The weekend crypto rally extended to the start of a new week. This has caused traders to question whether Bitcoin (BTC) is bottoming out. So has Bitcoin bottomed out? Also, can buyers keep their momentum higher? Or will the bears continue to sell in the rallies? Crypto analyst Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out.

An overview of the crypto market

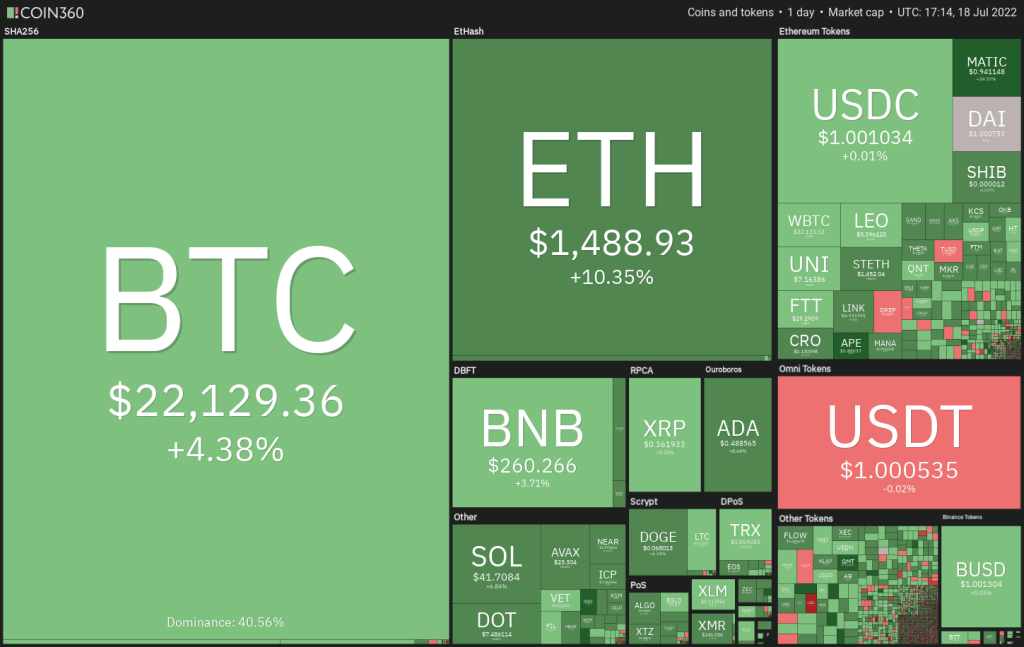

cryptocoin.com As you follow, on July 18, Bitcoin (BTC) rose above $22,000. Ethereum, on the other hand, traded above $1,500. This shows that the bulls are gradually returning to the cryptocurrency markets. This development put the total crypto market capitalization above $1 trillion for the first time since June 13. It also raised hopes that the worst of the bear market could be behind us.

According to crypto intelligence firm Glassnode, more than 80% of the total supply of Bitcoin in US dollars has been dormant for at least three months. This is another positive sign. In previous bear markets, such an event was before the end of the bear phase.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360But a report by Grayscale Investments expresses a different view. He suggests that the current bear market in Bitcoin started in June 2022 and if history repeats itself, the bear phase could continue for another 250 days. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

