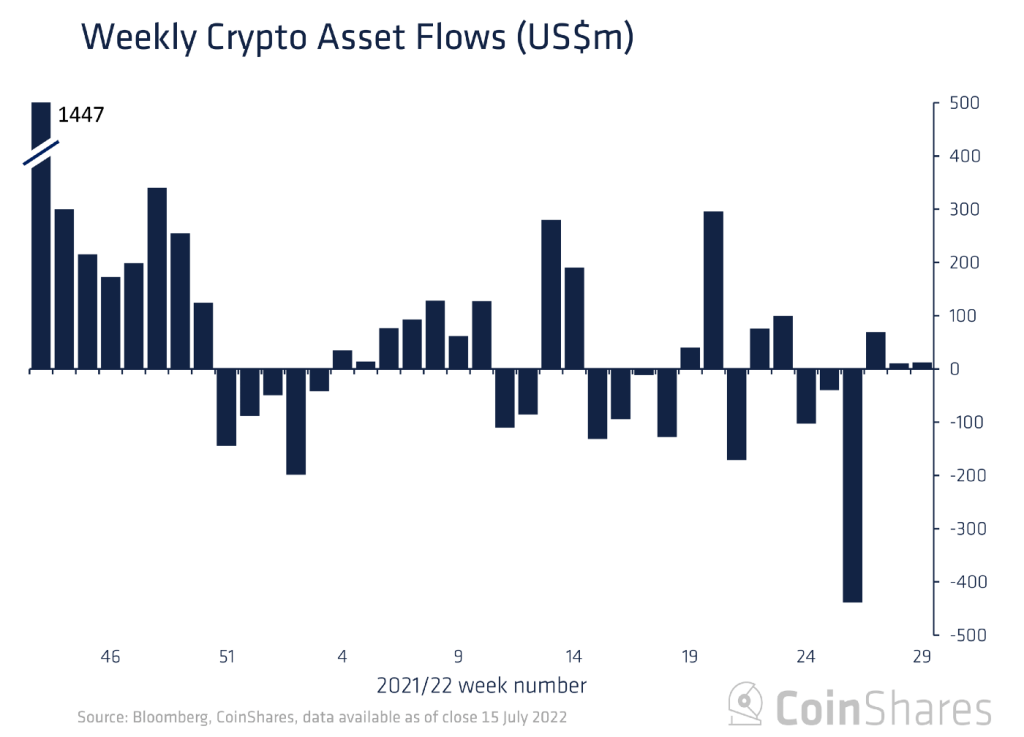

The crypto market continues to move on the green line. However, experts say the bear market is not over yet. CoinShares, a leading digital asset manager, has released its report on fund flows in digital asset products. According to CoinShares, as the cryptocurrency markets turn green, institutional investors are increasing their short Bitcoin positions.

Institutional investors load up on shorts for the leading cryptocurrency

cryptocoin.com As you follow, the leading cryptocurrency Bitcoin has performed well in the last week. At press time, BTC was trading at $23,300, gaining about 20% on a weekly basis.

In its latest Digital Asset Fund Flows Weekly report, CoinShares revealed that it saw $15 million in inflows in short BTC investment products last week. It also found that there are clear outflows in long Bitcoin investment products. On the subject, CoinShares shared the following data:

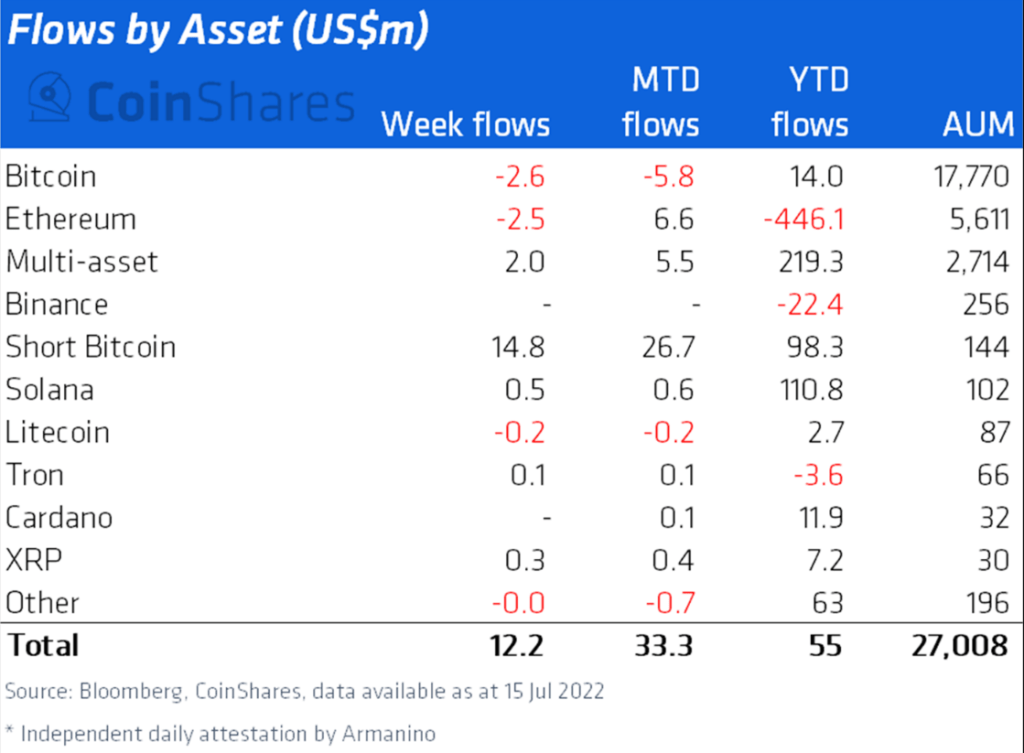

Digital asset investment products saw a total inflow of $12 million last week. However, $15 million of this is the entry into short (reverse price) investment products. Net outflows for Long investment products totaled $2.6 million.

CoinShares sees the rise in short BTC products as an indication that investors expect further declines in the cryptocurrency markets. However, he interprets it as a sign that they do not necessarily want to sell their long positions. Meanwhile, long Bitcoin investment vehicles saw an outflow of $ 2.6 last week. However, it has brought inflows to 14 million dollars since the beginning of the year.

Leading altcoin reverses entries, sees exit again

Ethereum (ETH) had the most spectacular performance among the top 10 cryptocurrencies of the market. ETH rallied around 49% on a weekly basis to $1,560.

On the other hand, after three weeks of inflows, Ethereum investment products have experienced minor exits over the past week. Litecoin (LTC) also saw small outflows last week. However, some altcoins saw small inflows throughout the week.

Cryptocurrencies withdrawing funds: SOL, XRP and ADA

Solana (SOL), Ripple (XRP) and Cardano (ADA) investment products received inflows of $0.5 million, $0.3 million and $0.1 million, respectively. Multi-asset products rose above the rest with $5.5 million in inflows. CoinShares made the following statement regarding the streams:

Multi-assets, a favorite of this bear market in terms of flows, saw inflows of up to $2 million. It has increased inflows to date to $219 million, well above all other assets.