Gold prices seem to have made a short-term bottom at least. Many analysts are looking for a bounce to at least $1,750 as market sentiment has improved significantly. Meanwhile, the bulls dominate the weekly gold survey results.

“Gold and US dollar are also on the rise”

Emotion and speculative positions have dropped to their lowest levels recently. This is why many analysts say that gold has become an attractive anti-bullish game. At the same time, there are those who question the current strength of the US dollar, which saw its first weekly drop in four weeks.

Chris Vecchio, senior market strategist at DailyFX, notes that the Federal Reserve’s aggressive price action is now fully priced in. That’s why the US dollar is losing momentum, he says. He adds that an approaching global recession and a potential debt crisis in Europe could make the US dollar and gold rise together.

Chris Vecchio says that real interest rates may peak with the US dollar. He also says there are signs it could create another tailwind for the precious metal. In this context, the analyst makes the following statement:

A debt crisis in Europe is not a guarantee. But it lurks in the shadows. As long as there are concerns about the euro, there is room for gold. Gold and the US dollar are both in an uptrend.

Is it possible to change the trend of gold?

However, Vecchio adds that gold sees a limit in its strength with solid resistance around $1,760. He says that in the current environment, investors should prepare for higher volatility. The analyst makes the following assessment:

A complete collapse in real interest rates is required to change the current trend of gold. This is unlikely to happen.

What do the gold survey results show?

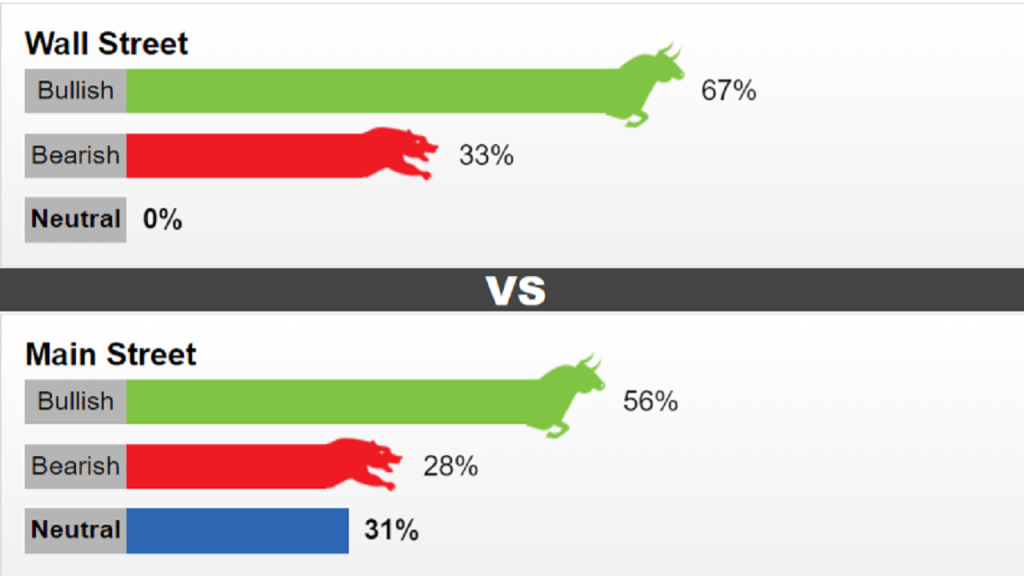

This week, 18 Wall Street analysts took part in Kitco’s gold survey. Among respondents, 12 analysts (67%) are optimistic about gold in the near term. At the same time, six analysts (33%) were bearish for gold. Also, there are no neutral votes this week.

Due to technical issues, respondents only voted 187 in online Main Street polls. Of these, 105 (56%) expect gold to rise next week. Another 52 (28%) voters predict it will be lower. Meanwhile, 16 voters (31%) remained neutral in the short term. The renewed bullish sentiment comes at a time when gold prices are trying to end their five-week losing streak.

“When this time comes, gold will rise above the weakness of the dollar”

For many analysts, the biggest factor driving gold prices remains the US dollar, driven by the Federal Reserve’s aggressive monetary policy action. However, some analysts point out that the slowing activity in the US economy may prompt the Fed to loosen its tightening stance.

cryptocoin.com As you follow, on Friday, preliminary data from S&P Global Market Intelligence showed that activity in the US manufacturing and services sectors fell to a two-year low. Also, the decline in activity reflected a similar weakness in Europe. Adam Button, chief currency strategist at Forexlive, said:

The market feels that the rate hike cycle will end sooner due to rapidly slowing growth. Friday’s US service PMI was shockingly soft. It means the Fed will stall around 3% and possibly cut it in 2023. When these cuts actually occur, gold will rise above the weakness of the dollar.

“Recognition of this situation will cause gold to explode”

Adrian Day, head of Asset Management, says inflation will remain persistently high despite the US central bank’s extraordinary rate hike. For this reason, he notes that inflation will keep real interest rates under pressure. Day explains these views as follows:

The market will realize that the Fed cannot raise rates enough to rein in inflation without causing a serious recession. It will also soon realize that what it has done so far has been insufficient to bring inflation down meaningfully. The Fed doesn’t even need to spin or pause. Just realizing that they will not achieve their goals will cause the gold to explode.

“There is a bearish trend in the technical picture of the yellow metal”

However, not all analysts are optimistic that gold’s fortunes have reversed and the US dollar has peaked. Some analysts say the dollar remains an important safe-haven asset in global financial markets. The rally may have stalled. But the dollar’s uptrend is still there. Equity Capital market analyst David Madden explains:

The dollar remains the strongest currency in the market. Gold is struggling with the resistance at $1,745. That’s why I’m thinking of selling rally.

On the other hand, senior technical analyst Jim Wyckoff says the technical picture is bearish, despite the cloudy fundamentals as well as gold bounce.