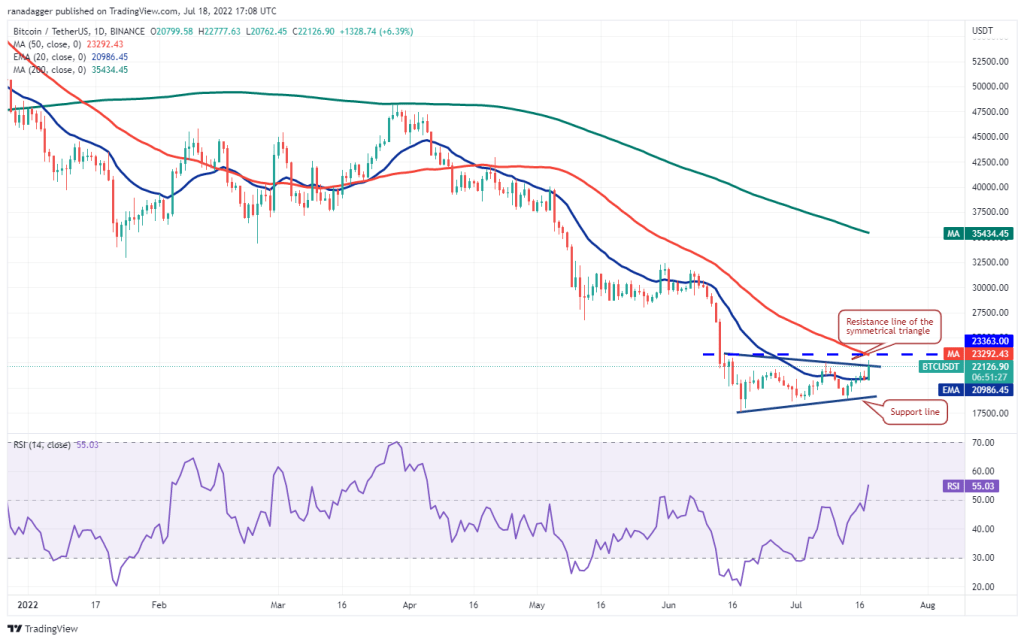

Bitcoin (BTC)

BTC hesitated near the 20-day exponential moving average (EMA) ($20,986) for two days. Then, on July 18, it made a decisive rise. This upward move indicates a possible trend reversal with the symmetrical triangle rising above the resistance line.

The 20-day EMA is stable, but the relative strength index (RSI) has rallied into positive territory. This shows that the momentum is supporting the buyers. BTC bulls will now attempt to break through the barrier at $23,363.

If the price drops from this level but bounces back from the breakout level of the triangle, it will suggest buying lower. It is possible that this will increase the likelihood of a break above $23,363. BTC could then rise to the $28,171 pattern target.

Conversely, if BTC price fails to stay above the triangle, it will show that the bears are aggressively defending the overhead zone between the triangle’s resistance line and $23,363. This could keep BTC inside the triangle for a few more days.

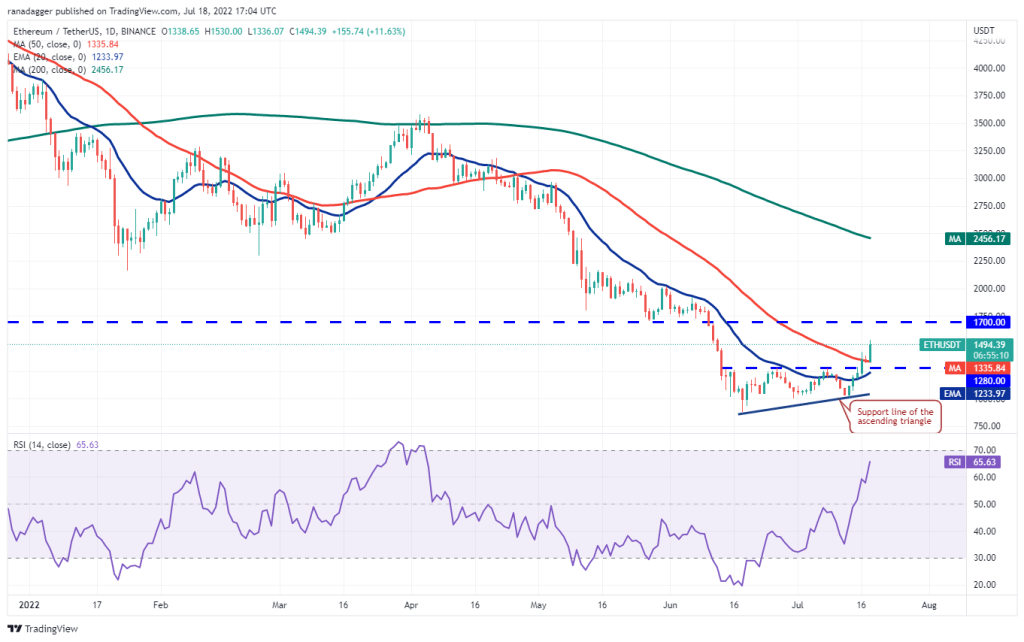

Ethereum (ETH)

