Gold market sees third week gains. However, prices cannot go above $1,800 an ounce, according to a gold survey. That’s why the sensitivity changes again. In the most recent gold survey, some market analysts said Friday’s record-breaking jobs report has given gold a headwind, at least in the short term. Here are the results of the survey…

What were the factors affecting the market this week?

Ahead of the latest survey results, the U.S. Bureau of Labor Statistics said 528,000 jobs were created in July. The data significantly exceeded economists’ expectations of around 250,000. cryptocoin.com As we have reported, there was also a solid increase in wages. Some analysts continue to see more upside potential. On the other hand, many of them are more neutral and bearish. Individual investors continue to rise solidly on gold. Forexlive.com chief currency strategist Adam Button used the following statements in his statements on the subject:

The gold market has given us an idea of what a Fed breakout will look like. But the real break is not here yet. Lower prices may come in the near term. Next week’s CPI data is a big risk for gold and pretty much everything else.

Results of gold survey: Majority in decline

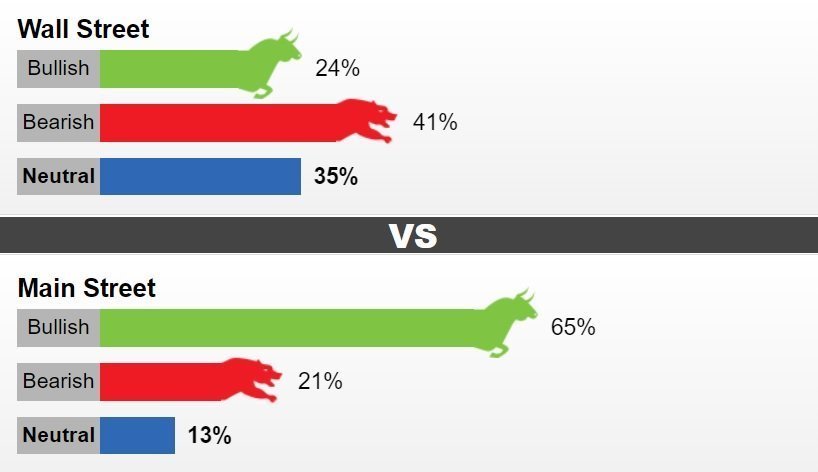

This week, 16 Wall Street analysts took part in the Kitco News gold survey. Among the participants, four analysts, i.e. 24, were bullish on gold in the short term. At the same time, seven analysts, namely 41, were bearish for gold. Six analysts, or 35 percent, voted neutral this week. Meanwhile, 579 votes were cast in online Main Street polls. Of these, 379, or 65 percent, predicted that gold would rise next week. Another 124 people, that is, 21 percent of the voters, declared their lower expectations. Finally, 76 voters, or 13 percent, remained neutral in the short term.

The shift in Wall Street sentiment comes as gold prices drop from a three-week high, ending the week in roughly neutral territory. December gold futures traded at $1,789.10 an ounce, up less than 0.5 percent from the most recent Friday. Analysts said the July jobs report alone changed market sentiment as investors now expect the Fed to continue its aggressive monetary policy stance in September. Marc Chandler, director at Bannockburn Global Forex, used the following statements:

US jobs data means the Fed is more likely to raise another 75 [basis points] next month. The gold light is fading. A break below $1,750 could result in $1,725. However, it is a reasonable possibility that it will see $ 1700.

Every analyst points to the Fed’s decisions

The CME FedWatch Tool shows that markets now see more than a 70 percent chance of a 75 basis point move next month. Prior to the employment report, markets were pricing in a 34 percent chance of an aggressive move. Adrian Day, head of Asset Management, thinks the latest employment data will make gold investors much more cautious. That’s why he said he’s neutral on gold next week. However, he added that it continues to rise in the long run.

Frank McGee of Alliance Financial said the precious metal “couldn’t fight the Fed.” Therefore, he said that in the short-term, gold is in a bearish trend. However, some analysts remain bullish on the precious metal, noting that prices are still holding support. Jim Wyckoff said the market still has some technical bullish momentum that could push prices up next week.