The price of gold fell to its lowest level in nearly a year at $1,680 on Wednesday. However, it managed to record a decisive recovery in the second half of the week. The yellow metal benefited from the sharp decline in US Treasury bond yields. With this opportunity, he ended a three-week losing streak. However, according to market analyst Eren Sengezer, gold may struggle to make a convincing move either way, due to the different effects.

Fed’s 100 basis point hike being shelved?

cryptocoin.com As you follow on , the dollar had a hard time finding demand at the beginning of the week. However, gold also failed to gain traction and fluctuated in a tight range above $1,700. Growing fears about China imposing additional coronavirus-related restrictions weighed on the demand outlook for gold. Meanwhile, data from the US showed Housing Starts fell 2% month-on-month in June. This lowered the possibility of a 100 basis point rate hike by the Fed in July.

In the absence of high levels of macroeconomic data on Tuesday, the gold price climbed above $1,700. On Wednesday, the downside shift in risk sentiment helped the dollar outperform its rivals. This forced gold to drop below $1,700.

Interest rate hike from ECB exceeded expectations, gold price rose

On Thursday, the ECB announced a 50 basis point rate hike. With the initial market reaction, the dollar came under heavy selling pressure. This situation reversed the course of gold. DXY wiped out most of its daily losses during ECB President Christine Lagarde’s press conference. However, gold retained its bullish momentum. Indicator The 5% decrease in the 10-year US Treasury bond yields ignited the rally of gold. Lagarde, meanwhile, stayed away from committing another 50 basis points increase in September.

US T-bond yields continued to decline on Friday. Gold managed to increase its gains on Thursday. The yellow metal broke above $1,730 for the first time in a week. Data from the US ahead of the weekend showed that business activity in the services sector contracted in early July. S&P revealed that its Global Services PMI fell to 47 from 52.7 in June. This data came much weaker than the market’s expectation of 52.6. This triggered another drop in US interest rates. This move allowed the gold bulls to take control of the price action.

What effect will the Fed’s choice have on the gold price?

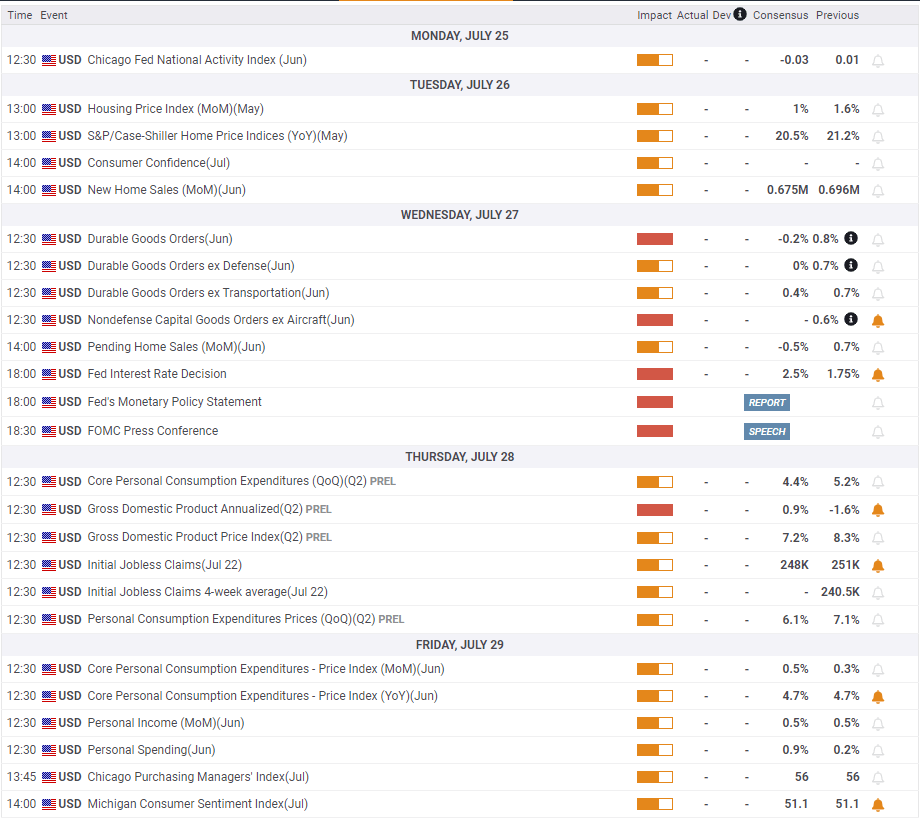

June New Home Sales and Conference Board’s Consumer Confidence Index data will appear in the US economic report on Tuesday. According to CME Group’s FedWatch Tool, markets are pricing a 100 basis point rate of increase with a 22% probability. Housing data is likely to see an unexpected increase in sales. But investors are unlikely to reconsider the FOMC’s upcoming rate decision, according to the analyst. The analyst makes the following assessment:

Disappointing late macroeconomic data and the University of Michigan’s modest decline in long-term inflation expectations have prompted investors to refrain from betting on a 100bps increase in July despite warm inflation data.

An increase of 100 basis points at this point could be a major hawk surprise. Therefore, it is possible to trigger a dollar rally. If the Fed chooses a 75 basis point increase as expected, market participants will look for new clues about the September hike and the location of the neutral rate. The dollar is likely to strengthen if the Fed commits to at least another 75 basis points increase in September, according to the analyst. Also, in this hawkish scenario, US Treasury bond yields are likely to gain traction and put more pressure on the gold price.