ETH broke above the overhead resistance on July 16 and closed at $1,280, completing the ascending triangle pattern. The bears tried to stop the upward move at the 50-day simple moving average (SMA) ($1.336) on July 17. But the bulls did not give up.

Buyers continued their purchases on July 18 and pushed the price above $1,500. This indicates the start of a new bull trend. It is possible for ETH to rise to the overhead resistance at $1,700, where the bears could pose a strong challenge.

If the next correction is arrested at the 20-day EMA ($1,234) it will indicate that the sentiment has shifted from selling on rallies to buying on dips. This is likely to increase the likelihood of a break above $1,700. This positive view could be invalidated in the short term if the price drops and dips below the 20-day EMA. This is likely to pull ETH to the support line of the triangle.

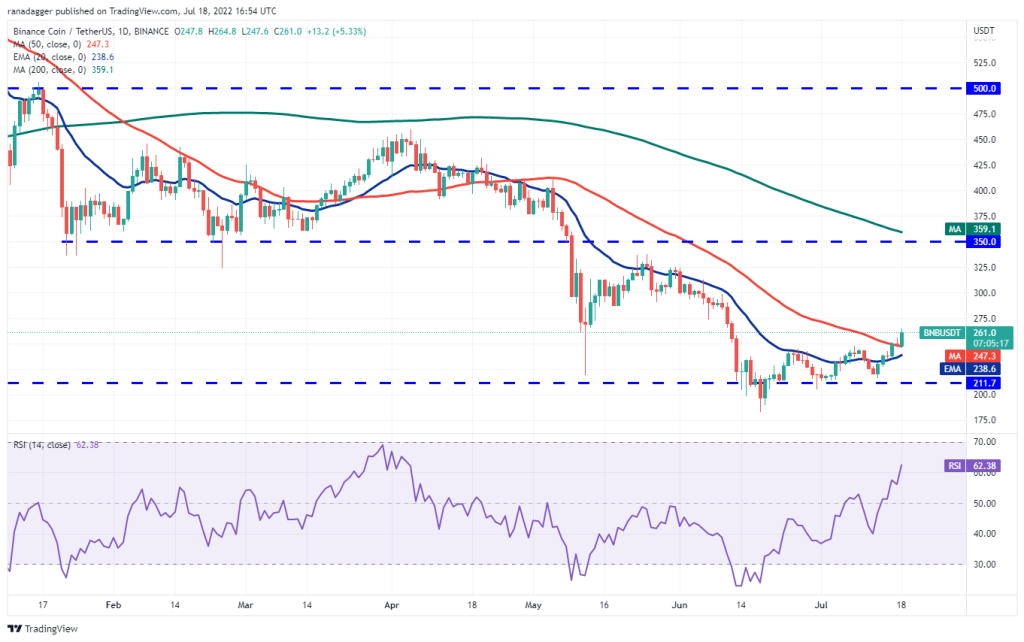

Binance Coin (BNB)

BNB broke above the 20-day EMA ($238) on July 14. It then broke the overall hurdle at the 50-day EMA ($247) on July 16. The bears tried to push the price below the 50-day SMA on July 17. But the bulls held their ground.

BNB continued its bullish movement on July 18. This indicates that the bottom may have been made at $183. The 20-day EMA has started to rise and the RSI is in the positive zone which indicates the bulls are in control.

