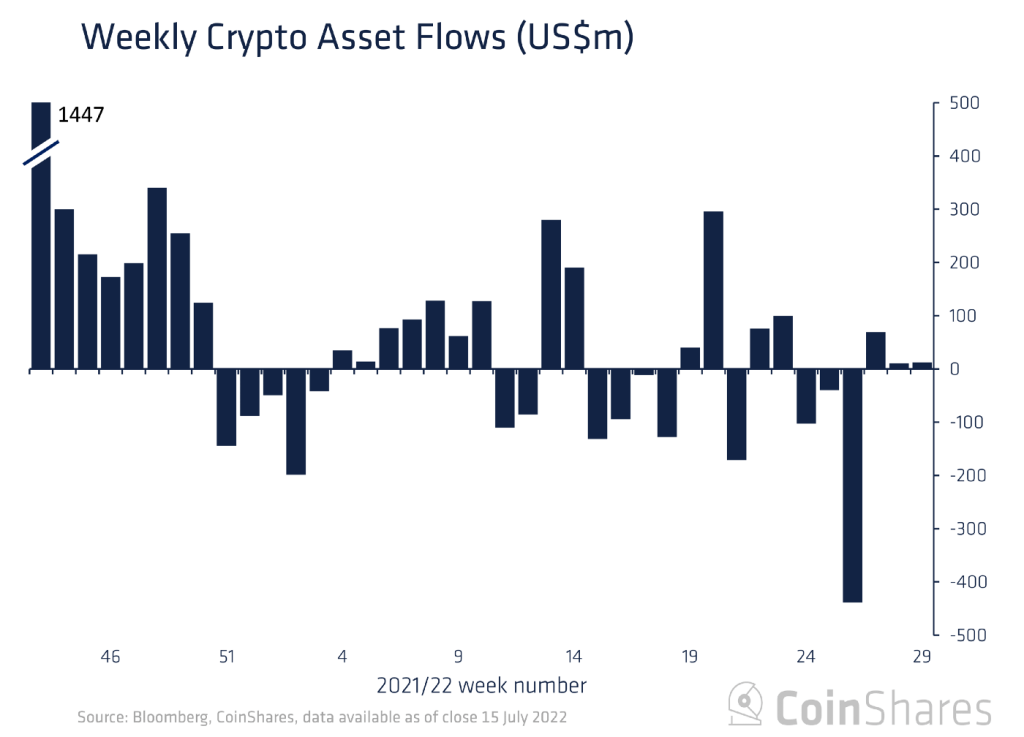

Digital asset investment products saw a total net inflow of $12 million last week. However, 15 million dollars of this went into short investment products. Long investment products, on the other hand, had a total net outflow of 2.6 million dollars. Leading altcoin Ethereum has witnessed the exit again after three weeks of inflows. While altcoin projects in general have remained quiet, Solana (SOL) has managed to attract significant funding.

Crypto assets saw net inflows last week

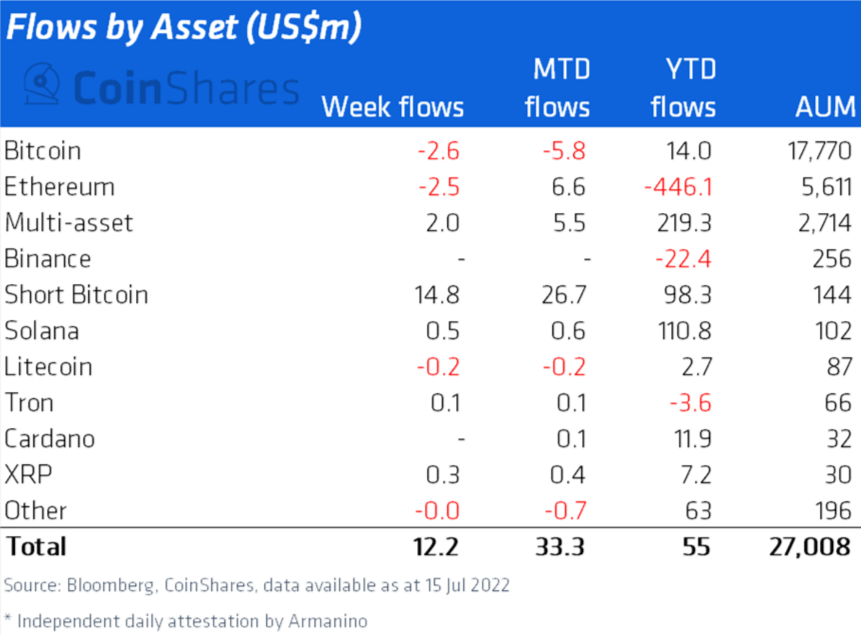

Digital asset investment products attracted a total of $12 million in net fund flows last week. However, 15 million dollars of these fund inflows went to short (reverse price) investment products. On the other hand, long investment products witnessed a total net outflow of $2.6 million.

