The crypto market has received news of many lawsuits recently. These include popular blockchain Solana, hedge fund 3AC, and debt platform Celsius. The 5 separate courts listed below have the potential to affect the entire market, depending on their results. In particular, 20 altcoin projects are expected to be affected much more intensely.

Three Arrows Capital (3AC) lawsuit: 20 altcoins Affected

Singapore-based crypto hedge fund 3AC has managed around $18 billion in crypto assets. He has also invested in various altcoin projects, including ETH and SOL. However, the company has suffered terrible losses in the last period. This was because he had a prominent position in the LUNA when the Terra network went down. 3AC’s investments in Terra were worth roughly $560 million at its peak. A leaked court document filed with the Singapore Supreme Court reveals that 3AC is owed over $3 billion. It also states that its biggest creditor is Genesis, with a $2.3 billion loan.

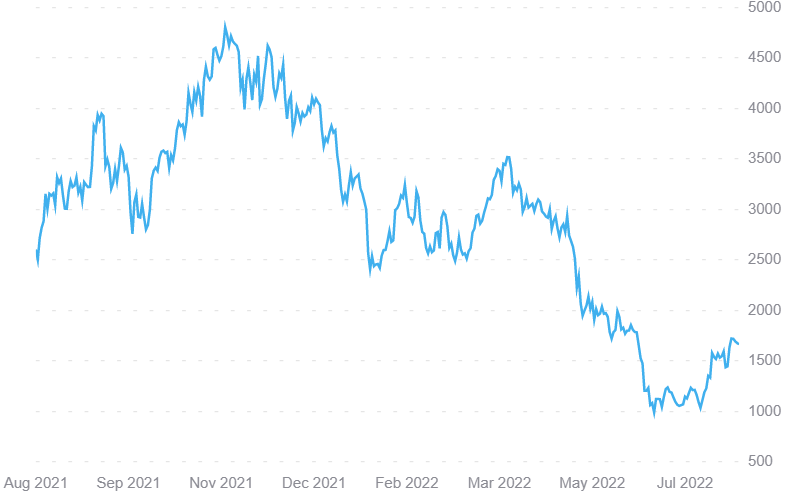

ETH price

ETH priceAs the bankruptcy was only reported in mid-June, creditors were late to realize that 3AC was collapsing. Co-founder Zhu Su has made luxury purchases, including a yacht and property, possibly used to mark 3AC’s creditworthiness. He also used borrowed money to buy them. The founding partners went to MIA. But recently they broke their silence by saying that they will move 3AC to Dubai to see if the firm has a future. 3AC’s default on debts had a knock-on effect on both Celsius Network and Voyager Digital. If the 3AC case ends negatively, most altcoins will suffer negatively. Altcoins expected to be affected are:

- Polkadot (DOT)

- Uniswap (UNI)

- AAVE (AAVE)

- Compound (COMP)

- Synthetix Network (SNX)

- yearn.finance (YFI)

- Balancer (BAL)

- WOO Network (WOO)

- Hxro (HXRO)

- Perpetual Protocol (PERP)

- DODO (DODO)

- KeeperDAO (ROOK)

- mStable Governance Token (MTA)

- dHEDGE (DHT)

- Kyber Network (KNC)

- Near Protocol (NEAR)

- Avalanche (AVAX)

- Ethereum (ETH)

Popular altcoin Solana faces lawsuit

A SOL investor in California has sued Solana’s team and its venture capitalist backer, Multicoin Capital. The case concerned the illegal advertising of ‘enormous profits’ in the sale of tokens to retail investors. Accordingly, the lawsuit alleges that SOL sales are “sales of unregistered securities under controlling federal law.” It also says that as of April 2020, defendants spent “large sums of money promoting SOL securities across the United States.” Plaintiff further argues that selling SOL violates the rules regarding registered securities. Rosen Law Firm is urging SOL token buyers to join the class action between March 24, 2020 and now.

