Gold underperformed largely in the first half of the year due to the Federal Reserve’s aggressive rate hikes. That’s why MKS PAMP says gold is undervalued as we enter the second half of 2022. Market analyst Christopher Lewis notes that gold markets are directly skyrocketing as US GDP figures are shabby. Market analyst Pablo Piovano thinks there is room for more gains in the near term.

Reasons for severe seasonal underperformance in gold price

Yellow metal has defied seasonal patterns so far this year. Gold trade is down 4.3% to date. Nicky Shiels, head of metal strategy at MKS PAMP, comments:

The severe seasonal underperformance in gold was due to fears of the recession curbing demand and the quarantine of China. Also, fears of the Fed leading to a stronger US dollar and higher real US interest rates outweighed inflation/war risk.

Historical trends point to precious metals as traditional winners until Labor Day. And as we enter that era, gold seems to be priced low. However, it’s possible that a few triggers are helping precious metals turn things around. This includes the slowdown in the Fed’s rate hikes.

“We are now getting closer to where we need to be in terms of interest”

It is possible for gold to start pricing in a Fed pivot, according to the strategist. Especially after Fed Chairman Jerome Powell said the US central bank may soon be ready to slow its tightening. cryptocoin.com As you follow in , Powell said on Wednesday that US monetary policy is now neutral after a second straight 75 basis point gain. He also noted that this means that the Fed may soon begin to slow the pace of rate hikes. Nicky Shiels has this to say on the subject:

Now that we are neutral, it will be appropriate to slow down at some point as the process continues. And we haven’t made a decision about when that point is. However, intuitively this makes sense. We loaded these huge interest rate hikes from the front end. Now we are getting closer to where we need to be.

What does it take for a bigger tactical leap in the gold price?

The peak falconry is already behind the market, according to Nicky Shiels. But he says gold has not yet priced it in. Now, the outlook may be changing as rising recession risks and falling commodity prices point to deflationary forces. In this context, Nicky Shiels says:

It just takes a few things to come together for a bigger tactical leap. If your financial leverage decreases. If the US dollar turns convincingly. Structurally, the decision on whether to revisit above $2,000 remains unclear. Because if the recession is moderate and inflation is brisk, there is much less fiscal and monetary space to launch another war-like QE/stimulus program.

Gold market technical analysis

Market analyst Christopher Lewis illustrates the technical outlook for gold as follows. Gold markets rose significantly to kick off the trading session on Thursday with the release of US GDP figures. They were miserable. So they will definitely continue to play in the minds of traders. Note that the market will continue to pay close attention to the idea of the Fed and what it will do.

Traders jumped on the idea that the Federal Reserve couldn’t raise interest rates in a slowing economy. But frankly, that’s exactly what they’ve been telling you they’re going to do for a while. So I think we have a good rally ahead of us. However, it is short lived.

Be very careful with the US dollar! Because it will have an impact on where we go next. If the US dollar continues to strengthen, this will eventually weigh what happens to gold. Markets will likely not be very volatile. Even if we see a complete change in the attitude of gold, we still have a long way to go before it really explodes.

Yes, we bounced above the original barrier of $1,750 and hit the top of an inverted hammer. So I think we have a nice leap forward. But the real battle will likely be closer to $1,800. Expect a lot of fluctuating volatility. Therefore, I think you have plenty of time to participate in this market.

Pablo Piovano: Room for more gains in the near term

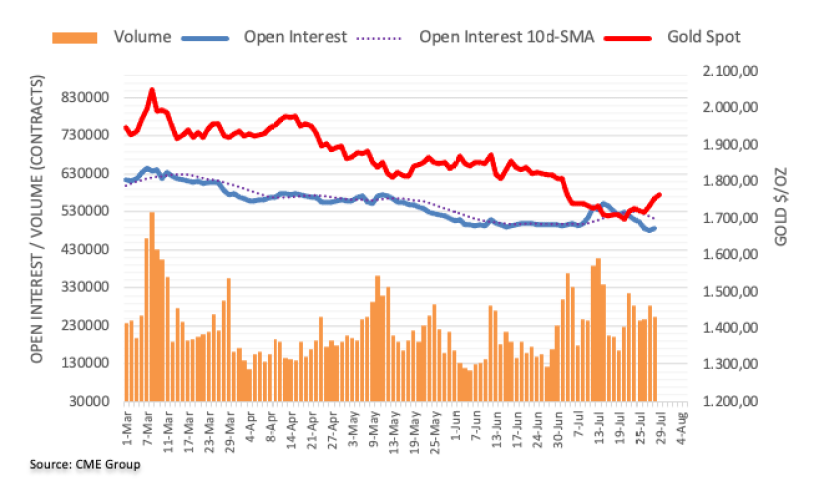

Open interest in gold futures markets rose nearly 4,000 contracts on Thursday after five consecutive days of pullbacks, according to preliminary data from CME Group. Instead, volume reversed the two-day structure and dropped nearly 29.2k contracts.

According to market analyst Pablo Piovano, gold prices continued to recover amid higher open interest rates on Thursday. The analyst says that this also opens the door to the continuation of the rise in the very near term. However, his next target is emerging as the key $1,800 mark.