Crypto lending platform Vauld owes $363 million to individual investors after halting withdrawals. Meanwhile, it is rumored that the firm is seeking a six-month extension for the legal moratorium. Vauld, who lost serious money in UST, opened a long position in BTC and three altcoin projects.

90% of BTC and altcoin loan platform debt to individual investors

cryptocoin.com As you follow on , Valud suddenly stopped withdrawals from its customers this month. According to the documents, Vauld owes $363 million to individual investors. The statement, presented by Vauld co-founder and CEO Darshan Bathija at the Singapore Supreme Court on July 8 and shared in an email with the firm’s clients on July 18, reveals that the crypto lender owes creditors a total of $402 million. $363 million (90%) of this total comes from deposits from retail investors.

The document outlines that Vauld owes a total of $125 million to its top 20 unsecured creditors. All but one unnamed ‘Party A’ appear to be individuals. He owes each of the three creditors more than $10 million. The largest owes $34 million. Unsecured creditors have one of the lowest priorities in a bankruptcy situation, ranking after secured and preferred creditors. In addition, they do not have collateral interests on any debtor assets.

There is a $70 million deficit in Valud assets

Singapore-based Vauld suspended customer withdrawals on July 4 as it struggled to avoid bankruptcy. The next day, London-based competitor Nexo began a process to potentially acquire Vauld by signing a terms document giving an exclusive 60-day discovery period to due diligence.

Apart from unsecured creditors, Vauld has two secured creditors. An unnamed ‘Counterparty 1’ and FTX Trading Ltd. Vauld’s assets are given at $287.7 million in the declaration, which consists of various cryptocurrencies including Bitcoin, Ethereum and XRP. But Bathija says Vauld’s total assets are actually worth about $330 million. Because she records that the affidavit does not include ‘bank balances’. That means Vauld has a deficit of about $70 million, which it announced earlier this month.

The firm opened a long position in Bitcoin and three altcoin projects

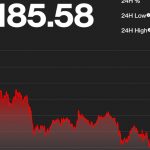

Vauld also detailed what caused the financial difficulties in his affidavit. The first factor was the collapse of the algorithmic stablecoin TerraUSD (UST). Vauld had invested approximately $28 million in the UST, according to the affidavit. This resulted in a sharp decline in the net asset position. Then, the broader crypto market downturn that followed the UST eruption resulted in further losses for Vauld. According to the sworn statement, the firm had “currently held long positions worth approximately $37 million in cryptocurrencies such as Bitcoin, Ethereum, MATIC, and XRP.”

The third driver was several borrowers who defaulted on their loans due to the market downturn. Fourth, Vauld had made several significant investments, including sponsorship deals totaling $6 million with Alfa Romeo and the English Premier League’s Crystal Palace Football Club. These were signed in September 2021 and March 2022, respectively, according to the statement. A final factor leading to Vauld’s financial difficulties is a software bug on its platform that caused a loss of approximately $4.5 million in August 2021.