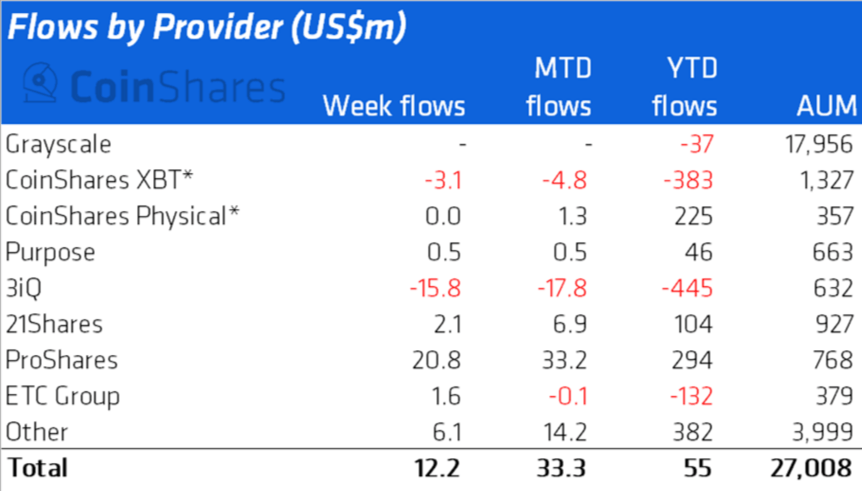

Experts evaluate this situation as underlining new investors who expect further price drops. They also note that currently traders are not selling their positions, believing that crypto prices are near the bottom. When we look at the fund basis, ProShares’ $20.8 million inflow draws attention. In addition, 3iQ’s $ 15.8 million exit does not go unnoticed.

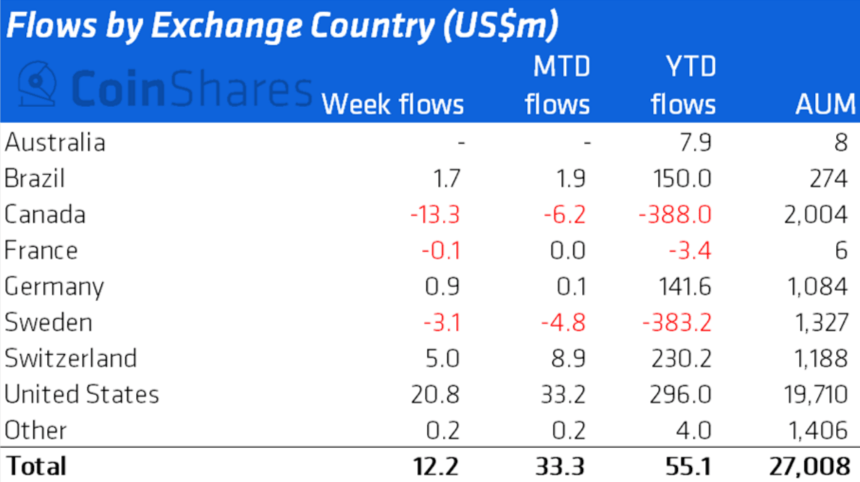

On a regional basis, this time Canada saw an outflow, while the US saw inflows, according to CoinShares data.

While there are entries in Short Bitcoin, there are exits from long Bitcoin

There was a total net outflow of $2.6 million in Long-Bitcoin. Total assets under management (AuM) have increased to $17.8 billion since the end of June. Meanwhile, investors are still adding to their short-Bitcoin positions. With a total of $15 million in entries last week, entries hit a record 4-week record totaling $88 million (61% of AuM).

Leader failed to continue altcoin entry streak

cryptocoin.com As you follow, the leading altcoin Etherum has seen an 11-week breakout streak. Then it managed to attract funds for 3 weeks in a row. However, this week the situation turned out again. Ethereum has seen minor outflows totaling $2.5 million. Therefore, a three-week intro series came to an end.

Solana, one of the altcoin projects, managed to attract significant funds

Multi-asset investment products, a favorite of this bear market in terms of flows, saw $2 million in inflows. The year-to-date inflows of these investment products are $219 million, well above all other assets.

Meanwhile, altcoin projects have been very quiet over the past week. There has been significant inflow of $0.5 million in total to Solana (SOL) alone. Along with this, Ripple (XRP) also attracted $ 0.3 million in funding. Also, Justin Sun’s Tron (TRX) saw an albeit $0.1 million entry.

Investment product volumes totaled $1 billion during the week. It remains very low compared to the annual average of $2.4 billion. It seems that the summer recessions have also affected this place.