Eastern markets are opening freshly into a new week. However, Bitcoin price reveals that buying pressure is resurgent. However, if BTC fails to overcome a major hurdle, a bullish reversal is possible. If that happens, the recent surge in Ethereum, Ripple and other altcoins is likely to return quickly as well.

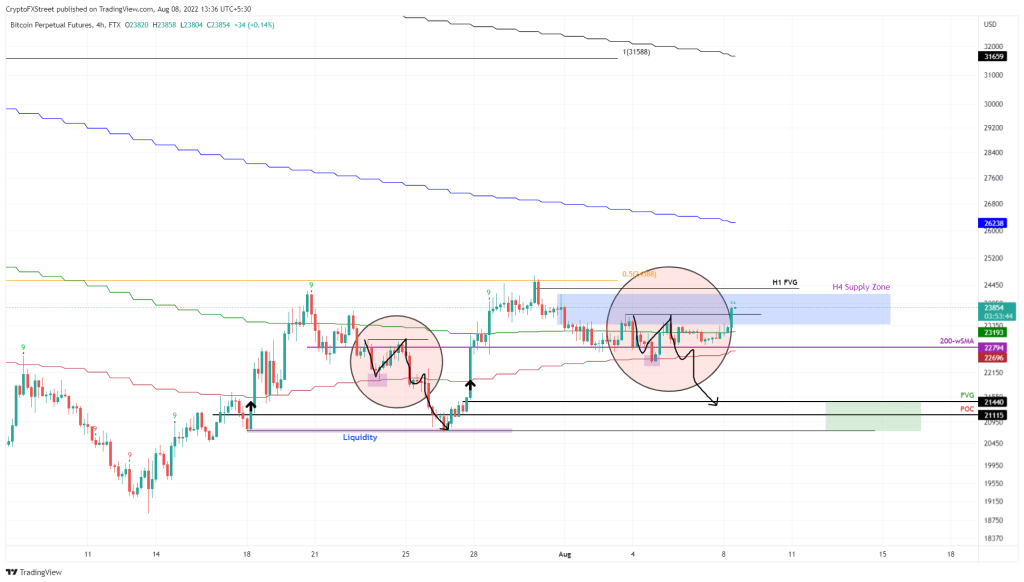

Bitcoin rise depends on taking this level

The fractal in the price of Bitcoin, which was announced earlier, is still valid. However, the recent spike in the bullish has caused BTC to break out of the $23,383 to $24,198 supply zone. This rally is possible until $24,362 one-hour price inefficiency is tagged. This is the point of no return for the bears and therefore they need to defend the aforementioned level. However, it is key for BTC bulls to take control and turn the $24,565 resistance level into a support level. If this happens, it will invalidate the fractal formation and trigger a rally to $28,000 or $29,000.

However, if BTC fails to break past the $24,362 level, it will reveal that the bearish outlook remains intact. In such a case, investors can expect Bitcoin price to return to the 200-week SMA at $22.794. A break of the 30-day EMA at $22.694 will confirm the start of a bearish regime. Next, it will pave the way for a collapse to $21,440 and $21,115. Additionally, an analyst from CryptoQuant suggests that the bottom for BTC is not located at $17,622. As we reported as Kriptokoin.com, BTC saw this level on June 18. After that, market participants started to define 17,622 as the bottom. According to the analyst, despite the buying pressure, there is still the possibility of Bitcoin revisiting below $20,000.

