The leading altcoin is preparing to switch to PoS in the third week of September with Ethereum Merge. But most of the promised scalability features will only be available after 2023. So how will Ethereum Merge affect the ecosystem and the market?

Ethereum Merge: Stage 0

The Ethereum Blockchain is on the verge of one of the most important technical updates since its inception. It is moving from Proof-of-Work (PoW) to Proof-of-Stake (PoS), also called Ethereum 2.0. Ethereum developers have set September 19 as the permanent date for merging the existing PoW Blockchain into the PoS Blockchain.

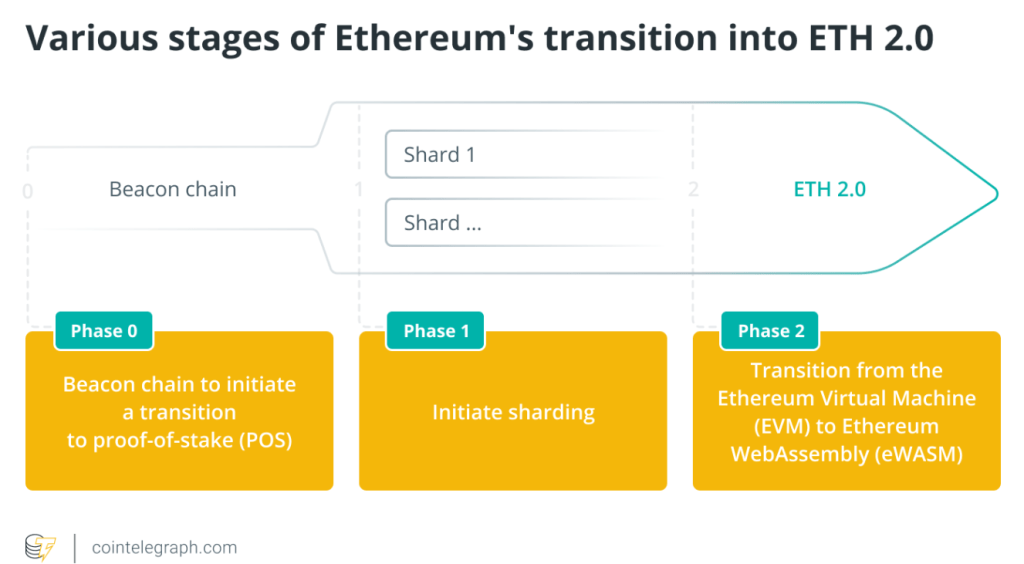

Merge is expected to be deployed on the Goerli test-net in the second week of August. After successful integration of Goerli test-net, Blockchain will launch Bellatrix update in early August. In two weeks, Ethereum Merge will be available. The discussion around the transition started with a focus on scalability. For this reason, Ethereum developers proposed a three-step conversion process. The transition itself began with the launch of Beacon Chain on December 1, 2020. It started Phase 0 of the three-step process.

Beacon Chain initiated the transition to PoS, which allows users to stake their Ether (ETH) and become validators. However, Phase 0 did not affect the main Ethereum Blockchain. Beacon Chain exists alongside Ethereum’s main-net. However, both Beacon Chain and main-net will eventually be linked to Ethereum Merge.

Ethereum Merge: Phases 1 and 2

Phase 1 was supposed to start in mid-2021. However, it was delayed to early 2022 with developers citing unfinished work and code auditing as the main reasons. Starting from Phase 1, Ethereum 2.0 will host the entire transaction history of Ethereum and support smart contracts in the PoS network. As Eth2 mining will be removed from the network, bookies and validators will officially take action.

Phase 2, the final phase of the transition, will see the introduction of the Ethereum WebAssembly, or eWASM, over the existing Ethereum Virtual Machine (EVM). WebAssembly was created by the World Wide Web Consortium. It was designed to make Ethereum much more efficient than it currently is. Ethereum WebAssembly is a proposed subset of WebAssembly for the Ethereum smart contract execution layer. eWASM has been specifically designed to replace the EVM, which will see implementation in Phase 2.

Marius Ciubotariu, co-founder of Hubble Protocol, a decentralized finance (DeFi) lending platform, says he doesn’t really worry about delays as any new technology with such big impacts on the ecosystem will take time:

PoS is not yet live. However, I don’t see this as a concern. I understand that Merge is taking longer than some expect. However, with new technology and opportunities for critical problems, a non-hurried approach is best. As this Merge goes live, I’m sure more protocols will emerge.

How will Ethereum Merge affect ETH price?

The upcoming Merge will see the existing PoW main-net merge with the Beacon Chain. It will also transfer all Ethereum history to the new Chain. A complete consensus shift for an ecosystem as large as Ethereum would have a dramatic impact, both technically and politically. Barney Chambers, co-founder and co-lead developer of the cross-chian DeFi platform Umbria Network, says Merge will be challenging:

Ethereum accumulation will be centralized in the hands of validators who already own most of the tokens. The Ethereum Foundation argues that Merge will not affect the Ethereum price. However, he notes that Merge will cause a fundamental change in the way new tokens are distributed. He claims that this will have a dramatic impact on the price of both Ethereum and the entire cryptocurrency ecosystem.

