Investors await US inflation data, which is likely to bring more clarity to the Fed’s rate hike plans to combat mounting price pressures. In this environment, the gold price remained flat on Tuesday. Analysts interpret the market and share their forecasts.

“These are the catalysts for an enormous rise for the price of gold”

cryptocoin.com As you follow, Friday’s US jobs report broke box office records. After a rally driven by this, the gold price hit a one-month high last week as the dollar and Treasury interest rates pulled back. Now the focus is on Wednesday’s July US CPI report. Analysts polled by Reuters expect annual inflation to fall to 8.7% from 9.1% in June. Clifford Bennett, chief economist at ACY Securities, comments:

Investors understand that both the US and global economies face significant challenges. But the emphasis will be on the question of how long higher interest rates will weigh on the market. Any surprise softening in the US inflation figure could be the catalyst for a massive rise in the gold price.

“Gold will have a hard time if the Fed tightens further”

Gold is considered a safe investment amid political tensions and recession concerns. However, high interest rates reduce the attractiveness of non-interest-paying bullion. Edward Moya, senior analyst at OANDA, said:

The market seems to have priced in the shock from the number of jobs. But gold will have a hard time if the Fed tightens further. Foreign investors will seek alternative investments. So gold is an option with the ongoing situation in Taiwan and Ukraine.

“Gold gains limited by potential for more aggressive interest rates”

Kinesis Money analyst Rupert Rowling notes in a note that gold’s gains are limited by the potential for more aggressive gains. That said, the strength of technical support around $1,700 will be tested when the Fed’s next decision is announced. The US CPI report to be released on Wednesday is likely to provide clues about the Fed’s next move.

TD Securities: Yellow metal managed to stay intact

A blockbuster business report led to a brief repricing in gold. But prices have bounced back strongly. Still, TD Securities strategists expect the yellow metal’s rise to be largely reversed. Meanwhile, the market continues to grapple with expectations for the Fed’s next move. Strategists make the following assessment:

Market prices slipped further towards a 75 basis point gain in September. However, it is far from deadlocked. Also, with the CPI data to be released mid-week, the yellow metal managed to stay intact. On the other hand, post FOMC shorting is likely to be exhausted, especially amid stronger data and continued pressure against a pivot in Fedspeak.

“We are waiting for the last rally to finally fade”

According to strategists, after briefly hitting the CTA triggers to start a new short closing area, the employment report quickly put a cap on the action. Strategists note that the flow of purchases then turns into a modest sale. In this context, strategists make the following statement:

Prop traders still hold a significant amount of longs. Also, continued strong economic data could be the catalyst needed to see some easing. In this sense, we have not yet seen under capitulation. This shows that the pain trade is still on the downside. We expect the last rally to finally fade.

Pablo Piovano: Gold price limited around $1,800

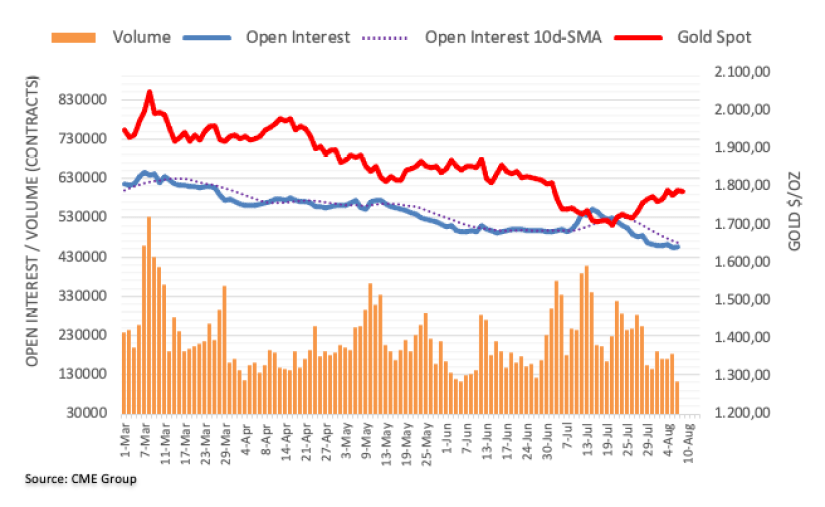

According to preliminary data from CME Group, open interest on gold futures markets followed a volatile course. Nearly 1.1k contracts were up on Monday. Instead, volume shrank by around 69.7k contracts, reversing the previous day’s structure.

Gold price dropped just below the $1,800 level once again earlier in the week. According to market analyst Pablo Piovano, the daily gain was behind the rising open interest rate, which supports further upside in the very near term. Therefore, the analyst says the extra challenges of this key resistance zone should remain in place for now.