If the price stays above the 50-day SMA, a rise to $300 is possible for BNB. It could then try to rise to $350. This level is likely to act as a stiff resistance. This positive sentiment is likely to be invalidated in the short term if the price declines and dips below the 20-day EMA. This is likely to pull BNB to $211.

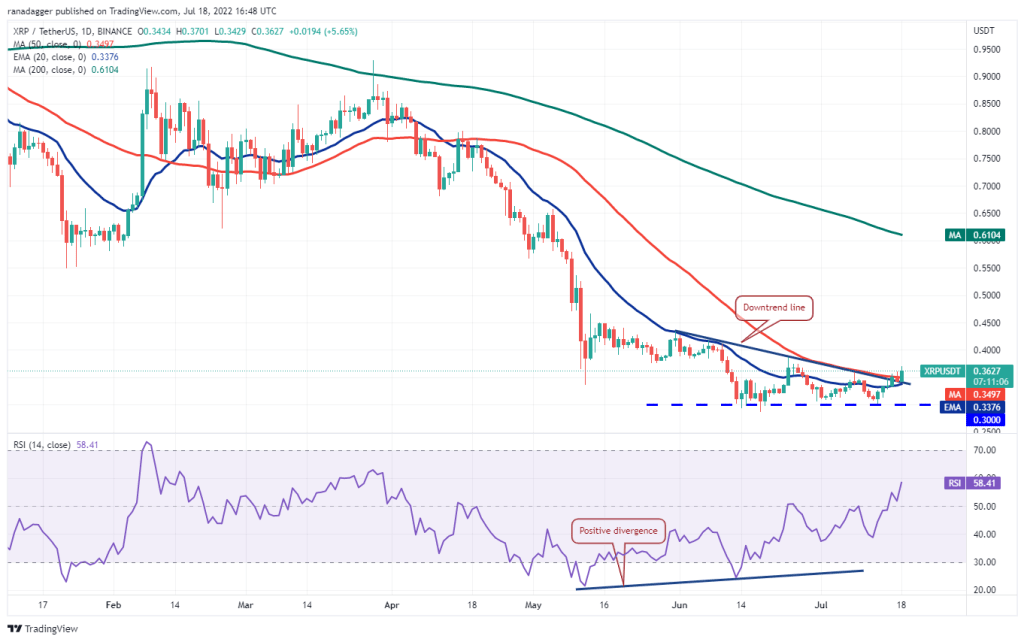

Ripple (XRP)

XRP broke above the downtrend line on July 16. However, the bears stopped the relief rally at the 50-day SMA ($0.35). Sellers tried to push the price below the 20-day EMA ($0.34) on July 17. However, the bulls did not budge and bought the dip.

The 20-day EMA started to rise gradually and the RSI jumped into the positive territory, giving the bulls an advantage. XRP broke the overall barrier at the 50-day SMA on July 18, invalidating the bearish descending triangle pattern. If the bulls sustain the price above the 50-day SMA, it is possible for XRP to pick up momentum and rise to $0.45.

For this bullish view to be invalidated, the bears will need to pull the pair back into the triangle. Such a move is likely to trap aggressive bulls. In this case, XRP is likely to drop to key support at $0.30.

