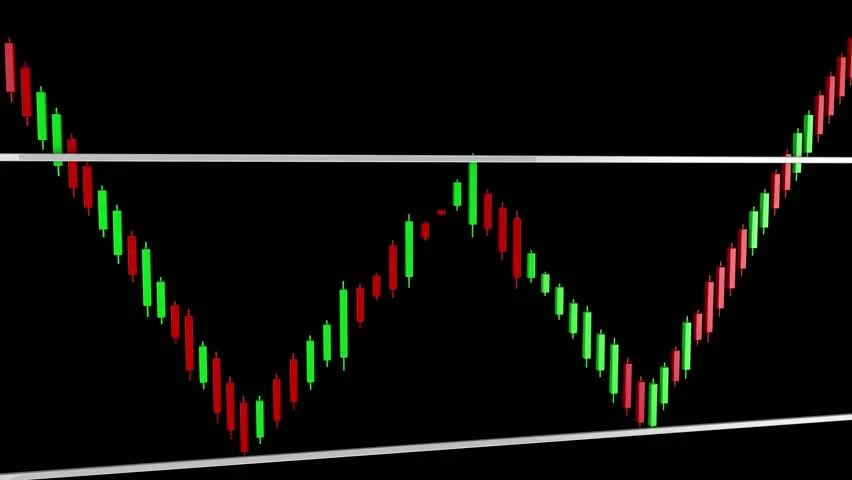

The sharp increase in Ethereum (ETH) price may have been caused by a recent double bottom formation.

Pay attention to these on the Ethereum chart while the market is rising

A double bottom pattern is a reversal indicator that once the price reaches the support level, it has recovered, retested the level as support and is likely to rebound. If the price retests the level as support, it may cause a triple or even a quadruple bottom to occur.

The pattern is always defined when the price is down and at the bottom of the downtrend. On the other hand, a bearish double top pattern always indicates an uptrend. An increase in volume indicates confirmation of a double bottom pattern. Increasing volume after that indicates that the price will return to an uptrend. In this case, it is useful to pay attention to the following:

- Aggressive bulls choose to take positions when their volume increases after the second retest of the support level. Bull-in-waiting seeks to take a position when its price exceeds the initial rebound level.

- Bear traders choose to short if the price declines at the initial recovery level or falls below the key support level where the double bottom pattern was formed.

What does this pattern say for ETH price?

Ethereum registered a double bottom pattern just below $1,000 on June 30 and July 13. Then, on July 14, the formation began to react with an upward trend. The bullish price action in the stock market on Friday likely boosted confidence among investors.

The increase came as volume rose. This indicates a high degree of investor interest at the moment. At press time, Ethereum’s volume was over 200,000 on Coinbase compared to the 10-day average of 285,000.

The bulls will want to see Ethereum drop further for the HL level which will confirm the start of the uptrend. ETH could register an inner candlestick during Sunday’s trading session to consolidate Saturday’s bullish action. An upward break from the formation will give a solid entry point to investments that are not currently in a position.

Conclusion

cryptocoin.com As we covered in our analysis, Ethereum is currently trading above the 8 and 21-day EMAs. The 8-day EMA is starting to cross above the 21-day bullish one. In the coming days, traders will want to see Ethereum regain the 50-day SMA line as support. This will indicate that long-term sentiment is bullish. Ethereum has resistance above $1,421.80 and $1,717.41 and support below $1,245 and $1,081.