On the other hand, the dollar is likely to weaken against its rivals if the Fed acknowledges the increased risk of recession and voices its concerns over worsening conditions in the housing market. Moreover, the possibility of a 50 basis point increase in September can be seen as a dovish development. The analyst sees it as possible that this situation will open the door to a new rise for gold.

“It is possible that this situation will limit the rise of gold”

On Thursday, the U.S. Bureau of Economic Analysis will release its first forecast for second-quarter GDP growth. Markets expect the US economy to grow 0.9% after shrinking 1.6% in the first quarter. It’s hard to predict the market reaction following the Fed event. But better-than-expected data is likely to be positive for the dollar, according to the analyst. Of course, the opposite is also true. The analyst makes the following prediction on interest rates:

A significant 2.7% support for the 10-year US T-bill yield. If this level remains stable, it is possible for interest rates to recover and limit the rise of gold.

Finally, there is the Personal Consumption Spending and Personal Income data for June, and the Personal Consumption Expenditure (PCE) Price Index. Market participants will be watching this data closely before the weekend.

Gold price technical view and gold sentiment survey

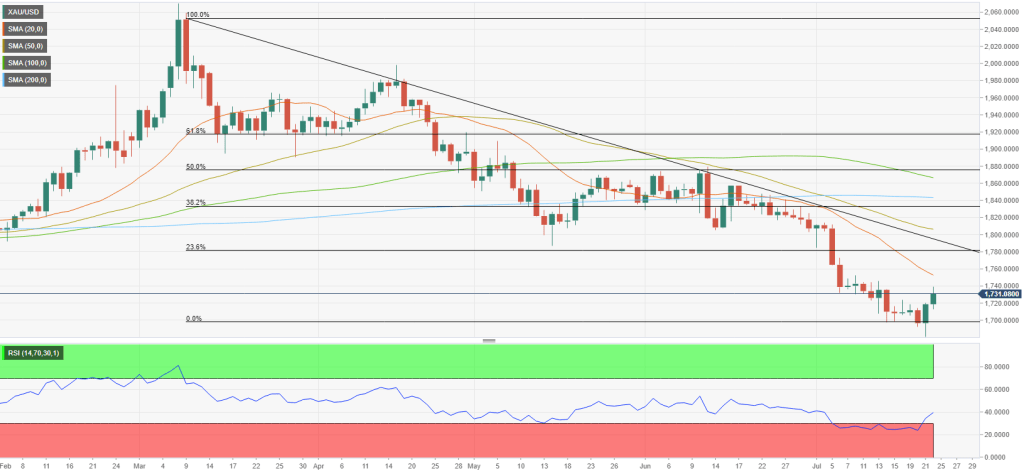

Market analyst Eren Sengezer analyzes the technical outlook of gold as follows. The Relative Strength Index (RSI) indicator on the daily chart broke above 30 for the first time in two weeks. This indicates that gold has finally corrected the oversold conditions. The technical recovery is likely to continue until the daily RSI reaches 50.

On the upside, $1,750 (20-day SMA) stands as initial resistance ahead of $1,780, where the 23.6% retracement of Fibonacci’s latest downtrend and descending trendline meet. A daily close above the second level is likely to be seen as a key bullish development and open the door for additional gains towards $1,800. On the downside, $1,700 (psychological level), $1,680 (July 21 low, static from March 2021) and $1,670 (static from May 2020) form key support.

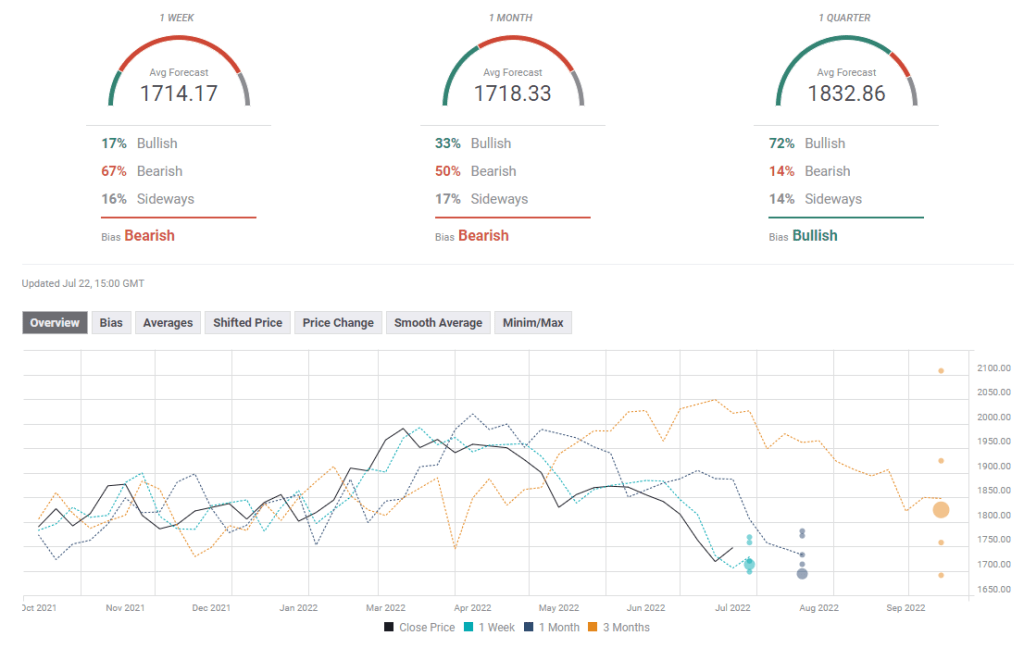

Despite this week’s recovery, the short-term outlook for gold remains bearish, according to the FXStreet Forecast Survey. Similarly, half of the experts surveyed expect the price of gold to continue to decline next month.