The Securities and Exchange Commission (SEC) “probe” into whether Binance’s BNB token is a security might just be the commission asking questions, as Binance CEO Changpeng Zhao has claimed.

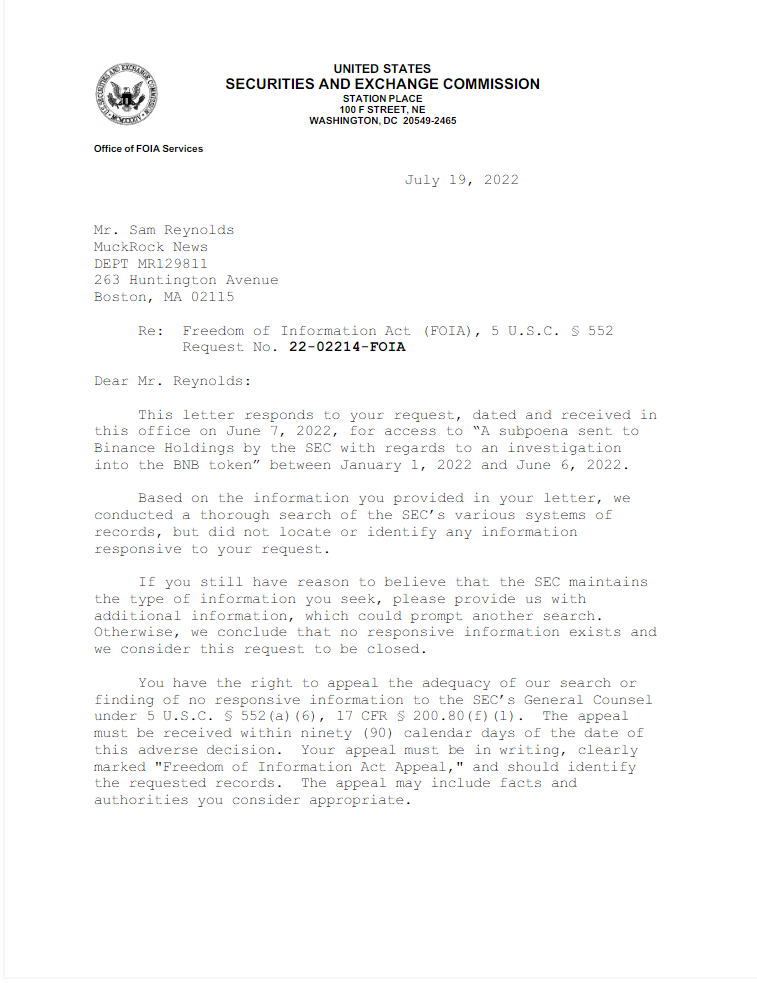

A Freedom of Information Act request sent by CoinDesk to the SEC about a “subpoena sent to Binance by the SEC with regards to an investigation into the BNB token” came back with no responsive documents.

“Based on the information you provided in your letter, we conducted a thorough search of the SEC’s various systems of records, but did not locate or identify any information responsive to your request,” an SEC FOIA officer wrote in the commission’s response to CoinDesk.

This suggests there was no legally binding subpoena that would compel the exchange to produce documents and make personnel available for questioning.

A response to a Freedom of Information request put forward to the SEC by CoinDesk (SEC)

Bloomberg reported in June that “investigators are examining if the 2017 initial coin offering [of BNB] amounted to the sale of a security that should have been registered with the agency.”

At CoinDesk’s Consensus 2022 event in June, Zhao said that Binance is in regular contact with authorities about its products and denied that the company had been subpoenaed.

Zhao has been a frequent critic of the media, sometimes equating reporting to playing a game of “telephone.” He has said publicly that he’d no longer give interviews to news outlets that use “clickbait titles.”

BNB is Binance’s exchange token, meaning holders get a discount on Binance’s trading fees, and the utility token behind the Binance (BNB) chain — which has a market cap of $471 million and is home to a variety of DeFi projects.

While BNB does not confer equity in Binance, its value fluctuates with the perceived success or failures of Binance on the market.

Would the SEC admit there’s a BNB investigation?

Should there be an active investigation into Binance, the SEC could withhold disclosing documents under Exemption 7, one of the exemptions available to it, which prohibits the release of documents compiled for law enforcement purposes that “could reasonably be expected to interfere with enforcement proceedings.”

But in order not to tip its hand to the presence of an investigation, the SEC will occasionally answer with a “can neither confirm nor deny” response.

After all, a response withholding documents due to the presence of an investigation could be materially damaging to a company even if the investigation came back empty-handed. Hence the need for a “neither confirm nor deny” policy to maintain the confidentiality of investigations.

Colloquially, this response is known as a “Glomar,” named after the Howard Hughes-owned ship the CIA contracted to hunt for a sunken Soviet submarine. Journalists at the Los Angeles Times didn’t buy the cover story, and pushed under the then-nascent Freedom of Information Act to get more details.

They were blocked with a “can neither confirm nor deny” response, not a specific national security exemption, and the American Civil Liberties Union (ACLU) sued alleging abuse of the Act.

Courts eventually sided with the CIA, and the term “Glomarization”