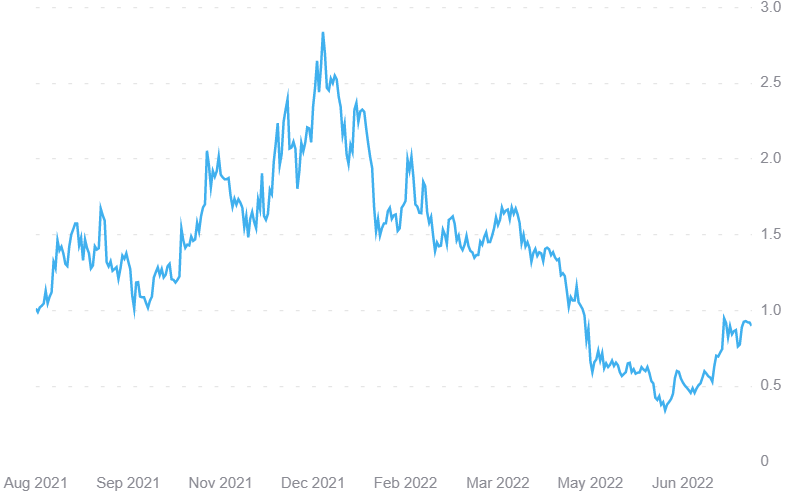

LEFT price

LEFT priceLBRY-SEC lawsuit

The blockchain start-up is at the center of a dispute with the US Securities and Exchange Commission (SEC) over its native token LBC. US regulators argued that the offering of the LBC represented the sale of unregistered securities. According to CEO Jeremy Kauffman, the SEC is implying that anyone selling altcoin assets like ETH, ADA, and MATIC in the US is breaking the law. Accordingly, the SEC-LBRY lawsuit has the potential to set a precedent for the potential future. As such, it is likely to have major implications for the industry.

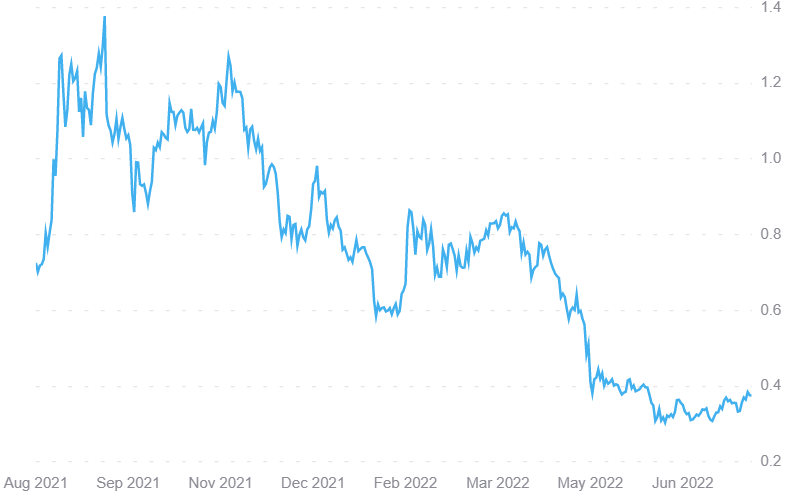

MATIC price

MATIC priceRipple-SEC lawsuit

In 2020, the SEC sued Brad Garlinghouse and Christian Larsen, directors of Ripple Labs. The issue centered on allegations that the company had raised more than $1.3 billion “through an unregistered, ongoing digital asset security offering.” Court Judge Analisa Torres ruled that the SEC plausibly argued that the XRP digital currency constituted an unregistered sale of securities. Accordingly, the SEC-XRP case is a big event and could affect altcoin prices.

XRP price

XRP priceCelsius Network

Celsius’ consulting partner Kirkland & Ellis entered a recent court filing. Accordingly, Celsius has a $1.2 billion gap on its balance sheet. In fact, the crypto debt platform filed for voluntary bankruptcy in the US, citing ‘extreme’ market conditions. Thus, it was unable to use the assets of its 1.7 million customers. As a result, the network’s altcoin asset CEL has seen a series of wild price swings as investor confidence wanes.

CEL price

CEL priceAccording to a statement, Celsius wants to allow the company to make a smooth transition to bankruptcy. To this end, he made a series of well-known moves to the court. Also, he has $167 million in cash on hand. The CEO of the company, Alex Mashinsky, made a statement. In a statement, he said his decision to file for bankruptcy would stabilize Celsius’s business. He also stated that this will protect his customers.