The PoW mining difficulty level will skyrocket due to the difficulty bomb. It will be unable to do mining at economically appropriate scales. The difficulty bomb is a code built into the Ethereum protocol since 2015. It is set to execute when a certain number of blocks are mined and added to the Blockchain. It significantly complicates mining activity on the current PoW Blockchain.

As a result, Ethereum’s PoW Blockchain will have to stop generating blocks. Because difficulty bombs will make mining a block almost impossible. This situation is described as “Ice Age” by its developers. The simple purpose of the bomb is to encourage miners to merge completely. This, in turn, will increase the adoption of PoS Blockchain.

Network congestion made PoS mandatory

Migration to a new PoS network for Ethereum has become necessary given its expanding ecosystem, which has led to several network congestions and very high gas fees. However, over the past year the narrative has also changed towards PoS being more environmentally friendly than PoW. Some praise Eth2 for paving the way for a more environmentally friendly protocol. However, Patricia Trompeter, CEO of carbon neutral crypto mining company Sphere3D, has other thoughts. Trumpet says:

Marketing plans such as “Band-Aid solutions” and the “Change The Code” campaign do not offer any solution to a complete industry shift towards renewables. Therefore, PoS only leads to unnecessary expenditure and mis-allocated energy resources.

Patricia notes that PoS rather distributes crypto’s decentralized infrastructure. She also believes she’s ‘pushing power towards the wealthiest owners with impeccable control over users’.

After the merge, ETH issuance will drop to around 0.6 million per year. A similar 2.7 million ETH will be burned. So a net 2.1 million ETH will be burned per year, or -7% of the annual ETH supply, making it a deflationary asset. ETH miners will be officially out of business when the difficulty bomb hits, forced to mine other PoW coins with the same hash algorithm for their existing equipment, or exit the market altogether.

“Merge will scale the network and reduce energy consumption”

Ethereum co-founder Vitalik Buterin predicts that the transition will not only help the network scale, but also reduce energy consumption by 95%. Transaction processing speed is expected to be on par with central payment processors. But none of these features will come with Ethereum Merge on September 19.

The main scalability solution called Sharding, which allows parallel transaction processing, will arrive only after the completion of Phase 2, which is expected to take place in the second half of 2023. Daniel Dizon, co-founder and CEO of Swell Network’s unattended and liquid ETH staking protocol, says:

Merge represents a significant change in the underlying economic model and hardware requirements of Ethereum. This results in a large reduction in energy output. Rewards from participation in ETH staking will increase significantly from priority fees and MEV capture. Therefore, significant demand for ETH is expected. Ethereum Merge is not exactly priced. Increasing demand and decreasing issuance for ETH will put structural upward pressure on the price compared to the current Ethereum situation today.

Does Merge make Ethereum a security?

Aside from the technical and financial impact of the consolidation, the biggest debate seems to be whether Ether qualifies as security once the network moves to PoS. The debate has gained a lot of momentum on social media in recent days. The answer to the question depends on who you ask. Discussions about Ethereum’s securities status were common long before the transition to PoS arose. cryptocoin.comAs you follow, the debate gained momentum after the US Securities and Exchange Commission (SEC) sued Ripple by considering the sale of XRP tokens as a security.

Since then, many XRP proponents have pointed to the “pre-mine” state of ETH. He often accused the SEC of giving a free switch to Ethereum. The confusion and dilemma regarding the security situation stems from the lack of clear regulations for the crypto market. Lawmakers agree that Bitcoin (BTC) can be considered an independent asset class. On the other hand, the status of Ethereum is a matter of debate. Adam Levitin, a research professor at the Georgetown University Law Center, explains what could make the PoS-based Ethereum network a security in the eyes of regulators.

I've gotten some pushback here, so let me elaborate. "Security" includes an "investment contract." "Investment contract" is defined by SCOTUS in Howey as a K for investment in a common enterprise where profits are expected "solely from the efforts" of a third party. 2/

— Adam Levitin (@AdamLevitin) July 24, 2022

Adam Levitin, “Howey talks about a ‘money’ investment. But this has always been interpreted as just a value investment. Putting a stake easily satisfies that element,” he says.

Coin Metrics co-founder Jacob Franek disagrees with Levitin’s argument. He suggests that Ethereum is one of the most decentralized platforms with open source support.

2/ 1️⃣ Let’s start with the odd fetish of some to retroactively label ETH, a 7-year-old asset, a security.

– What is the practical reason for this?

– Who is the issuer of the security?

– What remedy can the SEC pursue? Rescission?

– Do ETH purchasers want their $5/ETH back?— Jacob Franek (@panekkkk) July 24, 2022

Another concern: Centralization

Another major concern with the PoS transition has been centralization in the decision-making process. Konstantin Boyko-Romanovsky, CEO of reward tracking and block transactions verification platform Allnodes, said:

There is a risk of centralization with Ethereum’s new consensus mechanism, PoS. However, this is far from happening. So far, the strong community behind the Ethereum network has overcome every challenge. There is no reason to assume that the problem of centralization will not be resolved either.

The Ethereum Blockchain has become the backbone of DeFi, NFT and DAOs. The ecosystem will continue to support such emerging use cases. However, the real transition to aPoS with sharding and high scalability features will only be possible after 2023. Eth2’s success largely depends on the execution of the final stage. But many market experts are still skeptical about it, given the past delays.