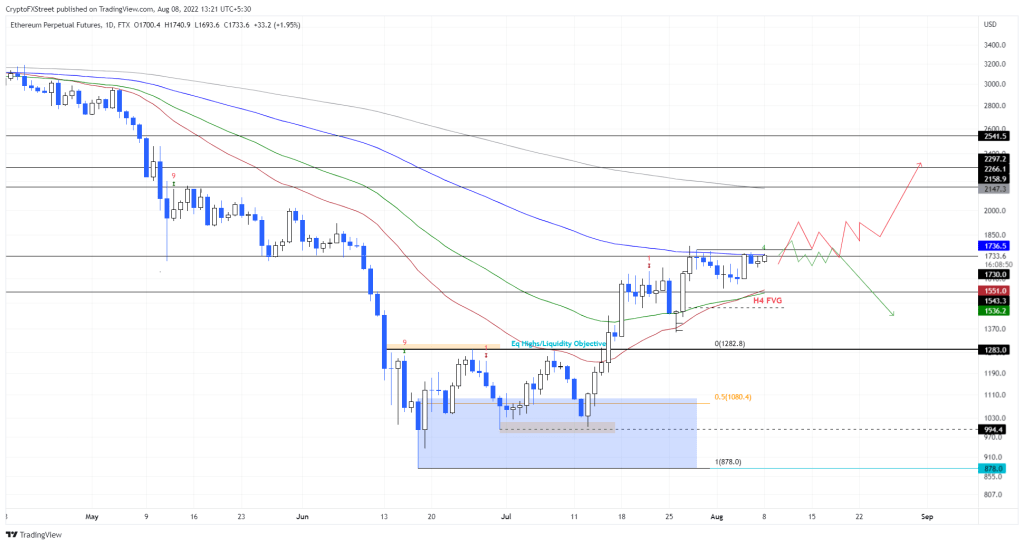

Ethereum wants to test its strength

Ethereum price is trying to make a comeback. Accordingly, it is currently testing the $1,730 resistance level, which coincides with the 100-day EMA. This set of resistance levels acts as a breaking point for ETH. A breakout is likely to result in an explosive move to $2,147, called the 200-day EMA. But this scenario remains heavily dependent on Bitcoin’s price action. This optimistic attempt will vanish if BTC bulls price fails to break past the $24,565 resistance level. On the other hand, cryptocoin.com As we reported, it is possible for the Ethereum price to be rejected at $ 1,730 due to itself or the Bitcoin price. If this happens, it will most likely confirm the presence of bears. Accordingly, ETH will decline further and fill the four-hour price inefficiency at $1,446.

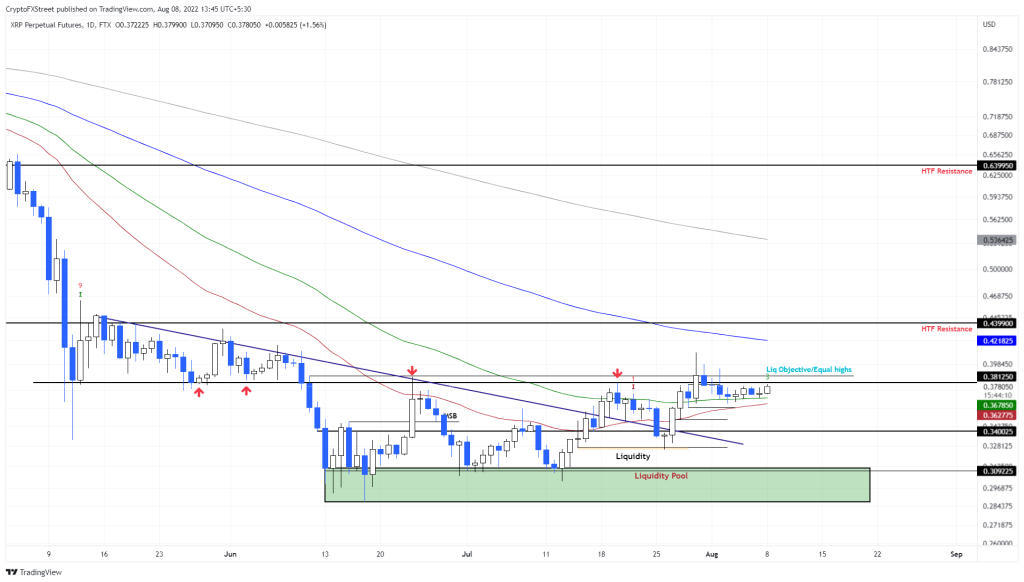

XRP consolidates for its next move

XRP price is above the 30-day and 50-day EMAs. Besides, it shows potential for a rise towards the 100-days EMA at $0.421. Therefore, it seems to be in a better position than ETH. As a result, traders need to be prepared for an explosive 12% rally. However, it is useful to be skeptical of this rising expectation. It is possible for Bitcoin price to decline and reverse its trend. This will put an end to the bullish trend currently in the market. So the Ripple rally prediction is heavily dependent on the BTC price. Also, there could be a rejection in XRP price at the $0.381 resistance level. If this happens, it will indicate that the bulls are weak. Accordingly, a break of the 30-day EMA at $0.362 will invalidate the bullish argument. As a result, it will trigger a possible collapse to $0.340.