A closely followed crypto analyst talked about stocks and crypto markets. Both markets are asset markets that offer high risk and rewards. According to the analyst, Bitcoin, altcoins, and stocks are all set to rise in value with another upcoming step. However, American banking giant Morgan Stanley says we need to pay attention to two factors for a bull run.

Analyst: “Bitcoin is still in a bullish trend”

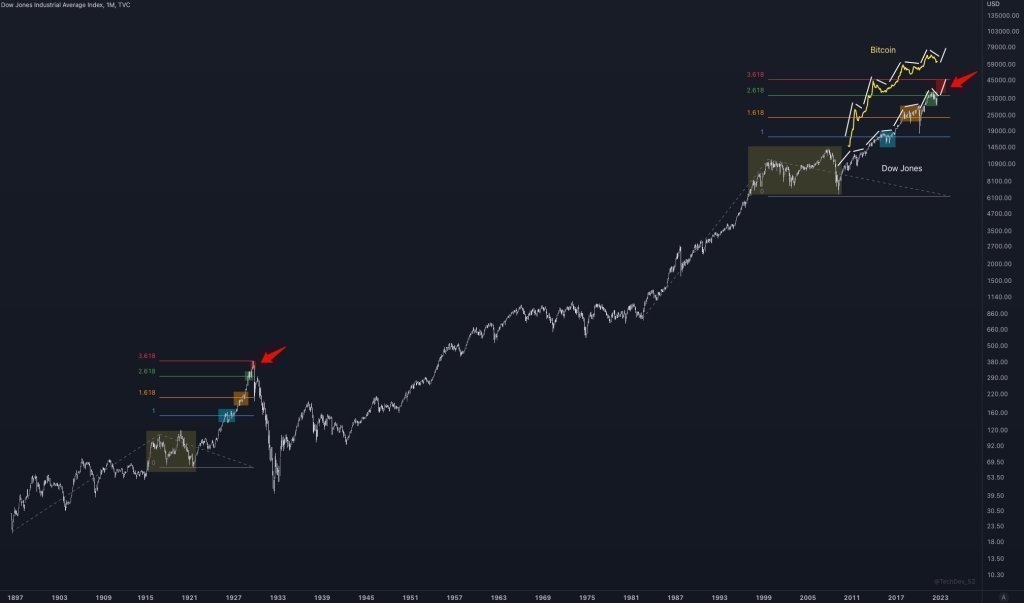

The cryptocurrency analyst, who goes by the nickname TechDev, is known for his long-term technical analysis. Speaking to his 399,000 Twitter followers, the analyst predicts bullishness for Bitcoin (BTC). According to him, the leading cryptocurrency is still moving in an uptrend. In addition, the analyst predicts that this upward trend will continue in 2023. He says Bitcoin’s rise is linked to the stock market. Then, he estimates that the steepest stock leg in 40 years will be in 2023. According to him, a big test will emerge for Bitcoin and altcoins from now on. BTC technical information hints at a correction after the rally next year. After that, he reveals that another bull run in 2025 is among the options. TechDev said:

“Bitcoin price chart implies 2023 rally, sideways 2023-2024 correction + 2025 bull run. But even the potential of the 2023 stock peak will have me watching from the sidelines to see how much of a correction we are in in 2024.”

“A dip signal is flashing”

TechDev adds that a historically accurate bottom signal is flashing for Bitcoin. According to him, the NASDAQ has bounced off its 200-week exponential moving average (EMA). Meanwhile, the Real Strength Index is making an upward cross. This has been a huge opportunity for BTC bulls in the past. The Real Strength Index measures whether an asset is oversold or overbought. It also stands out as a variation of the widely used Relative Strength Index (RSI). Bitcoin saw some good entries as the NASDAQ bounced off its 200-week EMA. cryptocoin.comAs we reported, BTC was trading at $24,108, gaining 3.54% in the last 24 hours.

Morgan Stanley: “Look at these 2 factors”

According to American banking giant Morgan Stanley, there are two main factors that point to another bull run for Bitcoin. The bank’s analysts say the Fed’s move to expansionary monetary policy could spark another rally. According to the bank, these surviving crypto debt platforms suffered a major crisis following the collapse of the Terra ecosystem. However, they still continue to offer high returns. So the cryptocurrency futures market remains healthy despite the significant correction. Morgan Stanley states that the existence of leverage will be an important sign that the crypto market may be on the verge of another rally.