look at how consistent this estimate is.

Crypto analyst explains that altcoin market will drop 45-50% body size

On Saturday, July 8th, popular analyst Crypto Capo warned of a 50% drop on Twitter. According to the analyst, the altcoin market will fall by another 45-50% from current levels.

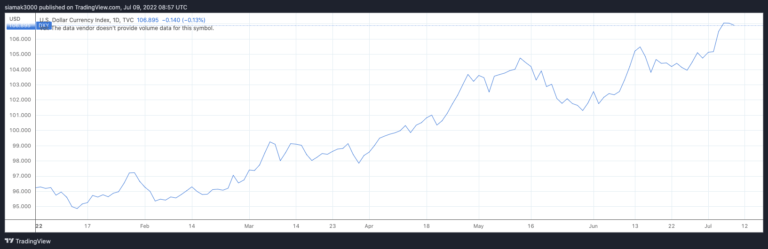

The US Dollar Index (DXY), designed, maintained and published by ICE, is an index (or measure) of the value of the US dollar. The dollar is followed against fiat currencies such as EUR, GBP, JPY, CAD, SEK and CHF. According to data from TradingView, the US dollar index is currently around 106.89. Yesterday it hit 107.77, the highest level of this year. In fact, DXY has increased by 12% since the start of 2022.

In contrast, the Bitcoin price has lost over 54% since the beginning of the year.

On this subject, Crypto Capo said on Twitter on July 8th:

DXY is going parabolic. Bitcoin is rising a little. People get euphoric and look for $40. There is not a single bullish sign to support this move. Price faces resistance at $22,000

The alarm given by Capo for the altcoin market was as follows:

Rejection will be strong. Altcoins can drop 45-50%. There will be no mercy.

However, there are analysts who do not participate in Crypto Capo.

However, two other crypto analysts disagreed with Crypto Capo’s comments that the DXY rise is bad for crypto. Ran Neuner said:

I think you don’t see this correctly. The only thing that will reduce inflation is a strong DXY. Strong DXY means lower energy. That means a less aggressive Fed. Therefore, the growth stock and Bitcoin are rising.

cryptocoin.comAs we quoted Miles Deutscher on Twitter:

Although historically inversely proportional, DXY rise is actually not a bad thing given the current macro environment. Strong dollar = lower commodity/energy prices > lower inflation > increases the likelihood of an earlier FED pivot.

Later in the day, Crypto Capo explained why he expects the crypto market to hit new lows in the near future:

Some other exchanges like Kraken and FTX just fake every bounce to fill the above sell orders. Both in BTC and ETH. This is not an organic rise, but a fake move. A bull trap. When they pull fraudulent orders, the market goes to new lows. They just pulled them.

Kraken and some other exchanges like FTX have been spoofing every bounce up, just to fill sell orders above. Both on BTC and ETH. That's not an organic move up, but a fake one. A bull trap.

When they pull the spoofing orders, market goes to new lows. They just pulled them. pic.twitter.com/vv6cWXgAJ1

— il Capo Of Crypto (@CryptoCapo_) July 8, 2022

The behavior of Bitcoin miners supports this view.

Elsewhere, there has been a significant drop in Bitcoin miner reserves over the past two weeks, according to analysis in Crypto Quant. This is interpreted as an indication that confidence is declining despite an upward curve in Bitcoin price. The data shows that there have been about 4,300 Bitcoin drops in the last two weeks. It also revealed that it points to positions that are hedged against price declines. The general trend in the Bitcoin mining community seems to be about transferring assets to the derivatives market. This is perhaps a clear signal to expect further declines in Bitcoin price.