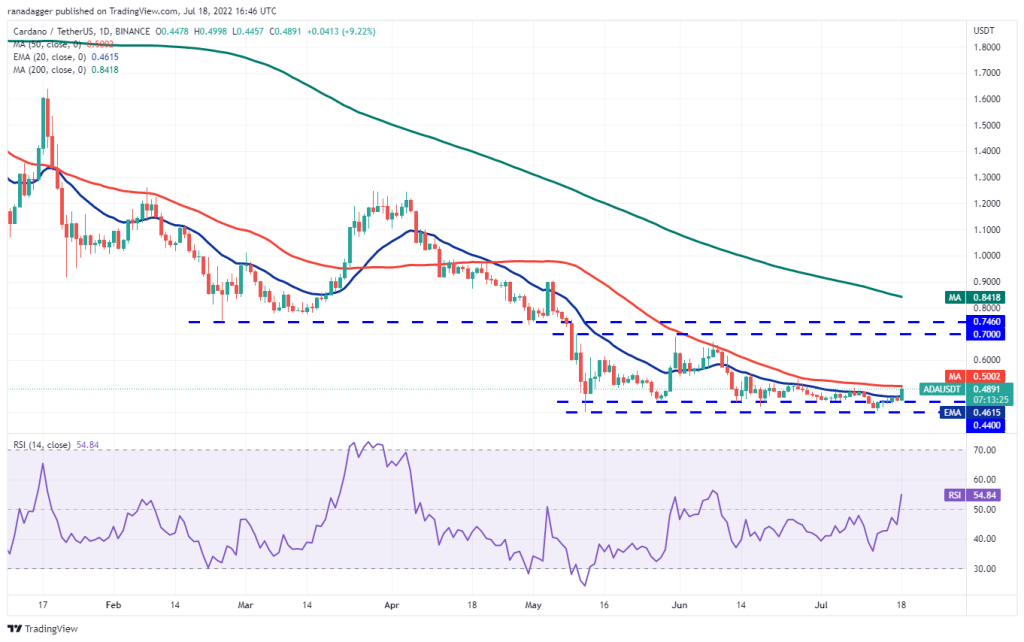

Cardano (ADA)

ADA struggled to push above the 20-day EMA ($0.46). Later, the bulls finally found success on July 18. The price climbed to the 50-day SMA ($0.50), which could act as a strong resistance.

The RSI in the positive zone shows that the momentum is supporting the buyers. If the bulls push the price above the 50-day SMA, it is possible for ADA to rally to $0.60 followed by a breakout towards the stiff overhead resistance at $0.70. Alternatively, if the bulls fail to sustain the price above the 50-day SMA, it will indicate that the bears continue to sell aggressively in the rallies. ADA is likely to drop towards the critical support zone between $0.44 and $0.40 later.

SOL, DOGE, DOT, MATIC and AVAX analysis

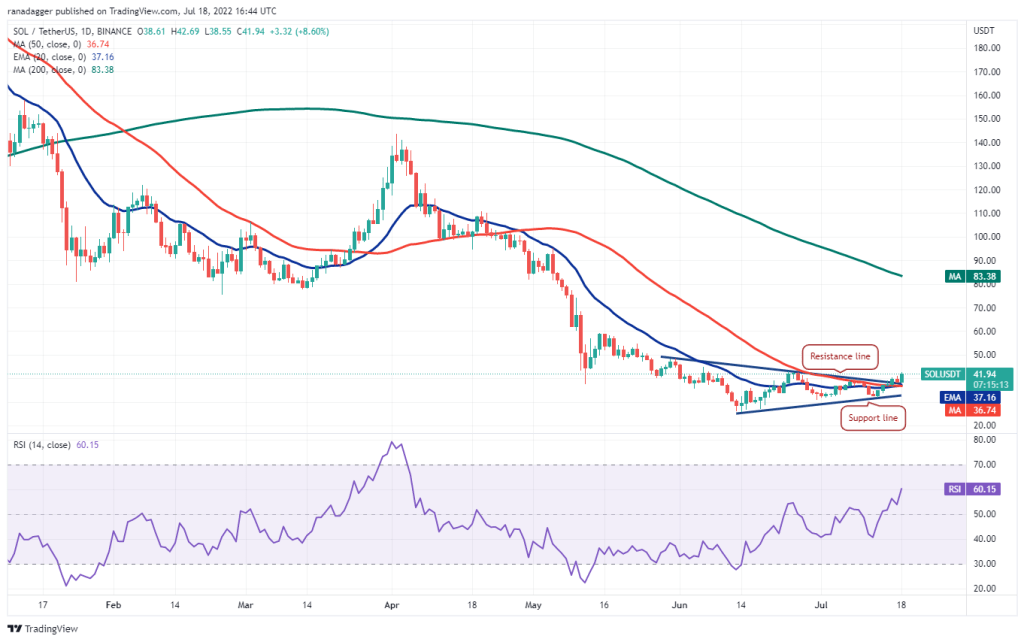

Left (LEFT)

SOL broke above the symmetrical triangle pattern on July 16, showing that uncertainty has been resolved in favor of buyers. The bears tried to pull the price back into the triangle on July 17. But the bulls held their ground.

