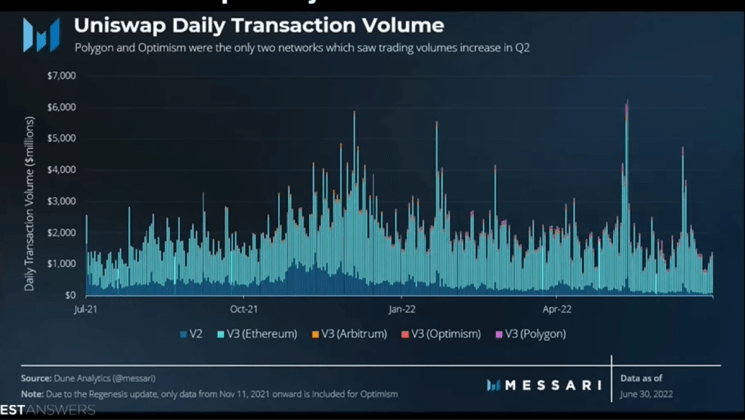

Centralized exchanges and DEXs continue to compete during bull and bear periods. Decentralized exchanges like dYdX1 and Uniswap have the largest volumes. A popular crypto analyst is comparing a DeFi altcoin project of his choice between these two competing categories.

Analyst shared his selection from the DeFi altcoin market

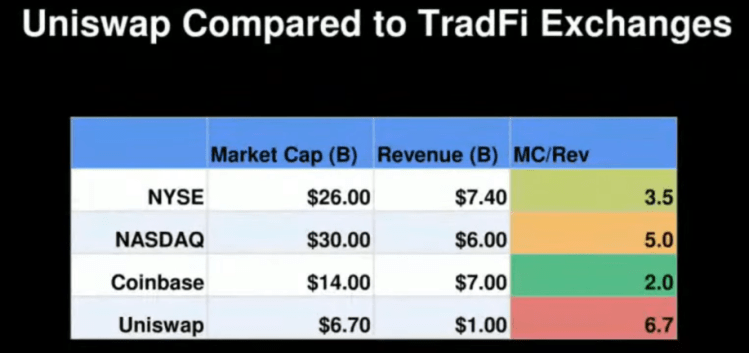

A prominent crypto analyst is trying to determine the real-world value of the DEX market by comparing it to traditional finance (TradFi). Analyst for Youtube channel InvestAnswers looks at how DeFi platform Uniswap (UNI) stands up against two well-known exchanges or Coinbase. The analyst describes what he did as follows:

Uniswap vs TradFi DEX. This is how I do most of my valuations. What would it be worth in the real world, I ask? I opened Uniswap, Coinbase, New York Stock Exchange (NYSE), and Nasdaq. I calculated market capitalizations and revenues, divided the two and got various ratios.

According to the analyst, Uniswap is almost twice as expensive as the NYSE by this criterion. It also has a market cap of $6.7 billion, compared to $1 billion in revenue. Coinbase currently has a 2:1 market capitalization to revenue ratio. However, the analyst says that despite this, the largest stock market in the USA may face difficulties in 2023. According to the InvestAnswers server:

Uniswap at 6.7 is the most expensive using this very rough metric. Coinbase is actually the cheapest. Things like the NYSE and the Nasdaq are actually very profitable. In the coming year, Coinbase may experience problems with sales growth and profitability. In addition to all the other negative press and news he receives, he is criticized for this reason.

Analyst shares why he expects 4x from UNI

The InvestAnswers host says that DEXs have generally performed well in recent bad markets. The analyst claims that Uniswap could potentially quadruple, although it doesn’t shine in the DeFi market:

Given the popularity and expansion of DEXs, as well as how they have endured and thrived over this bear market winter, I believe the future of Uniswap is pretty promising…. I think DEXs will have a great future.

The analyst interprets the current levels in the UNI price as a bottom. He shares his 4x targets for the upcoming periods due to the current momentum:

UNI is down 54% from its 12-month high and 81% from ATH. Can Uniswap do 4x after this point? Yes, it could be, I say.

Finally, Uniswap is a DEX platform that provides automated DeFi transactions. The project originated as a plan to introduce AMMs on Ethereum to a wider audience. UNI, the local cryptocurrency of the exchange, is the 15th largest cryptocurrency in the market. cryptocoin.comAs you follow, it is trading at $9.11 with 8.19% in 24 hours.