Uniswap price risks a 50% drop from its current levels due to a bearish reversal setup. However, crypto analyst Luke Martin points out that with the upcoming Ethereum Merge upgrade, 7 altcoin projects are on the rise, including UNI.

This altcoin is up 80% in a month

Uniswap (UNI) rallied about 80% in July. Therefore, it looks like it’s ready to release its best monthly performance in over a year. But on the short-term chart, signs of a long-term pullback are emerging. The altcoin’s price is having one of its best months ever. The altcoin was trading at around $5 earlier this month. On July 30, it reached up to $ 9 . Thus, it achieved the best return since the 250% price rally in January 2021.

Why is Uniswap rising?

Uniswap’s gains were primarily driven by similar upward moves in the broader crypto market. However, the main reason for its rise was related to the Ethereum Merge upgrade. cryptocoin.com As we reported, Uniswap and the Ethereum network are interconnected. The Ethereum network will transition from Proof-of-Work to Proof-of-Stake with the Merge upgrade in September. Investor sentiment on this issue seems to have caused hysterical hype in UNI purchases. Additionally, the proposal for a “wage shift” may have led to UNI earnings. Uniswap’s DAO is discussing entitlement to UNI holders to earn 0.5% commission from 3% transaction fees on DEX. If this happens, the remaining transaction fee income will be given as a reward entitlement to liquidity providers.

UNI price preparing for collapse

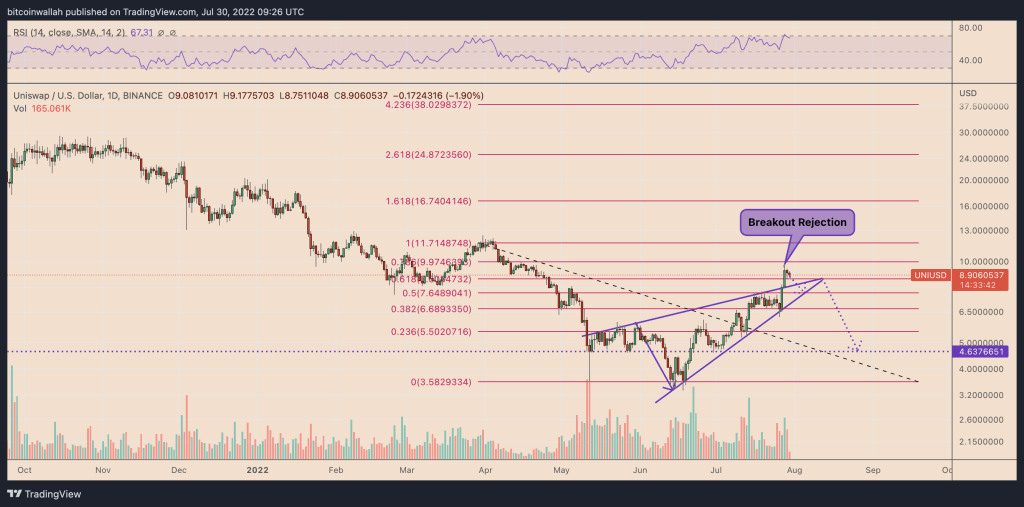

From a technical perspective, UNI is now falling further after testing $20 as its temporary resistance. It is now experiencing a broad pullback towards the upper trendline of the dominant “ascending wedge” pattern. The mentioned upper resistance line is located at around $8. However, the altcoin could return to the trading range of the pattern defined by the two converging trendlines. If this happens, the price will risk falling further.

This is mainly because rising wedges are bearish reversal patterns. They unravel after the price drops below the lower trend lines. Profit targets meanwhile, when measured from the breakout point, typically equal the maximum distance between the upper and lower trendlines. In summary, if the pattern continues, the UNI price will decrease by 50% from today’s price. So it will reach $4.50 by September. However, it is also possible to test the upper trendline of the ascending wedge or to experience a rebound before it. If this happens, it will cause UNI to retest $10 as intermediate resistance. So, the price will see a long upward move towards the $11.50 to $17 range.

“These 7 altcoins are rallying because of Ethereum”

Uniswap price is likely to be linked to the Ethereum Merge upgrade. However, UNI is not the only altcoin experiencing a price increase because of this. Crypto analyst Luke Martin points out 6 altcoin projects with UNI. He suggests that these cryptocurrencies are on the rise with the hype of Ethereum:

“ETH continues to rise, bringing the entire ecosystem with it. The best DeFi altcoins it has come after are LDO, UNI, BIT and AAVE. The best layer-2 solutions are Optimism (OP) and Polygon (MATIC). However, the biggest pump has emerged in the Ethereum Classic (ETC) project.”