SOL tries to climb above the immediate resistance at $43. If this happens, it is possible for the SOL to rise to the psychological level of $50. This level is likely to act as a hurdle. However, if it is exceeded, the upward movement is likely to reach $60. Conversely, a drop to the SOL support line is possible if the price declines from $43 and dips below the moving averages. A break and close below this level could indicate that the bears are back in the game.

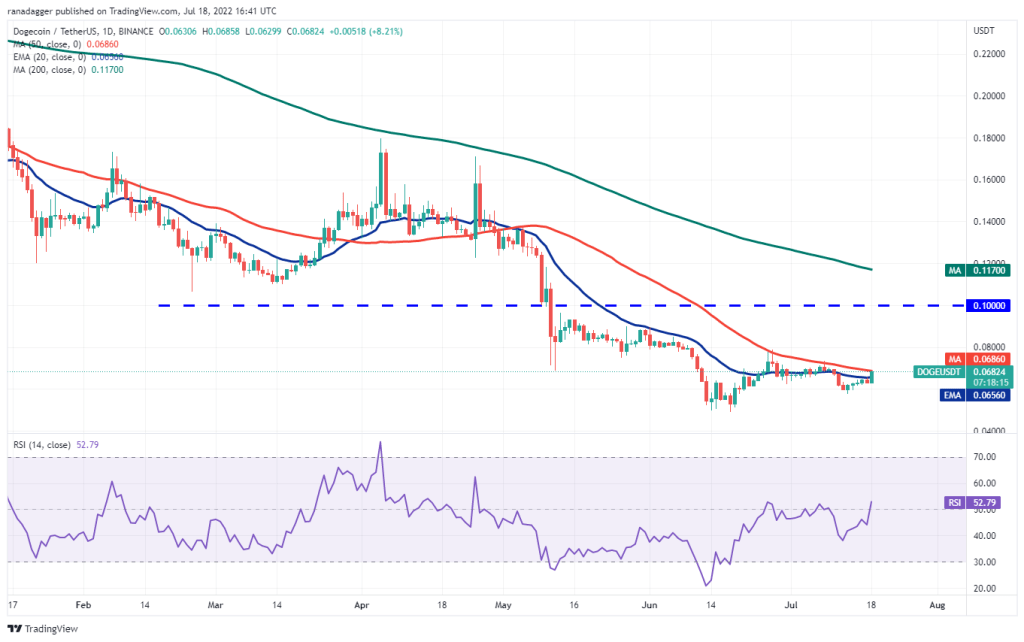

Dogecoin (DOGE)

DOGE is attempting to form a higher low at $0.06. The bulls, on the other hand, are struggling to push the price above the stiff overhead resistance at the 50-day SMA ($0.07).

If they manage to do so, it is possible for DOGE to rally to $0.08. This is an important level to consider. Because a break and close above this is likely to clear the way for a rally to $0.09 and then $0.10. This positive sentiment is likely to be invalidated in the short term if the price drops from the current level and dips below the intraday low of 13 July. In this case, it is possible for DOGE to drop to the critical level at $0.05.

