Gold price starts the new week on a positive note. It’s pulling away from the nearly one-year low it touched last week. But intraday gains lacked any bullish credibility, according to market analyst Haresh Menghani. Therefore, it lost strength just ahead of the $1,725 level. Economists at TD Securities expect the yellow metal to remain under pressure in the coming weeks.

Falling dollar supported gold price

The US dollar continues its pullback from its two-year high last week. Meanwhile, the prospects for a 100 basis point rate hike by the Fed in July have diminished. Therefore, the dollar is witnessing heavy selling for the second day in a row. This, in turn, offers some support to the dollar-denominated gold as an important factor.

Last week, many Federal Reserve officials signaled that they did not support the larger rate hike that markets had priced in. cryptocoin.com As you can follow, the US CPI reached the highest level in 40 years in June. After that, investors raised their bets on a massive Fed rate hike. However, the needle of the bets later returned to 75 basis points.

Less hawkish FOMC members put pressure on USD

Two of the most hawkish FOMC members (Fed Chairman Christopher Waller and St. Louis Fed Chairman Jim Bullard) backed off against the Fed’s more aggressive rate hike expectations. In addition, Atlanta Fed President Raphael Bostic said on Friday that too dramatic moves could undermine the positive aspects of the economy. He also warned that it could increase uncertainty. Market analyst Haresh Menghani comments:

These developments continue to put pressure on the dollar. However, a number of factors keep bullish traders from making aggressive bets. It limits any meaningful upside movement of the gold price, at least for now.

The urge to take risks acts as a headwind for bullion

Global stock markets are witnessing a countertrend rise amid hopes that the Fed’s upcoming meeting will be less aggressive than previously feared. The urge to take risks triggered a new rise in US Treasury bond yields. This acts as a headwind for safe-haven gold. The analyst makes the following statement:

In fact, the benchmark 10-year US government bond yield rose above the 3.0% threshold. This helps limit deeper losses for the USD. It also contributes more to cap earnings for gold. Therefore, it would be prudent to wait for continued strong buying before confirming that spot prices have bottomed out.

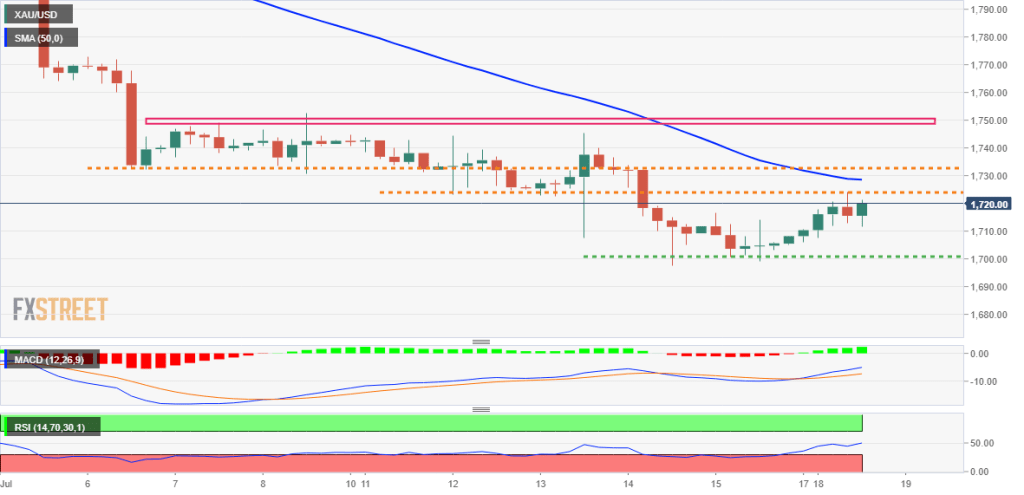

Gold price technical view

Here is how Haresh Menghani analyzes the technical outlook of the gold price. The gold price has repeatedly shown some resilience below the round figure mark of $1,700. However, the metal’s failure to gain any meaningful traction suggests that short-term risks remain to the downside. This suggests that beyond the $1,725-1,726 immediate resistance, any subsequent strength could face stiff resistance near the $1,734-1,735 horizontal zone. It’s possible that a sustained move above could trigger a short selling period. This is likely to push gold towards the $1,749-1,752 supply region.

On the other hand, last week’s low around the $1,698-1,697 area now seems to hold the immediate downside. A convincing break below will make the gold vulnerable. It will accelerate the fall to the September 2021 low, i.e. around the $1,787-1,786 region. Gold is likely to extend the downside to test near the 2021 lows area of $1,677-1,676.

“Money managers aggressively mitigated net long gold exposures”

Gold tested below $1,700 over the weekend. TD Securities economists expect the yellow metal to remain under pressure in the coming weeks. Economists make the following assessment:

It has become very clear that real interest rates at the short end of the curve will continue to rise. Also, there is little chance that nominal policy rates will go up. That’s why investors cut the net position by a very large 6% (3 million ounces) of open interest. With the pending economic collapse, inflation expectations also eroded. The Fed’s hikes continue and economic activity is less. Therefore, gold prices will remain under pressure in the coming weeks.

TDS: Gold poised to see additional downside

Gold suffered heavy losses and posted the lowest weekly close in nearly a year. Strategists at TD Securities expect the yellow metal to suffer further losses. In this context, they make the following predictions:

Gold prices have crossed the trend reversal threshold. This is a confirmation of a bear market trading regime in the yellow metal for now. Prices have since declined at various support levels, heading towards the $1,600 level. Fedspeak backed off against a 100 basis point gain from some key hawks. It increases the risk of a short-squeeze ahead of time. This will create the ideal layout for additional negativity.