According to crypto analyst Akash Girimath, Solana (SOL) faces a choice that could either push it to the highs seen in early May or push it into tedious horizontal consolidation. The analyst says the LUNA is showing signs of a healthy pullback after a horrendous increase in buying pressure triggered a rapid rise. Also, according to the analyst, the continued pullback will give investors another chance to rally. We have compiled Akash Girimath’s analysis of SOL and LUNA for our readers.

“Solana, at a crossroads”

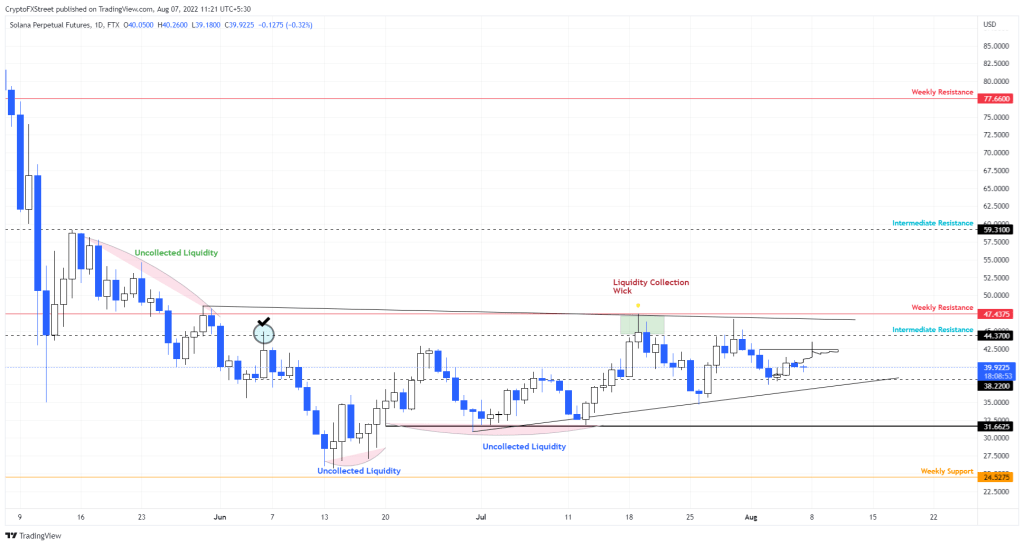

Solana has been making higher lows since the low of $25.71 on June 15. cryptocoin.com Since this local bottom, SOL has rallied 84% at one point, producing four highs. Currently, SOL is trading at $39. There are uncollectible stop-loss liquidity pools available below $31.66. Also, oscillating lows around $26 were formed during the bottom formation in June 2022. From the market makers’ perspective, these levels are likely to be swept away. That’s what will trigger a run when it happens.

Likewise, similar liquidity pools exist at $47.43 and above. Therefore, if investors are looking to buy the Solana price dips, the best levels would be $31 to $25. Assuming sales stops are swept first, potential returns will range from 40% to 90%. So, SOL will reach $45 to $60 levels.

The upward narrative looks appealing. However, investors need to understand that the directional bias of the cryptocurrency market is in shambles. Solana (SOL) is likely to move to collect the liquidity available above at $47. In this case, the absence of an upside target may cause the SOL to consolidate for a long time. However, Solana is likely to produce a lower low below the $24.52 support level. This will create an obstacle and invalidate the ascension thesis for the SOL.

“LUNA price ready for more profit”

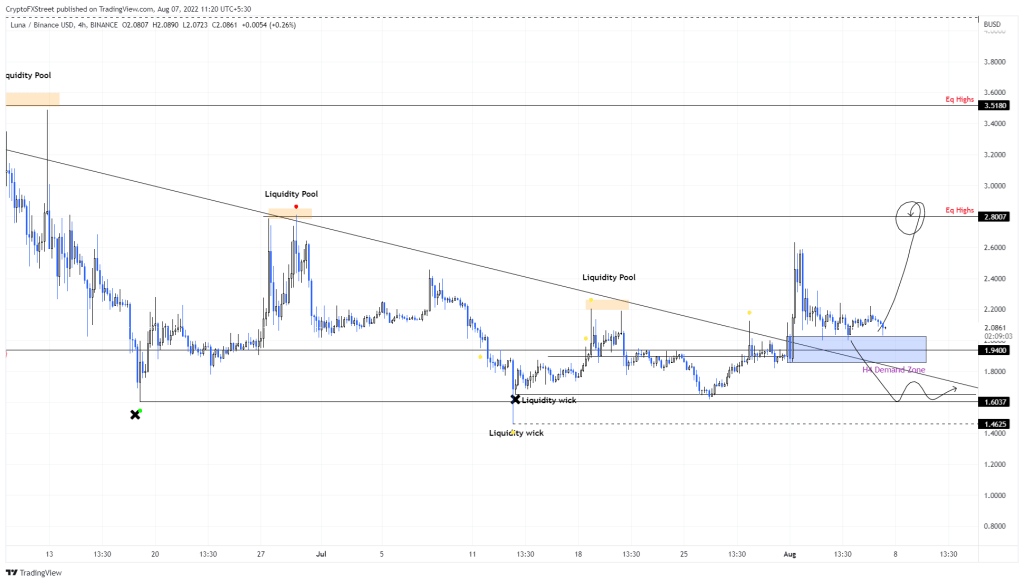

LUNA triggered a 41% rise on August 1. Thus, it broke through the two-month decreasing resistance level. This move also rallied buy-stop liquidity standing above the equal highs of $2.19. While this rally has served its purpose, it is now undergoing a correction that will provide another opportunity for buyers. In fact, LUNA retested the $1.85 to $2.08 demand zone twice. Therefore, an uptrend is likely soon.

Assuming that buying pressure is rising again, this time LUNA is likely to retest the $2.80 resistance barrier. This move will represent a 38% rise. Probably limited upside for altcoin. Therefore, interested investors can closely monitor the reactions outside of the said demand zone.

Although unlikely given the current market conditions, a turn of the $2.80 level to a support base would be indicative of increased buying pressure. If this fundamental holds, it is possible for LUNA to see remaining liquidity above $3.51. This move represents a 72% gain at $2.01.

Regardless of the bullish outlook, the bullish thesis will be invalidated if LUNA price drops below the lower limit of the demand zone at $1.85. Such a development is likely to pave the way for more declines where the bears will trigger a correction to $1.60.