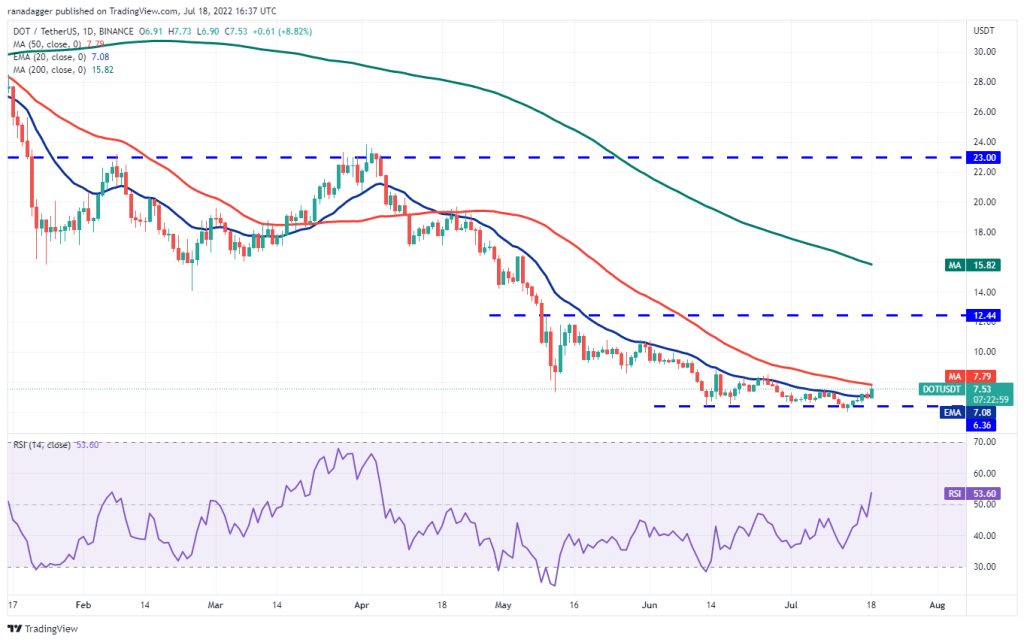

Polkadot (DOT)

The DOT broke and closed above the 20-day EMA ($7.08) on July 16. However, the bears pulled the price back below the level on July 17. This tough fight between the bulls and bears was resolved on July 18 in favor of the buyers.

The 20-day EMA is flattening and the RSI is just above the midpoint. This indicates that the selling pressure may decrease. The bulls will have to push and sustain the price above the 50-day SMA ($7.79) to gain the upper hand. If they manage to do so, it is possible for the DOT to rise to $10. Conversely, if the price drops from the current level, it will indicate that the bears are aggressively defending the 50-day SMA. The DOT is likely to get stuck between $6.36 and the 50-day SMA for a few days afterwards.

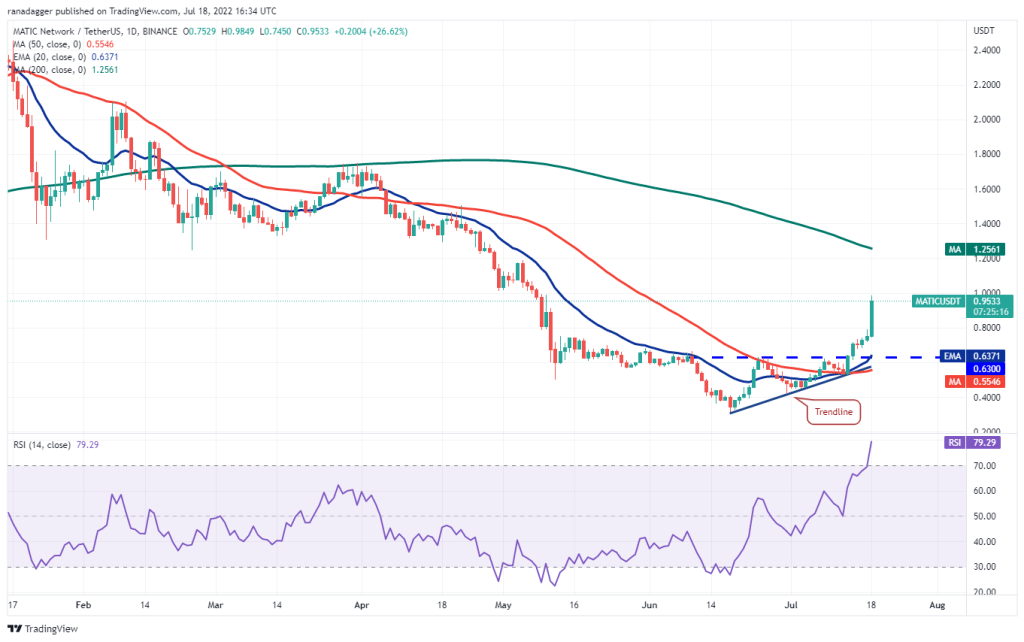

Polygon (MATIC)

MATIC bounced off the 50-day SMA ($0.55) on July 13 and broke above the overhead resistance at $0.63. This completed the ascending triangle pattern.

The MATIC gained momentum and hit its $0.95 model target on July 18. The sharp rally over the past few days has pushed the RSI into the overbought territory. MATIC, psychological level is close to $1. This points to a possible consolidation or correction in the near term.

Initial support on the downside is the 20-day EMA ($0.63). If the price bounces back from this level, it indicates that the bulls continue to buy on the dips. It is possible for MATIC to attempt a rally to the 200-day SMA ($1.25) later. However, this bullish view is likely to be invalidated on a break below $0.63.

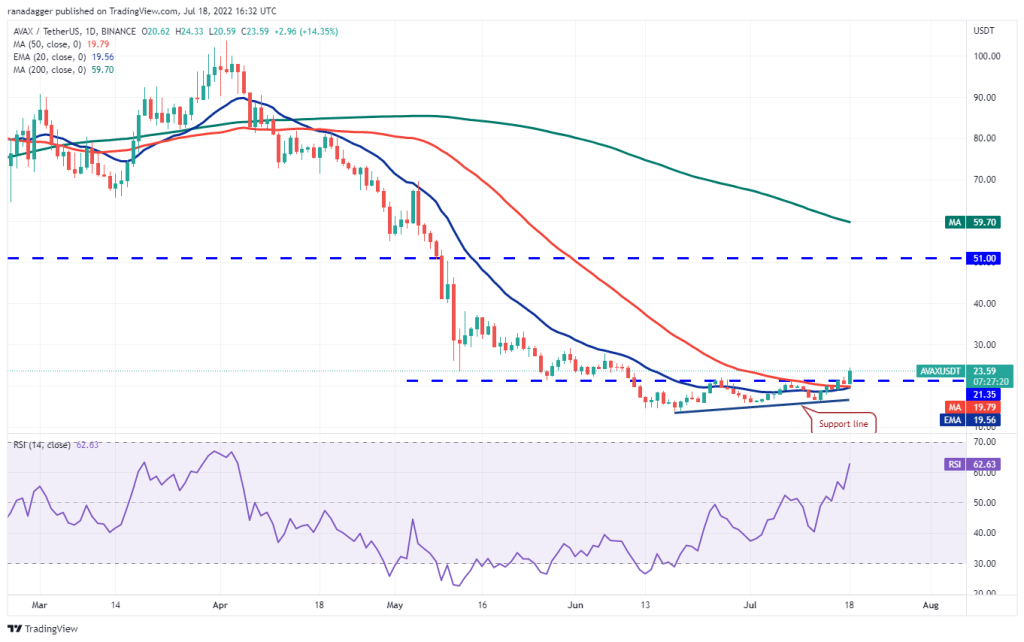

Avalanche (AVAX)

AVAX climbed above the overhead resistance at $21.35, which marks the completion of the ascending triangle pattern. This increases the likelihood of a trend reversal.

The 20-day EMA ($19.56) and the 50-day SMA ($19.79) are close to completing the bullish crossover and the RSI is in the positive territory giving buyers an advantage. If the bulls hold the price above $21.35, it is possible for AVAX to start a fresh upward move. The model target of the breakout from the triangle is $29. Contrary to this assumption, if the price declines and dips below the 50-day SMA, it will indicate that the bears continue to sell aggressively higher. This is likely to pull AVAX to the support line.